SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The bicameral conference committee on the proposed Tax Reform for Inclusion and Acceleration (TRAIN) has agreed to reduce rates and requirements on estate tax or the levy imposed on a dead person’s assets up for transfer to heirs.

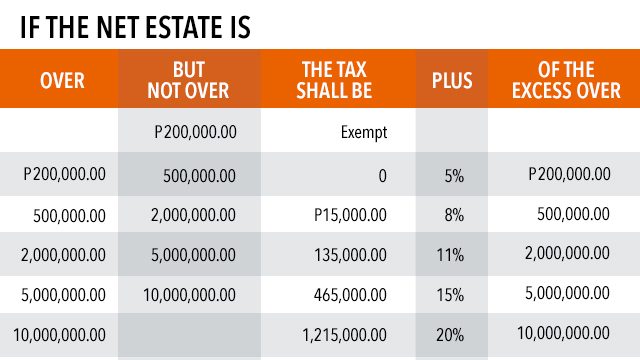

Senate President Pro Tempore Ralph Recto, member of the bicam, said they decided to impose a flat rate of 6% instead of the existing 6-tier tax scheme.

Recto and Senate ways and means committee chair Juan Edgardo Angara, who both filed bills seeking to reduce estate taxes, said the current system discourages the public from paying such levy.

“The overall objective is ease in payment of estate tax at a time when a family is grieving over the loss of a loved one. In their bereavement, they need to be consoled. Pero ang siste ngayon, una pang kukuha ng pera ang gobyerno, una pa ito sa abuloy, kaysa sa namatayan (But under the present system, the government gets money ahead of the grieving families),” Recto said in a statement.

Angara, for his part, said: “The estate tax burden has led families to delay settling the estate, resulting in huge penalties and surcharges while use of assets are not maximized. With this reform, grieving families will be spared the further anguish of paying high estate taxes which would speed up the distribution of assets to the heirs.”

The panel also finalized the increase in the tax exemption on family homes, from P1 million to P10 million.

“We have decided to increase it by 10-fold to reflect real estate realities. The current rates were set 20 years ago when homes were a lot cheaper. ‘Yung P2 million na bahay ngayon, matchbox lang ang laki. Bakit mo bubuwisan pa (P2-million homes now are just the size of a matchbox. Why should you tax them)?” he said.

The panel decided to increase the standard deduction rate from P2.7 million to P5 million to include all assistance, including medical expenses and funeral assistance. This means P5 million would be automatically deducted in computing estate taxes.

Filipinos would also no longer need a certification from an accountant and a notice of death before estate settlement, if the deceased person’s total assets amount to P5 million and below.

Relaxation of rules

The joint panel also allowed the withdrawal from the deceased bank’s deposits, which under the current law are automatically frozen upon death of the account holder.

Instead of helping the grieving families, the current rule even burdens them, the senator said.

“We have agreed to allow an heir, or executor, or administrator, to make withdrawals, with no limit, for as long as a withholding tax is paid every transaction,” Recto said.

“Ang sistema ngayon, hindi makawithdraw ang mga namatayan sa account niya. Kung kailan kailangan ng perang pambayad ng ospital at palibing, hindi mo magagalaw ang pera sa bangko hanggang hindi nakakapagbayad ng buwis at nasasubmit ang napakaraming papeles at clearances,” he said.

(With the system now, the families could not withdraw from the deceased person’s account. At a time when they need money most, they cannot touch the money in the bank until they pay tax and submit voluminous documents and clearances.)

Aside from this, the panel also extended the filing of estate tax return from 6 months to one year, with the option of installment payment up to two years.

Once the Senate and the House finalize the entire bill, it will be sent to both chambers for ratification. After this, the final version would be submitted to Malacañang for President Rodrigo Duterte’s signature.

The target implementation of the bill, so far, is by January 1, 2018. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.