SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Editor’s note: This content is sponsored by the Bank of the Philippine Islands and was produced by BrandRap, the sales and marketing arm of Rappler. No member of the news and editorial team participated in the production of this piece.

After being part of the workforce for about a decade, I’ve gone through a slew of payroll accounts with various banks as well as the apps and online accounts that go with them. But there was one bank that I really went out of my way to create a savings account with when I earned my first paycheck – and that was the Bank of the Philippine Islands (BPI).

I deliberately chose this bank for many reasons, but mostly because it has such a long history in the country (it is the first bank that was established in the Philippines and Southeast Asia, and was at a time functioning as our central bank) and my entire household uses BPI.

That was ten years ago. Today, I still use BPI. I’ve stayed with the bank for so long simply because I continue to enjoy their products.

From stocks investing and investment funds, prepaid cards with exclusive perks (like Amore that gave me access to lounges in Ayala Malls), down to their credit cards – I’ve gone through the wringer. Shoutout to those who made it to this year’s BPI travel fair, btw.

My most used product with BPI though is their BPI Debit Mastercard. Why? Because I like how much control they give their cardholders.

First off, if you’re a Mastercard user, you get all the usual perks – discounts and rewards from their very extensive list of merchant partners, the ability to use your card even when you’re abroad, access to exclusive events, and more.

BPI takes this a step further by granting you more control over how you use your card through the BPI Online portal or through their official app. And from personal experience, their online portal and app are some of the easiest to use when it comes to online banking. I like how the app has a dashboard of your BPI accounts too, so I have accounts for specific needs and enjoy filling them up like buckets as I work towards my personal financial goals.

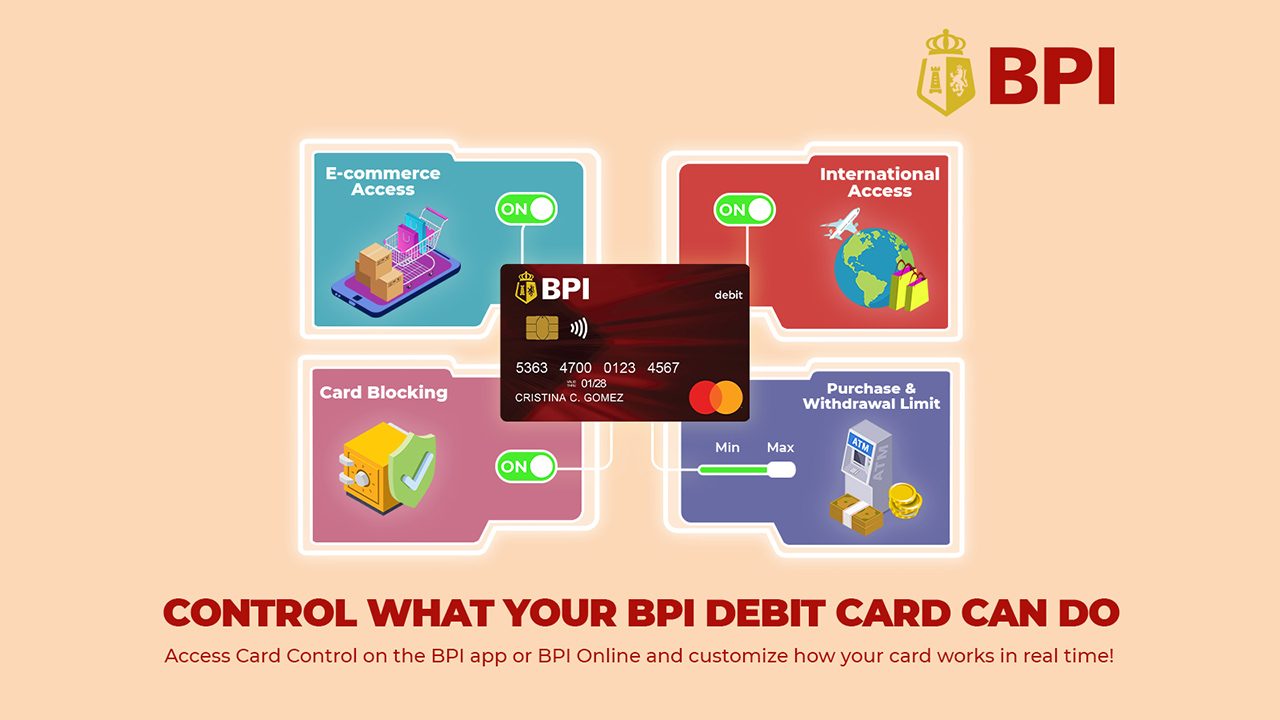

With a BPI Debit Mastercard, you can customize your banking experience in real-time, giving you more power over your finances.

Adjusting withdrawal and purchase limits

Say for example you want to control your spending so you can save more (or save up for that one thing you’ve been obsessing about), it’s easy to adjust withdrawal limits so you don’t go overboard when you get cash through an ATM. This way, you can keep tabs on how much money you withdraw at a time.

The same goes for purchase limits. If you want to put a cap on or increase how much you can spend on big-ticket items then you can do so in real time.

Enable or disable international access

Traveling? Gone are the days when you need to notify banks about your travel plans so they don’t pre-emptively block your card if you make a purchase in another country. Today, all it takes is a few taps on your screen. With a BPI Debit Mastercard, you can turn on international access through your BPI Online account.

And when you’re finally home and want to make sure no one’s using your card without your knowledge, you can easily turn international access off.

Toggling online shopping on or off

It’s not just international access that you can customize. You can also keep tabs on e-commerce access by turning it off or on. Say you’re shopping online and want to use your BPI Debit Mastercard, it’s easy – just toggle e-commerce on!

And if you’re done shopping and want to keep your accounts secure, you can easily turn e-commerce access back off. This way, you won’t be so worried about your debit card being exposed to online fraud.

That being said, do practice reasonable security measures like transacting with trusted websites only and never giving out your personal pin or one-time password to anyone.

Temporarily or permanently block your card

I remember losing my wallet a couple of years ago and calling up every bank I had accounts with to have my cards canceled, and then finding my wallet immediately after. Can you imagine the amount of stress I had dealing with replacing all my cards afterwards?

With a BPI Debit Mastercard, you won’t have to go through that anymore. You can just temporarily block access to your card as you look for it. And honestly, it’s embarrassing to admit how much I’ve had to use this feature since I first stumbled upon it. But hey, it’s always better to be safe than sorry. At least with a temporary block feature, you can just unblock your card if you do find it.

And if it so happens that you’ve actually lost your card with no way of getting it back, there’s also an option to permanently block it.

Being in control

Knowing what you can do with your bank is an empowering feeling, especially as you grind towards financial stability. I used to keep tabs on my spending manually (with spreadsheets and personal trackers), but it’s been a great experience using BPI Debit Mastercard’s card control features because what used to be overcomplicated processes are now simplified.

And I don’t know about you, but all this has just made it even more exciting for me to work hard, save, invest, and of course, spend my money.

If you want to know more about BPI Debit Mastercard control features (and all the other perks that go with owning one), you can visit https://www.bpi.com.ph/debitcards/debit-mastercard/card-control – Rappler.com

Add a comment

How does this make you feel?

![[Finterest] What exactly does a bank do, and how can they help you?](https://www.rappler.com/tachyon/2022/09/shutterstock-philippine-peso.jpg?resize=257%2C257&crop=329px%2C0px%2C900px%2C900px)

There are no comments yet. Add your comment to start the conversation.