SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

With the highly controversial Metro Manila Film Festival (MMFF) disqualification case against Erik Matti’s “Honor Thy Father,” I wonder if film producers get tax incentives for producing “quality movies.” What are the taxes investors and producers in the film industry need to know to avoid problems with the BIR?

Yes. Films which have obtained an “A” or “B” grading from the Film Development Council Cinema Evaluation Board pursuant to Sections 11 and 12 of RA 9167, shall be entitled to the amusement tax reward.

A grade “A” or “B” film shall entitle its producer to an incentive equivalent to the amusement tax imposed and collected on the graded films by cities and municipalities in Metro Manila and other highly urbanized and independent component cities in the Philippines pursuant to Sections 140 and 151 of Republic Act No. 7160 at the following rates:

a. For grade “A” films – 100% of the amusement tax collected on such films.

b. For grade “B” films – 65% of the amusement tax collected on such films. The remaining 35% shall accrue to the funds of the Council.

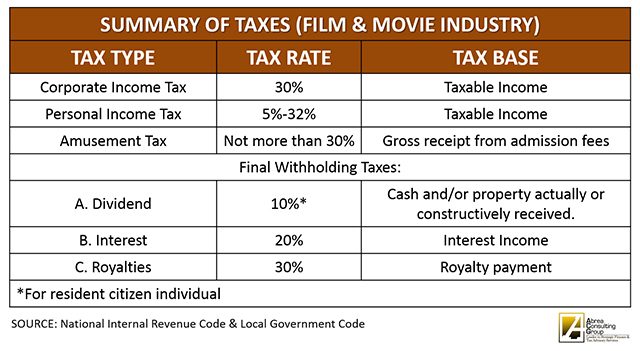

Here’s the summary of taxes investors, producers and contractors need to know to avoid tax problems:

The Star Wars movie definitely made a lot of money. Almost all cinemas were showing it before the MMFF. Are movie tickets subject to any special tax? How much?

Yes. It is subject to 10% Amusement Tax based on the gross receipts from the admission fees. The amusement tax is collected by the local government.

How much is the Miss Universe crown? Is it taxable even if the competition was held in Las Vegas? Will the Bureau of Internal Revenue (BIR) be after the prize of Miss Universe Philippines Pia Wurtzbach? Is it true that when the Philippines hosted the Miss Universe pageant in 1974, all Philippine taxes were waived in favor of the organizers and contractors?

If you’re referring to the prize package of the winning Miss Universe, it is a long list provided in their website: missuniverse.com.

If it is a local competition held in the Philippines, definitely the prize is subject to 20% final tax. However, given the tax treaty between US and the Philippines, any income or award given and received in the US will no longer be subject to Philippine taxes, including the year-long salary of Miss Universe Philippines Pia Wurtzbach.

If I were BIR, I would not (dare) waste time assessing the prize of Miss Universe Pia Wurtzbach.

Yes, its true that the government gave tax incentives for the Miss Universe pageant held here in the country. President Ferdinand Marcos signed Presidential Decree 486 giving tax exemptions to prizes of Miss Universe contestants and certain equipment and facilities to be used in connection with the Miss Universe Beauty Pageant.

Got a question about taxes? #AskTheTaxWhiz! Tweet @rapplerdotcom or email us at business@rappler.com. – Rappler.com

Mon Abrea is a former BIR examiner and an advocate of genuine tax reform. He serves as chief strategy officer of the country’s first social consulting enterprise, the Abrea Consulting Group, which offers strategic finance and tax advisory services to businesses and professionals. Mon’s tax handbook, Got a Question About Taxes? Ask the Tax Whiz! is now available in bookstores nationwide. Follow Mon on Twitter: @askthetaxwhiz or visit his group’s Facebook page. You may also email him at consult@acg.ph.

Add a comment

How does this make you feel?

![[WATCH] Try This: Empanada Salteña from Argentina](https://www.rappler.com/tachyon/2023/04/try-this-empanada-saltena-argentina.jpg?resize=257%2C257&crop=765px%2C0px%2C1037px%2C1037px)

There are no comments yet. Add your comment to start the conversation.