SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippines still lagged behind neighbors in Southeast Asia in attracting job-generating Foreign Direct Investments (FDI) in 2012. The good news, however, is that the FDIs that flowed into the Philippines showed one of the highest pace of growth.

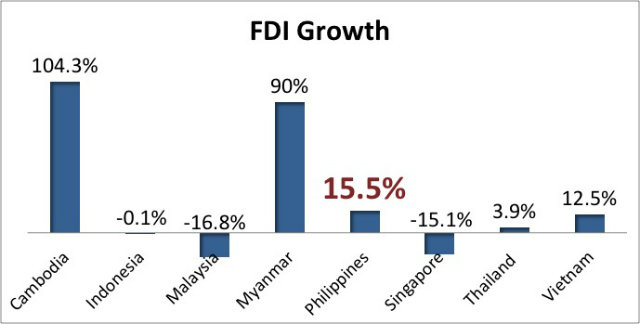

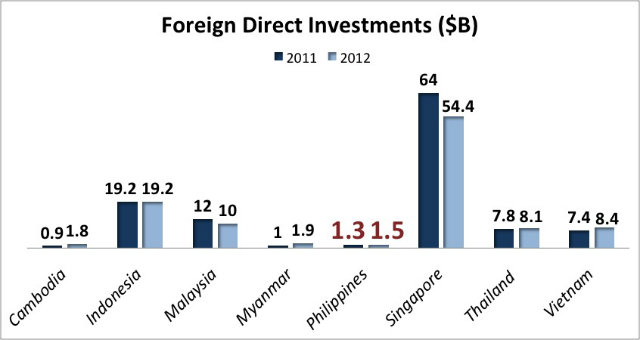

Preliminary figures released by the United Nations Conference on Trade and Development (Unctad) showed the Philippines received $1.5 billion-worth of FDIs in 2012, a 15.5% growth from 2011’s $1.3 billion.

The UN body noted that this pace of growth was faster than Vietnam’s 12.5%, Thailand’s 3.9%, Indonesia’s flat growth and against Singapore’s 15.1% decline. Cambodia posted the fastest growth of 104.3%.

FDIs into Southeast Asia

The Philippines was still considered a ‘bright spot’ for FDIs in 2012, particularly among Association of Southeast Asian Nations (ASEAN) member nations, which stayed resilient despite the economic woes of the world’s biggest economies.

“Despite an overall 7% decline in FDI inflows to the ASEAN, some countries in this group of economies appear to be a bright spot: preliminary data show that inflows to Cambodia, Myanmar, the Philippines, Thailand and Viet Nam grew in 2012,” Unctad said.

Unctad’s preliminary data showed the following FDI volume flowing into specific ASEAN-member countries in 2012:

- Singapore, $54.4 billion

- Indonesia, $19.2 billion

- Vietnam, $8.4 billion

- Thailand, $8.1 billion

- Cambodia, $1.8 billion

- Philippines, $1.5 billion

“FDI recovery is on a bumpy road. While FDI in developing countries remained resilient, more investment in sectors that can contribute to job creation and enhance local productive capacity is still badly needed. Therefore promoting FDI for sustainable development remains a challenge” UNCTAD Secretary-General Dr. Supachai Panitchpakdi said.

Risks

This 2013, Unctad said global FDI flows could increase to $1.4 trillion and $1.6 trillion in 2014 on the back of ‘uneven recovery’ in the global economy that is expected to persist until 2014.

Unctad said risks to this scenario persist, including structural weaknesses in major developed economies and in the global financial system.

Other risks include the possible further deterioration of the macroeconomic environment as well as the significant policy uncertainty in areas crucial for investor confidence, including fiscal policy and investment regulations and restrictions.

“Should these risks prevail, FDI recovery could be further delayed,” Unctad said. – Rappler.com

UNCTAD Global Investment Trends Monitor by Rappler Philippines

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.