SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (UPDATED) – President Rodrigo Duterte has signed into law the Tax Reform for Acceleration and Inclusion (Train) bill which is expected to generate P130 billion in revenues.

Duterte signed Republic Act 10963 or the Train Law – a priority measure of the Duterte administration – at Malacañang’s Ceremonial Hall on Tuesday, December 19.

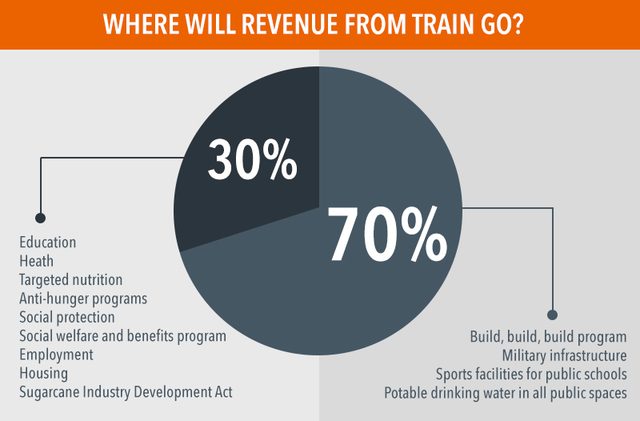

Revenues from the tax reform measure are meant to fund the Duterte government’s Build, Build, Build infrastructure program and socio-economic programs. (READ: EXPLAINER: What’s inside the bicam-approved tax reform bill?)

Lower income tax*

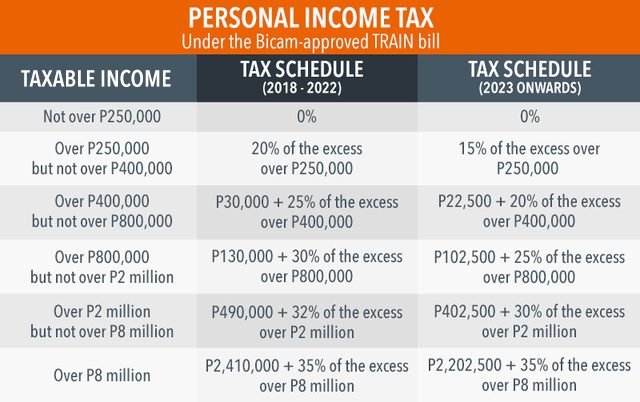

The first of 5 tax reform packages, the Train law “corrects a longstanding inequity of the tax system” by reducing the income taxes of 99% of income taxpayers, said Malacañang.

With the Train law now signed, almost all the 7.5 million income taxpayers in the country should see a reduction in their income tax rates starting next year, according to a media briefer from the Senate committee on ways and means on the bicameral committee-approved Train bill.

Income taxpayers with an annual salary of P250,000, or those earning approximately P22,000 monthly and below, are now exempt from income tax payment.

The law also exempts from tax payment the first P90,000 of the 13th month pay and other bonuses.

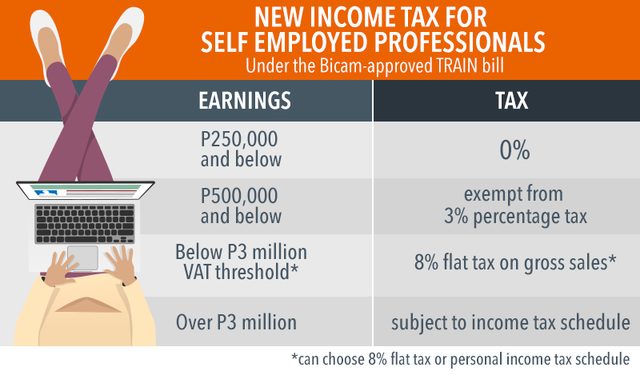

Self-employed professionals will see new income tax rates with the introduction of an 8% flat tax on gross sales or receipts instead of income tax and percentage tax to be filed once a year.*

Higher taxes on certain goods, services

To make up for the loss of revenue due to reduced income tax, the law imposes higher taxes on cars, fuel, tobacco, cosmetic surgery, tobacco, and some sweetened beverages.

Diesel, which is not taxed at present, will be imposed P2.50-per-liter tax in 2018, P4.50 in 2019, and P6 in 2020.

LPG would have be taxed P1 per liter in 2018, P2 in 2019, and P3 in 2020.

For gasoline, from the current tax of P4.35 per liter, it would be imposed a levy of P7 per liter in 2018, P9 in 2019, and P10 in 2020.

The law also applies a 4-tier tax scheme for automobiles:

- 4% for up to P600,000

- 10% for over P600,000 to P1 million

- 20% for over P1 million up to P4 million

- 50% for over P4 million

All pick-up trucks and electric vehicles would be exempted from additional taxes.

Hybrid cars would be imposed half the taxes as non-hybrid vehicles.

Finance Secretary Carlos Dominguez III had said the hike in prices of automobiles would mainly impact the well-off individuals who could afford to buy luxury cars.

The law also imposed a tax of P6 per liter for drinks using sugar and artificial sweeters and P12 per liter for using high fructose corn syrup. Milk and instant coffee, drinks consumed by a majority of Filipinos, are exempted.

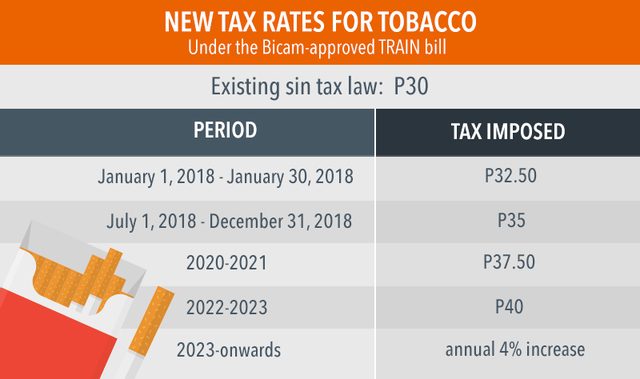

Tobacco products will also be more expensive as under the Train law, the sin tax on such products will be increased.

Coal will be taxed P50 for 2018, P100 for 2019, and P150 for 2020.

The Train law imposes a 5% levy on cosmetic surgery purely for aesthetic purposes. Mining will be taxed double, from 2% excise tax to 4% excise tax on metallic minerals like copper, gold, and chromite.

To cushion the impact of these higher taxes on the poorest Filipinos, the law provides a cash transfer mechanism.

Under the law, 10 million of the poorest households will receive cash transfer of P200 per month in 2018, and P300 per month in 2019 and 2020. (READ: Will tax reform really hurt the poor?)

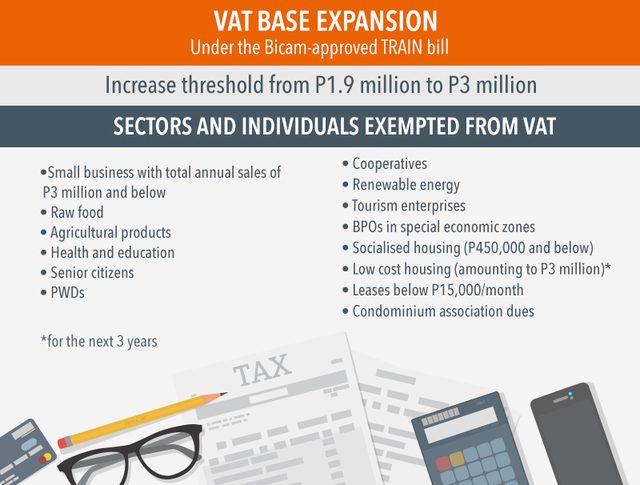

VAT base expansion

Under Train, there will be an increase in the value added tax (VAT) threshold from P1.9 million to P3 million.

This would mean small business with annual sales of P3 million and below would be exempt from paying VAT, which is envisioned to encourage growth and job generation.

The following sectors and individuals are also VAT-exempt under Train:

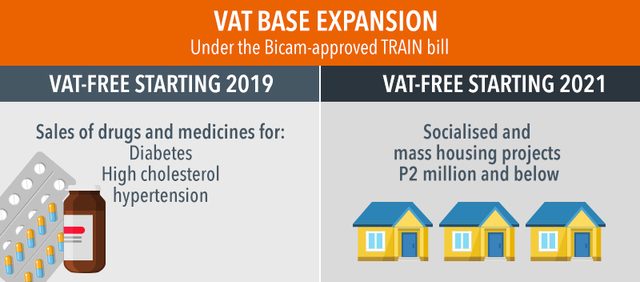

Three years into the effectivity of Train, the following items will be VAT-exempt:

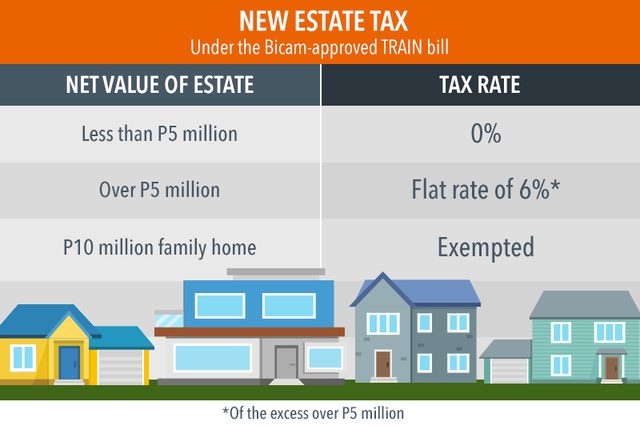

Estate tax, donor’s tax

A flat rate of 6% for estate tax and donor’s tax will also be imposed under the new law. Under the previous scheme, estate worth P200,000 and above was taxed between 5% to 20%.

Family homes that are worth up to P10 million, will be exempted from estate tax, higher than the P1-million tax-exempt value under the current law.

To help heirs settle expenses relating to the passing of the deceased person, the Train law also increased allowable withdrawals from the deceased person’s account to any amount, subject to a 6% final withholding tax. Currently, only withdrawals up to P20,000 is allowed.

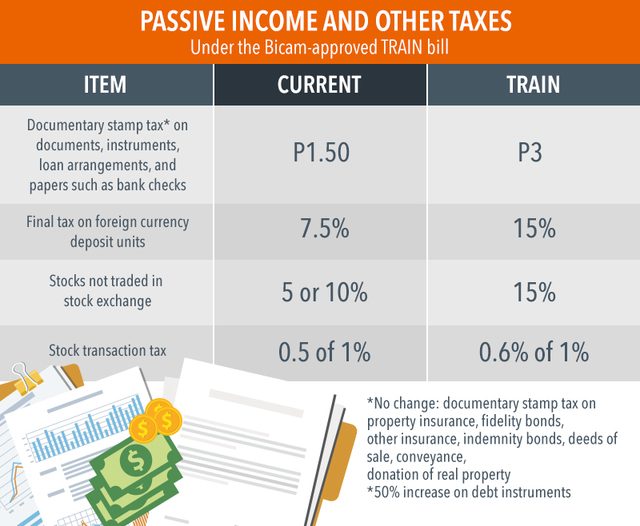

Passive income and other taxes

New rates for the documentary stamp tax and final tax on currency deposit units are provided in the Train law.

Tax rates for stocks not traded in the stock exchange as well as the stock transaction tax are increased under the law.

The government expects two-thirds of the needed revenue for priority projects to be provided by the Train law. The next tax reform package is expected to be passed in early 2018. – with reports from Aika Rey/Rappler.com

*EDITOR’S NOTE: We have corrected the table on income taxes. While the first column was originally labeled “Annual Salary,” it now correctly reflects “Taxable Income.”

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.