SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[OPINION] Tax carbon emitters, use new revenue for health care](https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/FF875DCC00474C20BA10987DDBD8ADCE/coal-fired-power-plants-aug-23-2014.jpg)

The passage of the TRAIN law and the ongoing debate now on additional tax reform packages raise the issue of what products and activities should be properly taxed. I argue in this article that carbon emissions should be the next target of tax policy and that revenue from this should be used to support universal health care.

The world is full of unintended consequences. Economists know this all too well and even have a term for it for when it involves a third party – they call it an externality. The classic example of a negative externality is smoking as the smoker does not compensate those nearby for damaged lungs caused by inhaling second-hand smoke.

In most cases, people will tend to ignore a small negative externality if they can step away from it. In a top Manila university, the establishment of isolated “smoking pocket gardens” was lauded by non-smokers, but obviously detested by the smokers.

But what happens when the negative externality is too big to ignore and the whole of society is affected?

Air pollution caused by emissions of carbon dioxide and other greenhouse gasses can’t simply be pocketed away. Economists also know that externalities that result in a net social welfare loss would need some form of market or government intervention.

Many have written about this topic, but it bears repeating: energy produced by coal-fired power plants (CFPP) generates a significant amount of greenhouse gasses, which contributes to climate change. If the country’s planned CFPP projects all become operational, we will have an excess amount of energy generated from coal.

But, since you can’t just shut off a coal-fired power plant when you don’t need the energy, they will continue to burn coal and produce greenhouse gasses at maximum capacity. That’s like a smoker continuously lighting up another cigarette before finishing the previous one. It’s unnecessary and wasteful, not to mention it has severe implications on our environment and our health.

‘Market failure’ of fossil fuel prices

Coal, among all the fossil fuels such as gas and diesel, is perceived as “cheap” and readily available but its true social costs are not accounted for.

If carbon emitters all over the world were to pay for all the negative externalities, estimates put the global social cost of carbon at $40 per metric ton of CO2 emitted.

In contrast, the recently passed TRAIN law levies an excise tax on coal of less than $1 per metric ton of coal in 2018 – that’s equivalent to 34 US cents per metric ton of CO2 (MT/CO2) – far less than what it costs us to mitigate the impact of air pollution generated by coal power plants. Furthermore, the excise tax in this case is not at all meant to directly address the externalities caused by burning coal as a fossil fuel.

If we are to truly capture the externality caused by CO2 emissions, we need to address what the Department of Finance’s National Tax Research Center (NTRC) calls a “market failure” in fossil fuel prices.

Putting the right price on carbon that is specific to the Philippine experience will in effect make polluters accountable and address the risks of climate change.

To be fair, this accountability should extend to coal, gas, and diesel for energy generation as well, with the government annually collecting information on actual emissions to measure progress against our commitments to the Paris Agreement.

Getting price of carbon right

A soon-to-be-released study of by a team I led from Manila Observatory (MO) took into account different carbon pricing models in order to come up with a localized price model.

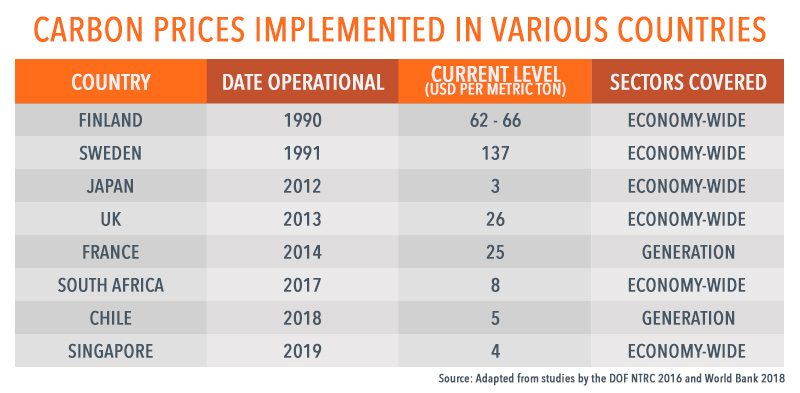

The models range from the globally accepted price of $40 MT/CO2 to the NTRC’s and World Bank’s estimates of $2-4 MT/CO2. Based on the MO study, the government should consider a Philippine carbon tax of $10 MT/CO2 to sufficiently cover the damages associated with carbon emissions.

When compared against other countries that have implemented the carbon tax, a Philippine carbon accountability charge of $10 MT/CO2 is way below the tax levied by industrialized western nations and slightly above our regional neighbors Japan ($3 MT/CO2) and Singapore ($4 MT/CO2).

If we do this right, we would be ahead of the curve and will be credited for thinking about our long-term sustainability.

Fund for health care, no burden for poor

Aside from the environmental dimension of the carbon tax, the government will be able to raise much needed revenue – around at least P52 billion – which would go in part to offset the inflationary impact of the new tax and in part to fund the estimated P100 billion needed for Universal Health Care (UHC).

For a country that spends 0.6% of GDP ($400 million) on health expenses caused by pollution, taxing carbon to fund health care coverage is not only logical, but it is the right thing to do.

Given the current atmosphere surrounding the TRAIN law and higher inflation, the public may be concerned that an additional carbon tax would be inflationary. The risk to inflation is valid but can be mitigated.

According to our study, electricity rates would increase by less than P1 per kWh. For an average household that consumes 200 kWh of electricity, that amounts to a P94 increase in their bill every month. For smaller consumers, their bill could be offset by direct subsidies so they won’t have to pay an additional centavo.

Window of opportunity

There is no better time to discuss carbon accountability charges than now.

The House and the Senate are currently deliberating additional tax reform packages, which can include this proposed tax.

House Bill 4739, authored by Representative Luis Raymund Villafuerte, proposes an even higher tax of $20 MT/CO2, which is still in line with global carbon tax practice. Between the banking sector’s increasing concern about stranded assets of fossil fuel power plants and our country’s commitment to reduce emissions and limit climate change, the policy window to take action that will benefit society for generations to come is wide open.

Will our lawmakers intently seize this golden opportunity or will they resign us to a future of unintended consequences? – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.