SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Some of the country’s poorest households are expected to continue suffering from a high inflation rate in the next two months, said the dean of the University of the Philippines (UP) Diliman School of Statistics, due to the recent spike in fuel and food prices.

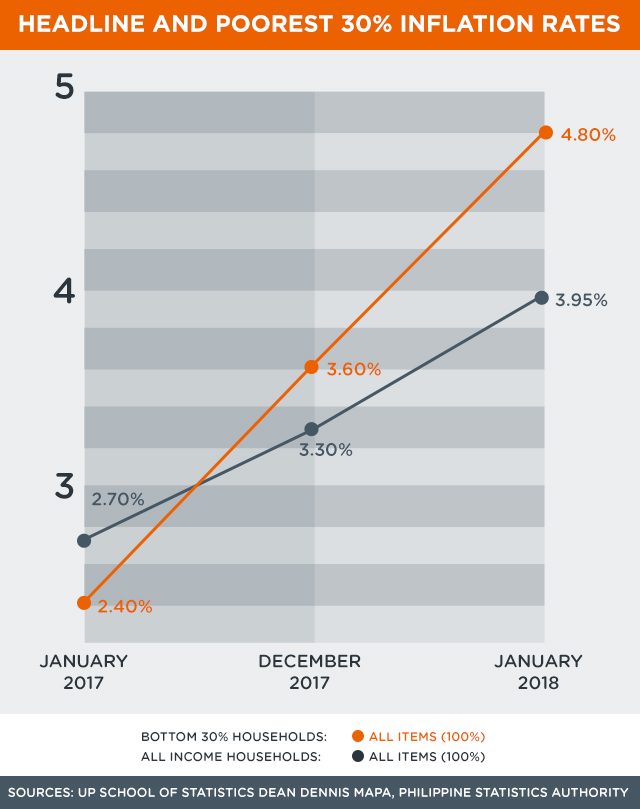

Citing data released by the Philippine Statistics Authority (PSA), Dennis Mapa pointed out that the inflation experienced by the bottom 30% households surged to 4.80% in January this year, from 3.60% last December.

This was higher than the headline inflation of 3.95% in January and beyond the government’s target of between 2% and 4%.

In an academic conference last Wednesday, February 28, Mapa highlighted the “direct and indirect impacts” of the newly-implemented Tax Reform for Acceleration and Inclusion (TRAIN) law on the movement of prices of basic goods and services.

For the bottom 30% of Filipino households, the food index (69.88% of all items) was faster at 4.90% in January 2018, compared to the 3.70% in December 2017.

This means the prices of food were increasing faster in January than in December. Food index tracks the movement of prices of food, including rice, corn and fish, in a specific period.

High inflation among poor households in January was mainly noted in the faster movement of prices of rice.

“[The] shock in the price of rice during the month has [an] immediate effect as well as future effects on the inflation rate of the poor. It will continue to rise in the next two months even if the price of rice starts to decrease,” Mapa said.

Direct, indirect impact of TRAIN

Mapa said the tax reform law has both direct and indirect effects on the cost of goods, with price hikes “particularly felt by the poor during the start of the year.”

The Department of Finance (DOF) claimed in a statement on Sunday, March 4, that TRAIN had no impact on inflation, except for sugar-sweetened beverages. (READ: EXPLAINER: How the tax reform law affects Filipino consumers)

According to the DOF, the 0.2-percentage-point increase for fish in January was due to the closed season in fishing which led to scarcity in fish catch.

“Vegetables, [which increased] by 0.09 percentage point, [was] due to typhoons in December which destroyed the vegetable harvest,” the finance department added.

But Mapa disagreed, saying that the economic managers “may have overlooked” the welfare side of the tax reform law.

“The DOF justified that it is seasonality – because there was [a] typhoon. But the type of fish that is mostly consumed by the poor is canned, so you cannot say that inflation was not affected by TRAIN,” the statistics dean and professor said.

“It is easy to say that weather was a factor if you are consuming the fresh ones, but if you are consuming the canned goods, weather pa din ba ‘yun (can that still be attributed to the weather)?” he added.

Mapa said the DOF only computed the direct effects of the tax reform law, not the indirect.

“You have to anticipate any change in behavior,” he added, citing the Lucas critique, which argues it is naive to try to predict the effects of a change in economic policy entirely on the basis of relationships observed in historical data.

“Any change in the policy, in this case TRAIN, will alter the behavior of individuals. For instance there was profiteering of traders and bigger adjustment on the expectation of higher cost somewhere,” Mapa said.

According to the DOF, beverage producers started raising their prices even when they were selling old inventory, in anticipation of the tax on sugar-sweetened beverages.

Mapa also cited organizational problems at the National Food Authority (NFA) as an indirect effect of TRAIN on inflation.

“There is [a] shortage of NFA rice in the market. You implement TRAIN and you are not ready with the price of rice,” he added.

Socioeconomic Planning Secretary Ernesto Pernia has been pushing for the lifting of the quantitative restriction (QR) on rice to increase the purchasing power of households, especially the poor.

While economic managers estimated a 0.1 to 0.7-percentage-point impact of the tax reform law on inflation, Mapa projected higher than that.

He said that for the bottom 30% households, it would be 0.9 percentage point for the 1st year.

“1.8 percentage points impact of TRAIN on inflation among [the] poor once the entire P6 per liter tax is implemented,” Mapa added.

Insufficient safety net

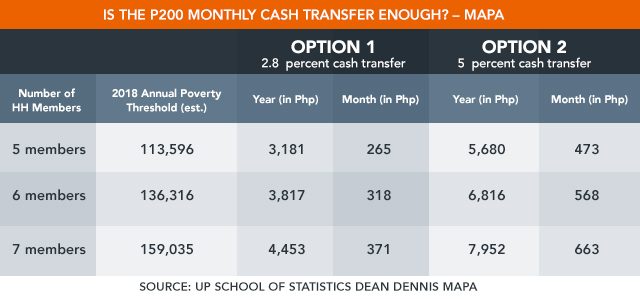

Mapa also argued that current cash transfers of P200 per family per month may not be enough.

“My problem with the cash transfer is it assumes that the poor household is of 5. But [a] poor household [can consist] of 6-7 members,” he said.

For 2018, the DOF said the government has allocated P25.67 billion for unconditional cash transfers to help low-income households cope with the inflationary impact of TRAIN.

“[The] DOF’s P200 monthly cash transfer estimate was based on [an] inflation rate of 3.3%. January was already at headline inflation of 3.95%. Perhaps policymakers should look at the latest data sets,” Mapa said.

The DOF had said that some 7.4 million households would each receive P2,400 for 2018, with the entire amount expected to be given in the 1st quarter.

“When it hits the poor, you can’t say it is just a transitory effect. For us, middle class, it is okay, we can delay a cup of coffee. But for the poor, no. The cash transfer is critical,” Mapa said.

He added that higher inflation among the poor is a threat to the government’s poverty reduction efforts. (READ: Poor families to get P200 tax reform subsidy starting January)

Finance Undersecretary Karl Kendrick Chua, however, had said TRAIN’s ultimate goal is to provide the government with the revenues to fund its inclusive growth agenda, which envisions an upper middle income status for the country by 2022 and eventually a high income one by 2040.

“This means reducing poverty from 21.6% today to 14% by 2022, or lifting some 6 million Filipinos from poverty by 2022 and eventually eradicating extreme poverty by 2040,” he said.

But for Mapa, with the high inflation rate, reducing poverty to 14% by 2022 would be “a tall order.”

“This is not the first time we are seeing it. Poverty statistics since 2006 showed that whenever there are spikes in inflation, poverty reduction efforts are constrained,” Mapa said.

The PSA is set to announce the February 2018 inflation rate on Tuesday, March 6. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.