SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

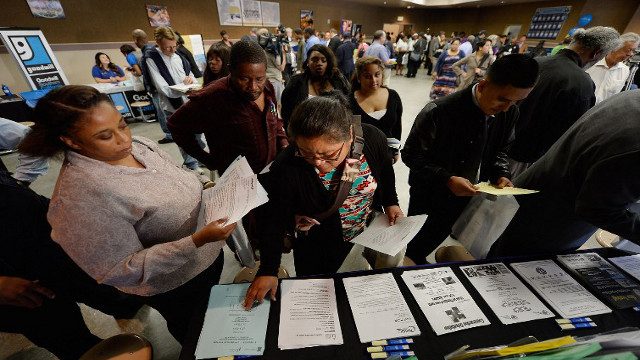

WASHINGTON DC, USA – The US economy turned in its best monthly performance for job creation in nearly 3 years in November, brushing off a global slowdown to pump out a huge 321,000 jobs.

The surprise surge reported by the Labor Department Friday, December 5, was some 90,000 jobs more than forecast, and was broad-based across the economy, with job pickups in retail, office positions, construction and healthcare, and no particular help from government hiring.

Revisions to the two previous months added another 44,000 positions to the rolls of the employed and brought the yearly average to 241,000 a month.

That further attested to resilience in the US economy even as China slows and Europe battles the threat of stagnation – on Thursday, December 4, the European Central Bank cut its forecast for eurozone growth to just 0.8% this year, compared with 2.2% or more being predicted for the United States.

The unemployment rate, which is based on a separate set of Labor Department survey data than job creation, held steady at 5.8%, the lowest level since July 2008, having shed 1.2 percentage points from a year ago.

“Santa just delivered a great pre-Christmas employment report,” cheered Doug Handler, chief US economist at consultancy IHS Global Insight.

“While hiring was bolstered by above-average seasonal hiring and the benefits of lower gasoline prices, these effects don’t alter the conclusion that this was a darn good month for the labor market.”

“A strong report. Although unemployment was flat, the trend is clearly still down,” said Jim O’Sullivan of High Frequency Economics.

Wages still flat

But the data showed some persistent weakness in employment, too, more than 5 years after the end of the Great Recession.

Wage growth remained dull: while average hourly earnings jumped in the month, they were still up just 2.1% year-on-year. And participation in the job market held at a 62.8%, compared with more than 66% in the years before the sharp 2008-2009 downturn.

That, in part, relates to the low pay offered by many of the positions created. Much of the job surge was in hotels and restaurants, health care services, and clothing stores. And 22 million positions were temporary jobs.

But there was also an acceleration of job creation in higher-paid sectors, including construction, manufacturing, accounting services, transportation, and insurance – all signs of more durable strength in the market.

President Barack Obama said job creation was running at its best pace since the 1990s, but that slow wage growth showed the need to raise the minimum wage, which the White House backs against stiff Republican opposition in Congress.

“It’s been a long road to recovery from the worst economic crisis in generations, and we still have a lot more work to do to make sure that hardworking Americans’ wages are growing faster,” he said.

Analysts said that as job creation strengthens, wages will have to post more gains.

“Temporary hires by retailers for the holiday season added to the strong employment number in November – but were not the most important driver,” said economist Harm Bandholz of UniCredit.

“Instead, the acceleration in job gains was broad-based and affected almost every goods-producing as well service-providing industry…We expect that the diminishing slack in the labor market will continue to put upward pressure on wages.”

The strong numbers raise the chance that the Federal Reserve could accelerate plans to raise interest rates, currently expected only in the middle of 2015.

“With job creation as strong as this and wages picking up, the economy looks increasingly able to withstand a modest tightening of policy,” said Bandholz.

“On the other hand, the lack of any significant wage growth points to a benign inflation outlook, which in turn suggests there remains no immediate rush to hike rates.”

US markets took the report as good news. In afternoon trade, the S&P 500 was up 0.1% and the Dow Jones Industrial Average gained about 0.3%.

The dollar pushed higher, reaching $1.2282 per euro and 121.52 yen. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.