SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Asia is home to 4.47 billion people, or three-fourths of the world’s population. On sheer numbers alone, it would be an obvious choice for a startup looking to leverage customers into cash.

The continent, however, has another lure for entrepreneurs: its people are quick to pick up on tech trends, as Alibaba can tell you.

“A trend might take longer to hit Asia, but once it hits Asia it spreads 10 times faster than in Western countries because in Asia people tend to be early adopters,” said FlySpaces founder and CEO Mario Berta in an exclusive interview with Rappler.

Berta first arrived in the East as a government consultant. Then he worked as sales director for a Hong Kong telecom firm, followed by a stint at Rocket Internet, which tapped him for the launch of the Easy Taxi mobile app around Southeast Asia.

After two and a half years in the Philippines with Rocket Internet, Berta resigned to start his own firm, which he said is pretty normal for Rocket Internet executives once they reach a certain level.

“Rocket is a fantastic school to work with and after a while you decide to become an entrepreneur and build your own company,” Berta said.

FlySpaces

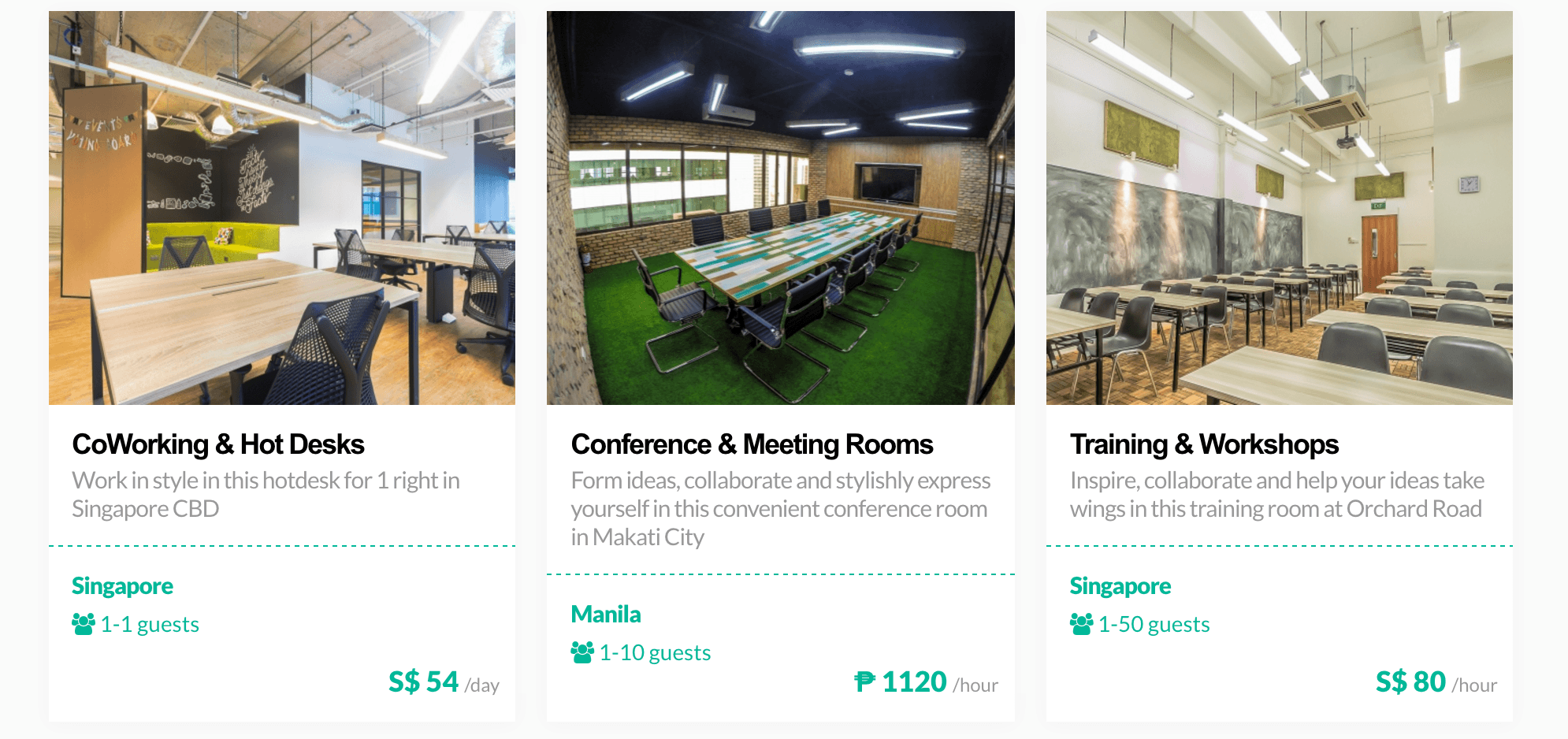

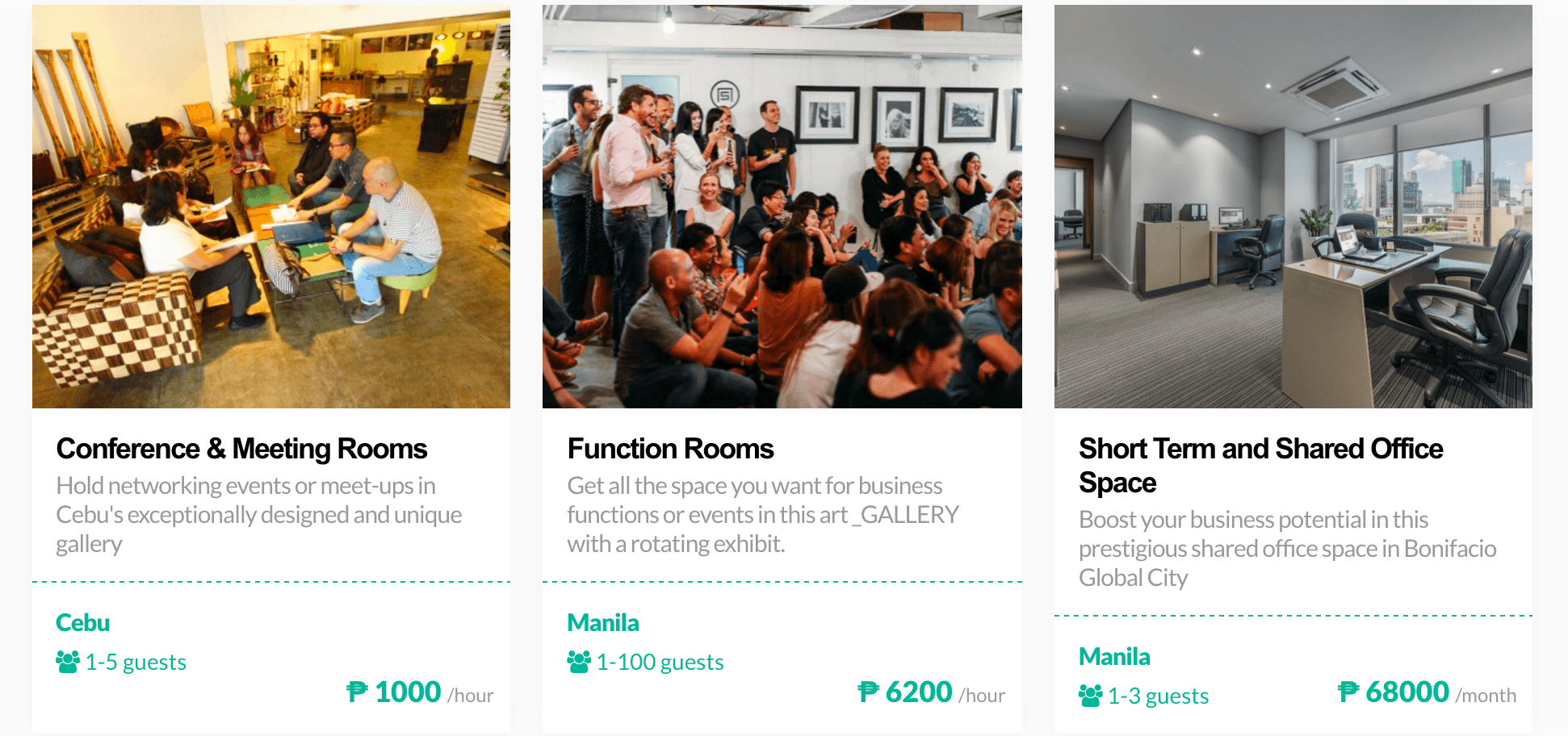

Berta’s latest venture is called FlySpaces, an online search and booking platform that seeks to connect small- and medium-sized enterprises (SMEs) and startups with short-term office spaces, coworking spaces, meeting and training rooms, event spaces, and retail spaces.

To do so, FlySpaces teams up with various providers to aggregate all the short-term inventory in a specific city.

The inventory comes from 3 types of suppliers that FlySpaces partners with:

- Businesses which offer subletting or coworking spaces, such as A Space and Impact Hub

- Serviced offices or hotels

- SMEs with extra office space for subletting (often, they are losing money because of high rent)

FlySpaces, which is currently available in Manila, Cebu, and Singapore, will launch in Kuala Lumpur in April. It has so far raised funding of $500,000 (P23.22 million) from local and and foreign investors such as venture capital firm Narra Ventures.

“It basically operates like an Airbnb for offices,” Berta said, adding that the only difference is that the FlySpaces model offers taxability, a crucial requirement for businesses so that they can account for expenses.

Airbnb, Berta explained, empowers consumers who are unable to issue official receipts, unlike businesses. As a consequence, they do not declare taxes.

“We only empower SMEs, so all our partners which receive tenants from us are businesses so they can issue receipts,” he said.

Helping out SMEs

Berta saw the opportunity to reach out to SMEs while he himself was going through the tough experience of finding suitable office space.

He explained that SMEs and startups, as they are small, do not have the financial track records or financial stability to afford a conventional office.

“That’s why you are starting to see the coworking spaces flourishing all over Southeast Asia and that’s why we exist,” Berta said.

He pointed out, however, that a lot of SMEs in the Philippines still do not understand the actual concept of short-term office space.

“A lot of them are still looking for conventional office space so a lot of our job is educating SMEs about the tremendous opportunity for them,” Berta said.

The opportunity lies in not being locked into a 3-year contract, for instance, and not having to pay 3 months rent as a deposit, which would be a lot of working capital for a small business. This current system, Berta emphasized, does not work for the SMEs, but works for the landlords.

“So we’re trying to tell them: Look, if you have an aggressive expansion plan or on the other side, if you are uncertain about growth, then there is no longer any need for you to be stuck in a 3-year contract,” he said.

“You can stay temporarily in a short-term office space and then we can adjust your space according to your growth.”

Freeing up capital

Opting for short-term office leases can free up quite a bit of working capital, as Berta illustrated with a conservative scenario.

Let’s say the average rent is P100,000 ($2,152) with 3 years as a lock-in period. On top of that, an entrepreneur would have to give P600,000 in capital ($12,912) or 6 months’ worth of rent to the landlord as a deposit.

If an SME is using a short-term office space instead, that P600,000 would be sitting in its bank account where it can be used as working capital, Berta said.

The knock-on effect is that an SME will not have to get a business loan from a bank, which generally averages 15% interest a year, for working capital.

Aside from freeing up working capital, SMEs can grow or reduce their office space as needed, as illustrated by a typical scenario for a call center.

Big call centers will always have office space and generally have long-term contracts with clients. But how about a smaller call center winning a seasonal contract for only 6 months?

For 6 months, the firm would need an additional 50 seats. Those seats, however, will no longer be occupied once the seasonal contract ends. In this scenario, Berta said, the call center would double its office expenditure if it leased additional long-term office space.

Coworking growing globally

The concept of short-term commercial leases and coworking has been picking up steam elsewhere around the globe.

WeWork, the world’s biggest coworking space provider, is among the top 10 most valuable startups, joining a list that includes Uber and Xiaomi.

“This is a trend that is not happening in Asia yet but I can guarantee you that it will follow here eventually,” Berta said.

When coworking eventually does take hold in the region, Berta envisions FlySpaces being at the forefront of the trend. The firm is projecting to break even by the end of 2017.

“If we weren’t expanding beyond the Philippines we would be profitable already. We reached earnings before interest and taxes (EBIT) positive in February,” Berta said.

“We have a lot of shared costs between all the countries we operate in and we’re going to stop expanding once we reach 7 cities, and then we’ll start consolidating.”

He added that FlySpaces wants to “create a true regional Southeast Asia brand – we want to be the GrabTaxi of office space for Southeast Asia.”

Waiting for the trend to kick in

Berta’s unyielding confidence that coworking will take root in the region stems in part from his past experiences.

Three years ago when he was starting Easy Taxi, taxi operators who had been dominating the market for 30 years initially laughed at him when he told them the plan was to give their drivers a smartphone to facilitate the process.

“They would sell the smartphone as soon as they left the taxi depot and spend it on drinks or gambling, the operators said. But now look, you can’t imagine not doing that,” Berta said.

“That’s the thing with technology in Asia. It takes a breaker to catch up with the cutting-edge trend, but once it does the adoption is much faster here than in Western countries.”

In Western countries, he explained, there is one technology that works, but the technology improves next month and another player takes over, creating many players in the market.

In Asia, there is usually one player that dominates, it takes longer for that player to educate others, but then the idea spreads like wildfire. Economies are growing faster, and consumers are more curious. They spend more time online and get more exposed.

“That’s why we’re just waiting for the trend to kick in.” – Rappler.com

$1 = P46.47

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.