SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Cutting bureaucreatic red tape, stepping up long-term urban planning, and adopting disruptive technology will help the Philippines overcome the risk posed by low productivity and sustain its momentum toward regional integration.

This was the conclusion of regional executives who addressed the 13th Management Association of the Philippines (MAP) International CEO Conference held on September 8.

“While other ASEAN (Association of the Southeast Asian Nations) member states are feeling the effects of volatile capital flows, falling commodity prices, and slowing growth in China, the Philippines continues to experience relatively robust economic growth,” said Oliver Tonby, McKinsey & Company Southeast Asia managing director.

To sustain its momentum, Tonby said the Philippines will have to address a problem that plagues most Southeast Asian countries: Low productivity.

Citing a study his firm conducted in November last year, Tonby said three-quarters of the country’s economic growth is pumped up by a shift from agriculture to urban employment, and the rising number of young people entering the workforce.

“As these factors diminish, productivity growth will need to pick up the slack. The Philippines will need to hike its historical pace of productivity gains by almost 60% just to sustain its economic growth,” Tonby said.

The Philippines’ gross domestic product (GDP), which measures the amount of final goods and services produced in a country, rose 5.6% last quarter, way below the 6.7% recorded the past year.

The latest GDP figure also caused the Philippines to slip as the third highest among Asia’s major economies, behind China and Vietnam.

To address what appeared to be a downward trend for the country’s economic growth, Tonby said disruptive technology, global trade, and urbanization will help the country top Asia’s major economies.

Adopting disruptive technology

Technology – such as cloud, big data, and the Internet of Things – is a major catalyst for growth.

“The Philippines could be fertile ground for these innovations; Filipinos are avid social media users and tend to be early adopters of new technologies,” Tonby said.

Xurpas, Incorporated President and CEO Nix Nolledo echoed this.

“Every company, traditional or digital, has to drive innovation to be around for a long period. So, whether you own a bank or a retail company, ask yourself: Am I offering something new to my target market?” Nolledo said.

McKinsey & Company’s Tonby said emerging economies like the Philippines show that Internet adoption drives GDP growth, helping large firms to expand their services to new segments at different price points while boosting productivity for small companies that significantly improve their competitiveness.

“The biggest near-term challenges for the Philippines will be building out the necessary broadband infrastructure (which in most countries has required government intervention and support) at a faster pace than ASEAN peers, and cultivating a high-tech workforce,” Tonby said.

But for Nolledo, slow Internet speed is a competitive advantage for his mobile content business.

“[A] not so fast internet connection is actually a competitive advantage, because we turn off a lot of foreign players who dont know how to handle a market where Internet connection isn’t quite as fast,” he explained.

Technology, according to Tonby, is likely to cause some disruption in the labor market, as supply chains are being automated and e-commerce supplanting the traditional physical stores.

“In all, 6% to 8% of ASEAN’s total non-farm labor force in 2030 – or 12 million to 17 million workers in non-farm jobs – could be displaced by technology. Governments will have to make sure that these workers have access to support and retraining,” Tonby said.

Streamlining red tape

The Philippines and other ASEAN member states will need to make critical decisions on how they will trade and compete in a more interconnected global economy.

In 2012, flows of goods, services, and capital across the world’s borders reached $26 trillion, according to a November 2014 McKinsey & Company report.

“The Philippines can reap benefits from this global phenomenon by pushing ahead with the measures necessary to make the ASEAN Economic Community (AEC) integration plan a working reality,” Tonby said.

Among these measures, Tonby said, are streamlining administrative red tape and harmonizing regulations.

“Beyond the potential for increased trade in goods, the Philippines can also benefit from tradable services and the freer movement of skilled labor, where its proficiency in English gives it a crucial advantage over ASEAN economies,” he added.

The Philippines, according to the McKinsey & Company report, currently ranks 45th on its connectivity index, which measures the inflows and outflows of goods, services, finance, people, and data and communication relative to the size of the economy.

This is far lower than some other ASEAN member states such as Singapore (4th), Malaysia (18th), and Thailand (36th).

This is because barriers such as foreign ownership restrictions, varying product standards between countries, and inefficient customs procedures have yet to be addressed, Scott Constance, senior executive director of PWC Consulting Services Sdn Bhd, said at the conference.

“Additionally, many local firms lack a sense of urgency about entering new markets and expanding their regional presence,” Constance added.

Ramping up urban planning

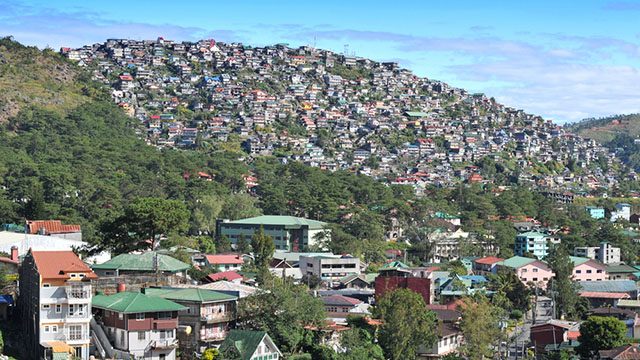

In his speech, Constance highlighted that ASEAN’s major opportunity lies in its booming cities, which account for two-thirds of the region’s economic growth.

“By 2030, more than 90 million additional people are expected to move to urban areas, a shift that, if well managed, will support the continued rise of a middle class with newfound spending power,” McKinsey & Company’s Tonby said.

To make the most of this opportunity, Constance said the Philippines will need to ramp up plans in long-term urban planning.

“This is also to avoid what happened before wherein the Philippines ranked 63rd of the 64 large global cities on quality of life under the Asia Competitiveness Institute’s Global Liveability Index,” he said.

According to the McKinsey & Company report, the Philippines needs an estimated $900 billion in infrastructure and real estate investment between 2014 and 2030.

As much as 40% of the Philippines’ infrastructure requirements from 2010 to 2020 could be public-private partnership (PPP) projects, PPP Center Executive Director Cosette Canilao said in a separate briefing.

Despite the Philippines’ status as one of the fastest-growing economies Asia, Tonby said about a quarter of Filipinos still live in poverty.

“Through global trade, urbanization, strengthened service sector, and infrastructure investment, the Philippines could build an era of shared prosperity,” Tonby said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.