SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Japanese billionaire Kazuo Okada reportedly has established links to Philippine corporations that may subject him to civil and criminal sanctions under Philippine law.

Local law firm M. M. Lazaro and Associates told American investigators at Freeh Sprokin & Sullivan LLP (FSS) that Okada-led firms may have violated the Anti-Dummy law, which prohibits foreign firms from owning more than 40% of a local entity.

Former Federal Bureau of Investigations (FBI) director Louis Freeh of FSS was commissioned by Wynn Resorts Ltd., where Okada also has stakes in, to look into Okada’s possible violations of the US anti-bribery law in its Philippine investments.

The Freeh report, which is the cornerstone of Wynn’s recent suit against shareholder Okada, cited law firm M.M. Lazaro’s research and legal insights into Okada’s investments in the Las Vegas-like casino entertainment complex soon to rise at the reclaimed area in Manila Bay.

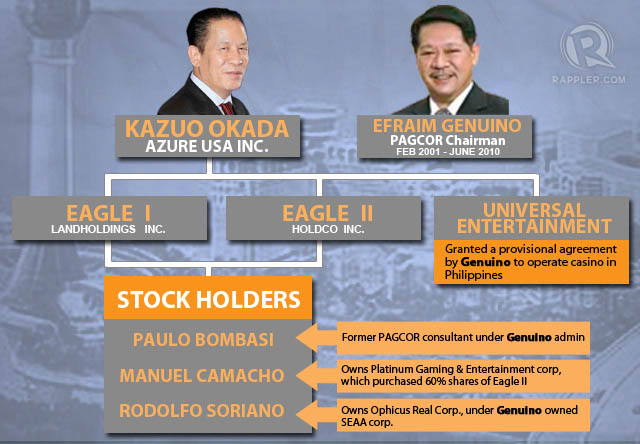

The Freeh report reveals that people associated with Philippine Amusement and Gaming Corporation (Pagcor) chair Ephraim Genuino have served in positions in companies controlled by Okada, providing corporate links between Okada’s business interests and those of Genuino’s.

Genuino served as Pagcor chair from 2001 to 2010. In 2008, under Genuino’s watch, Pagcor awarded provisional contracts to 4 investors, including Okada’s firm, for the upcoming Entertainment City project.

Specifically mentioned among Genuino’s associates are:

- Paolo Bombase, an officer/director and shareholder of Ophichus Real Properties Corp, which is under the Genuino-owned SEAA Corporation

- Manuel Camacho, a partner in Camacho & Associates, and was for a time in a law partnership with Genuino’s son, Erwin.

- Rodolfo Soriano, a former Pagcor consultant during Genuino’s administration. Soriano and a relative are among the Filipino delegation who were given lodging accommodation by Odaka at the Wynn Macau resort.

All 3 are currently listed as among the shareholders, directors and officers of Eagle I Landholdings Inc. and Eagle II Holdco Inc., both under Okada’s Aruze group of companies.

The connection

“Mr. Okada caused various legal entities to be incorporated in the Philippines, in order to develop his casino resort project there, over time replacing the original incorporating Filipino shareholders with combinations of foreign shareholders affiliated with or controlled by him and associates of then-Pagcor chairman Genuino,” the report says.

Eagle I and Eagle II were incorporated in the Philippines in May 2008. Listed as among its shareholders, directors and officers are 5 partners of the law firm Sycip Salazar Gatmaitan, which represents Aruze in the Entertainment City Manila project.

But the General Information Statement (GIS) of both Eagle I and Eagle II in 2009 shows that the Sycip partners were replaced by Camacho, Soriano, and Bombase.

The report reveals that Genuino ordered Camacho and Soriano to meet Okada and other representatives of Aruze in Japan. “This meeting resulted in Mr. Camacho’s firm replacing Sycip in representing Aruze with respect to the development of the project in Entertainment City Manila,” it says.

Also, 60% of the shares of Eagle II was acquired by Platinum Gaming & Entertainment Corp., which lists Soriano as a director/officer and a 20% shareholder. 60% of the shares of Eagle I was then acquired by Eagle II.

Evasion of legal requirements

The report has raised doubt on the actual Filipino equity of Eagle I and II, as Platinum “appears to be merely a shell corporation used to satisfy the Filipino equity requirement.”

Platinum, which purchased more than half of Eagle II’s shares, failed to file its annual required GIS with the Philippines Securities and Exchange Commission (SEC). The only corporate document filed besides the Article of Incorporation is a financial statement dated 2004.

Moreover, an application of the Grandfather Rule (a “stringent examination of the true ownership of the voting stock of the subject corporation and of the true ownership of the voting stock of all successive layers of corporate ownership”) reveals that more than 60% of shares in Eagle I are foreign investment:

|

Shareholder

|

Direct

|

Indirect

|

Total Filipino investment in Eagle I

|

TotalForeign investment in Eagle I

|

|

Aruze USA

|

40% of Eagle I

|

24%

(40% of 60% total holdings of Eagle II in Eagle I)

|

|

64%

|

|

Platinum

|

|

36%

(60% of 60% total holdings of Eagle II in Eagle I)

|

36%

|

|

The Philippine Foreign Investment Act limits foreign ownership to a maximum of 40% of the outstanding capital stock.

The report says that this shareholder structuring scheme may also constitute a violation of the Anti-Dummy law, in which penalties include imprisonment from 5 to 15 years.

Rappler tried to reach Genuino and M.M. Lazaro and Associates for a comment, but to no avail. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.