SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

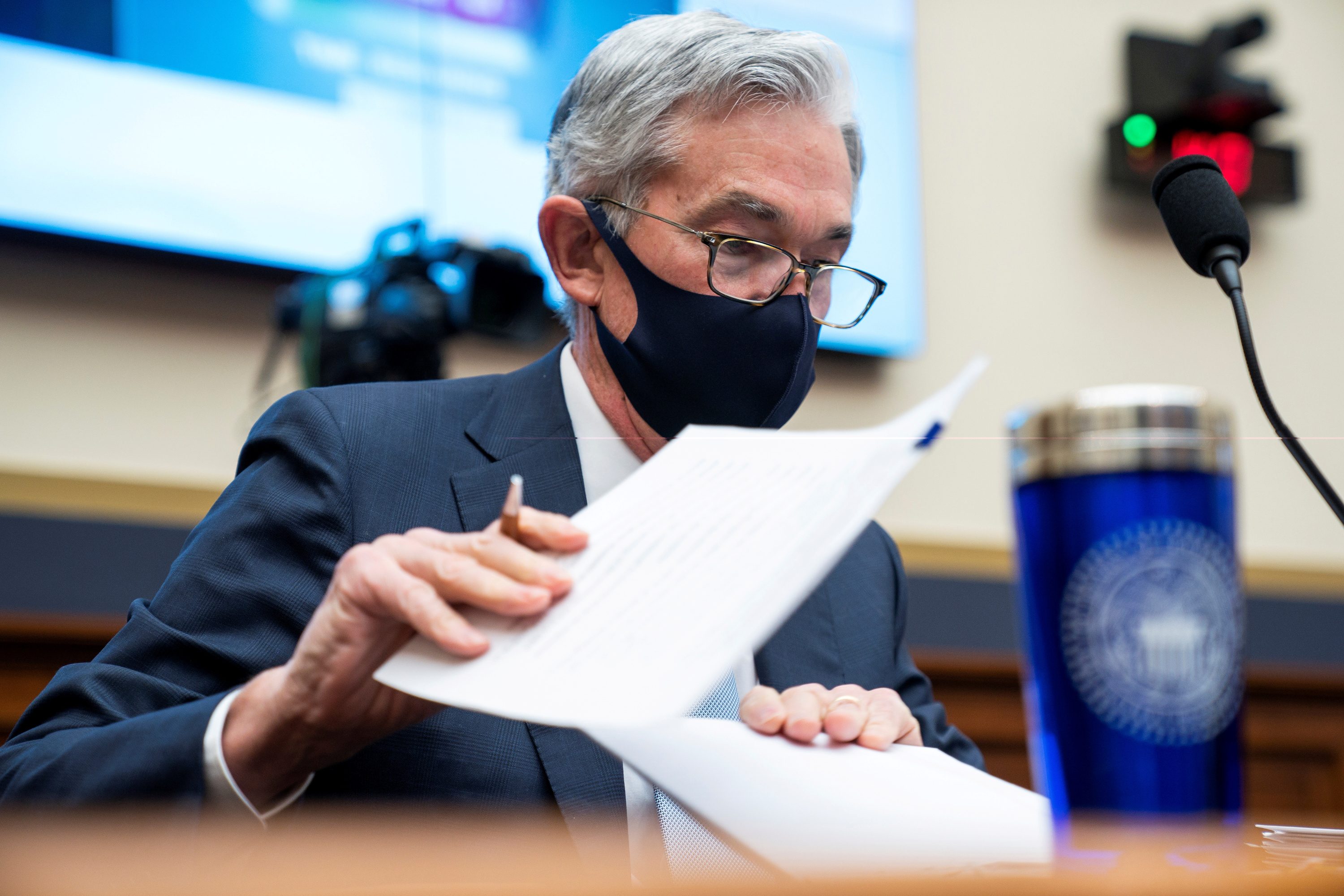

Those thinking the latest and most glaring evidence of stock market froth – the more than tenfold increase in GameStop Corporation shares in two weeks – might draw Federal Reserve Chair Jerome Powell into a “mea culpa” moment may be disappointed.

Powell, a former private equity industry attorney who knows a thing or two about a stock price, on Wednesday, January 27, declined outright to comment on the extraordinary rise in the shares of an unprofitable company that seemed proof positive the market had become detached from reality.

In his press conference following the Fed’s latest two-day policy meeting, he pushed back on the suggestion that the Fed’s super-low interest rates and massive bond purchases were creating asset bubbles, such as the one apparently forming in GameStop that has transfixed market mavens and the general public alike.

“I think the connection between low interest rates and asset values is probably something that’s not as tight as people think because a lot of different factors are driving asset prices at any given time,” Powell said.

It was a telling response from arguably the world’s single most influential financial figure, who came to his central banking post through Wall Street and whose policies in response to the COVID-19 crisis have been praised for their speed and boldness but also criticized for helping fuel a “K-shaped” economic recovery that favors asset owners.

Indeed, Powell said his motivation is fostering an economic environment that will help the millions still out of work in the pandemic to regain employment.

“In a world where, almost a year later we’re still 9 million jobs at least…short of maximum employment, it’s very much appropriate that monetary policy be highly accommodative,” said Powell, whose remarks followed the Fed’s decision to leave its benchmark interest rate near zero and to keep buying $120 billion a month in bonds.

That said, Powell said the Fed is cognizant that financial risks can emerge in periods of extensive accommodation, but it prefers to address those through so-called macroprudential tools largely focused on keeping the banking sector safe and sound.

“We don’t really think we’d be successful in every case in picking the exact right time to intervene in markets,” Powell said.

The Fed also coordinates with other regulators when it comes to monitoring financial stability risks in the nonbank sector, he said.

“We monitor financial conditions very broadly, and while we don’t have jurisdiction over…many areas in the nonbank sector, other agencies do,” he said.

GameStop’s dizzying rise has been assigned by many market watchers to a battle between retail investors who have piled into the shares and hedge funds and others who have placed big bets against the struggling video game retailer. It has also become a rallying cry among some who favor more market regulatory oversight.

On Wednesday, GameStop closed at $347.51 a share. Its price on January 12? $19.95.

The White House and Treasury Department are monitoring the situation with GameStop and other companies that have seen sharp gains in the last week or so, White House Press Secretary Jen Psaki said on Wednesday.

Back at the Fed, though, Powell said changing monetary policy to ward off bubbles would not be his first choice.

“If you raise interest rates and thereby tighten financial conditions and reduce economic activity in order to address asset bubbles and things like that, will that even help? Will it actually cause more damage?” he said.

“I think that’s unresolved…. We would rely on macroprudential and other tools to deal with financial stability issues.” – Rappler.com

Add a comment

How does this make you feel?

![[ANALYSIS] A new advocacy in race to financial literacy](https://www.rappler.com/tachyon/2024/04/advocacy-race-financial-literacy-April-19-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[ANALYSIS] Search for stocks that continue to sizzle](https://www.rappler.com/tachyon/2024/04/search-stocks-that-sizzle-April-5-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[ANALYSIS] Concern about the right trading call during Holy Week](https://www.rappler.com/tachyon/2024/03/Concern-about-right-trading-holy-week-March-22-2024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.