SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

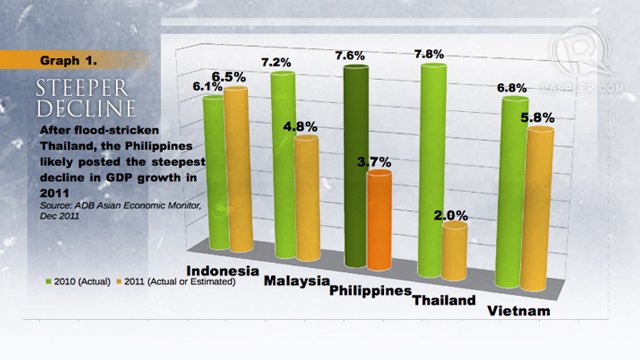

MANILA, Philippines – It’s said a crisis is too good an opportunity to go to waste. So is a sharp slowdown – like what happened to the Philippines last year when economic growth slumped to just 3.7% from the previous year’s 7.6%, the highest in 34 years.

There are 2 big lessons from the drastic deceleration in the Philippines, which likely posted the least growth in southeast Asia in 2011 after flood-stricken Thailand, according to the Asian Development Bank.

The 1st and more obvious one is the need for command and control over the government’s anti-corruption drive to prevent prolonged reviews that stalled many key infrastructure projects.

Government infrastructure spending dropped sharply under Aquino, cutting potential economic growth by 0.7 percentage points in 2011, according to the National Economic and Development Authority itself. Public construction fell by an average 30% in each of the first 5 quarters since the president assumed office on June 30, 2010.

However, we need to be clear that the problem is not the sharp decrease in spending itself. A spending slowdown is fine especially if it comes after a period of excessive election-related outlays, some of which went to unsound and possibly graft-ridden projects. Some of the expenditure decline could very well represent savings because of better project selection and design.

The problem is the lack of effective control over the review and reform process, which seemed to have gone out of hand. As NEDA chief Cayetano Paderanga Jr himself acknowledged: “The review was done by the different agencies. The degree (of the cuts) was probably – you know when you do these things separately – in a way not anticipated. Now that we have seen this, there will be adjustments.”

He made the statement back in May 2011, when first quarter economic output numbers showed that government capital outlays continued to slide. Yet, government underspending continued well after that. Non-interest government expenditures in the first nine month of 2011 fell 17% below the administration’s own budget for the same period. Public construction finally rose in the fourth quarter, surging by 49.4% from the previous year, after the government put in place a disbursement acceleration plan to counter the impact of the global economic slowdown.

The economic planning chief assures that government spending will continue to pick up speed this year. “The hard work of reforming government processes and plugging expenditure leaks has been done,” he said on January 30. The NEDA last year has already approved about 6 projects that will be ready for implementation this year.

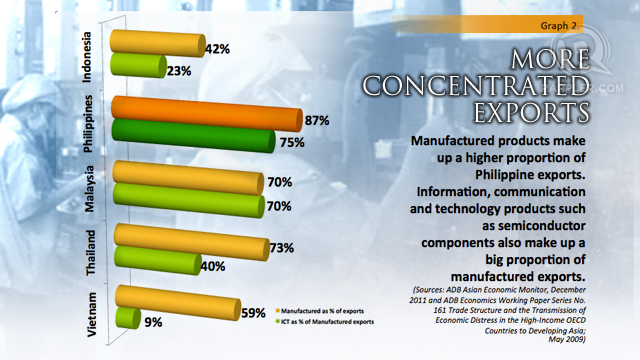

The 2nd lesson – diversifying Philippine exports which are dominated by low-end semiconductor parts and components – is not as obvious as the 1st. It may also prove harder to put in practice; every administration has been trying to expand the country’s export base as well as markets but with limited success.

But more than the other factors, weak exports contributed the most to the country’s sluggish GDP growth last year. NEDA estimates that falling overseas sales cut the Philippines’ potential economic growth by 2.2 percentage points.

In turn, the big drop in exports, which fell by around 13% in the 2nd half of the year as the global economy began to slow, can be traced largely to the Philippines’ narrow export base made up largely of semiconductor components. “Philippine exports is very concentrated in one sector and that was the sector most hit by global slowdown,” said Paderanga.

Indeed, manufactured products account for 87.3% of the country’s exports, far more than any other country in south-east Asia.

And information communication technology (ICT) parts and components, which go into computers, laptops, smartphones and other gadgets, made up 75% of Philippine manufactured exports, according to the ADB.

Too, almost half of Philippine exports go to just to the United States and Europe, the regions causing the global slowdown. In a downturn, the rich world’s consumers and companies typically cut back on spending for new computers, laptops and other electronic gadgets.

Other big south-east Asian countries such as Indonesia and Malaysia were also affected by the global slowdown but still managed to grow at much faster pace than the Philippines. The ADB estimates that Indonesia expanded by 6.6% last year and Malaysia by 4.8%. That may have something to do with their more diverse exports. Manufactured goods account for just 42.1% of Indonesian exports and 69.7% of Malaysian exports.

Aquino’s economic managers are acutely aware of the risks of too much export concentration, and want to boost exports to China, which is in the midst of rebalancing its economy towards domestic consumption. The Philippines is already China’s No.1 source of bananas and No.2 for coconut oil. Trade officials are exploring the prospects of selling high-quality and branded furniture and woodcraft, designer clothes and accessories, and health products such herbal supplements to China’s rapidly growing middle class.

No doubt, the Philippines urgently needs to rebalance its exports. It can’t be all electronics parts and components. There should be more of minerals and processed foodstuffs, which can be produced competitively in the country given the right conditions. At this time, it wouldn’t hurt to go easy on the semiconductor chips, and instead export more banana chips.

Aquino’s economic managers have begun to streamline and plug leaks in the government expenditure system. It would not be as easy to diversify the country’s narrow export base. All the more reason, then, to begin as soon as possible. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.