SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask the Tax Whiz] How do enforcement programs affect BIR collections?](https://www.rappler.com/tachyon/2022/03/tax-whiz-march-13-2022.jpg)

What are the different enforcement programs of the Bureau of Internal Revenue (BIR) for the taxable year 2022?

Recently, the BIR issued Revenue Memorandum Circular (RMC) No. 10-2022 to publish its priority programs and projects for 2022. Among the enforcement programs are the following:

1. Run After Tax Evader (RATE)

This program emphasizes the criminal nature of tax evasion in order to have a maximum deterrent effect on taxpayers. In addition, it aims to enhance voluntary compliance and promote public confidence in the tax system.

2. Oplan Kandado

This program promotes voluntary compliance and increases revenue collections through the closure of non-compliant business establishments.

3. Broadening of the Taxpayer Base

This targets to simplify taxpayer compliance to increase the number of registered businesses annually. It also seeks to uncover unregistered businesses through the Taxpayer Compliance Verification Drive and third-party information.

4. Intensified Audit Program

The objective of this program is to intensify investigation of taxpayer compliance through the maximization of computer assisted audit techniques. In addition, it targets to collect at least 3% of the bureau’s total collection goal from the following sources:

- Withholding tax on compensation

- Tax remittance advice

- Withholding tax on local government units

- Special allotment release orders

- One-time transactions

Which among the enforcement programs of the BIR had a huge impact on collections in 2021?

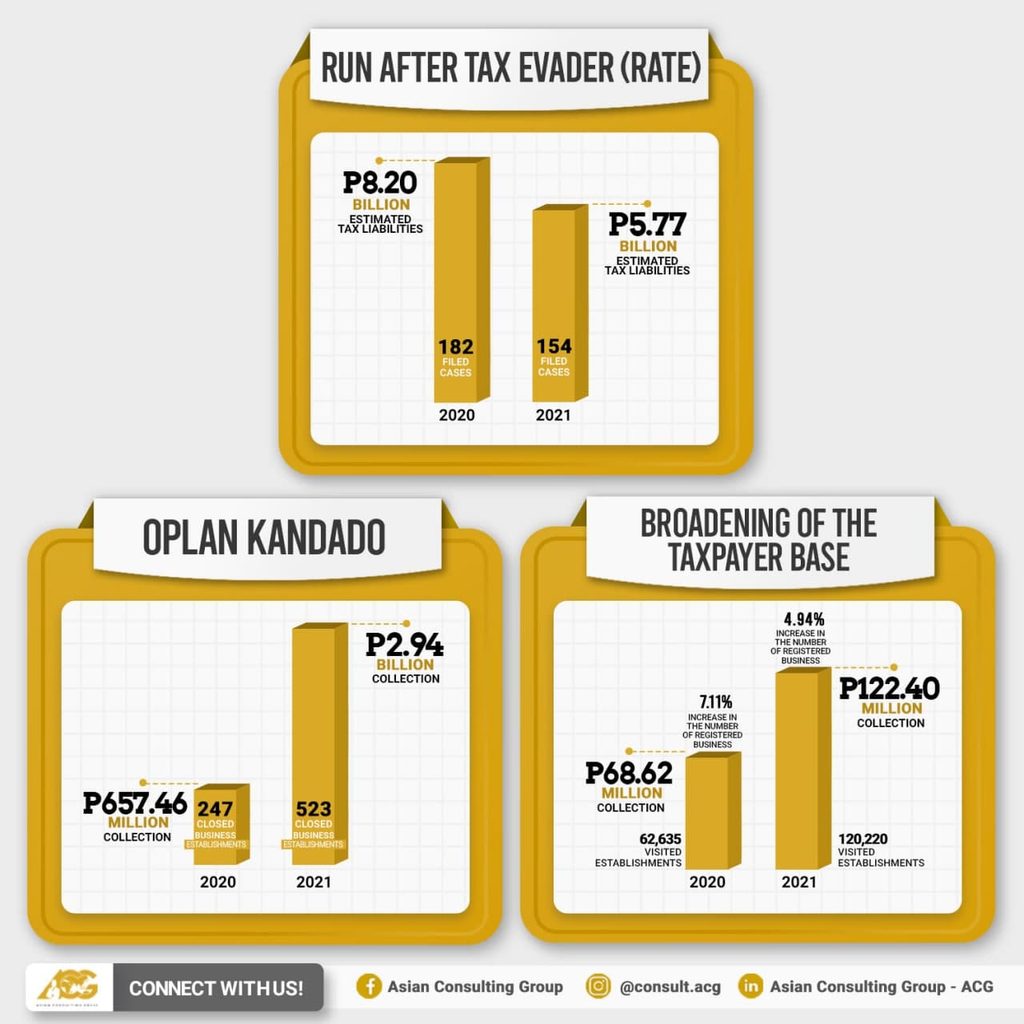

Under the RATE program of the BIR, the total cases filed with the Department of Justice and the Court of Tax Appeals went down from 157 and 25 to 137 and 17 for the taxable year 2021, respectively. This reduced the estimated tax liabilities to P5.77 billion from P8.20 billion in 2020.

| 2020 | 2021 | |

| Complaints filed | 182 | 154 |

| Estimated tax liabilities | P8.20 billion | P5.77 billion |

Oplan Kandado showed improved results. The bureau posted a 112% increase in collections, from P657.46 million in 2020 to P2.949 billion in 2021. The program also saw an increase in the closure of non-compliant businesses, from 247 to 523.

| 2020 | 2021 | |

| Collections | P657.46 million | P2.949 billion |

| Closed businesses | 247 | 523 |

Through the broadening of the taxpayer base, the bureau was able to collect a total of P122.40 million for 2021. It also recorded a 4.94% increase in the number of registered businesses and a total of 120,220 visited establishments.

| 2020 | 2021 | |

| Increase in the number of registered businesses | 7.11% | 4.94% |

| Collections | P68.62 million | P122.40 million |

| Visited establishments | 62,635 | 120,220 |

From the performance of these enforcement programs, we can see a huge improvement in BIR collections from 2020 to 2021.

For the taxable year 2022, the bureau’s overall collection is targeted to be P2.435 trillion. This is 17% bigger than its P2.081-trillion collection goal for 2021.

What are the other priority programs of the BIR for 2022?

In addition to the enforcement programs enumerated in RMC 10-2022, the BIR has other priority programs in line with its digital transformation thrust. These all aim to help the bureau meet its 2022 collection target.

A. Tax Compliance Monitoring Program

- Innovating taxpayer experience and BIR service process

- Streamlining of creditable withholding tax rates

- Re-architecture and enhancement of the eSubmission facility

- Re-architecture and development of the filing system

- Taxpayer Awareness Program

- Integration of the alcohol industry in the Enhanced Internal Revenue Stamps Integrated System

B. Enhancement of Administration and Support Services Programs

- Nationwide BIR Payroll System

- Expedite the recruitment of new personnel and the promotion of qualified employees

- Strengthen budget management

- Aligning policies to a BIR digital workplace

- Integrity Management Program

- Enabling the digital backbone of the BIR

Be prepared and don’t let the BIR run after you. Join us for another Executive Tax Management Program on Monday, March 14. Register through this link or scan the QR code in the image below. Use the promo code Rappler2022 to avail of a discounted fee. For inquiries, you may also email us at consult@acg.ph or contact 09176278805.

– Rappler.com

Mon Abrea, CPA, MBA, is the co-chair of the Paying Taxes-EODB Task Force. With the TaxWhizPH mobile app as his brainchild, he was recognized as one of the Outstanding Young Persons of the World, an Asia CEO Young Leader, and one of the Ten Outstanding Young Men of the Philippines because of his tax advocacy and expertise. Currently, he is the chairman and CEO of the Asian Consulting Group and trustee of the Center for Strategic Reforms of the Philippines – the advocacy partner of the Bureau of Internal Revenue, Department of Trade and Industry, and Anti-Red Tape Authority on ease of doing business and tax reform. Visit www.acg.ph for more information or email him at mon@acg.ph and download the TaxWhizPH app for free if you have tax questions.

Add a comment

How does this make you feel?

![[Ask The Tax Whiz] How to file annual income tax returns for 2023](https://www.rappler.com/tachyon/2022/11/tax-papers-hand-shutterstock.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.