SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

PARIS, France – The eurozone is in better financial shape than a decade ago, but not solid enough to withstand another economic crisis, the head of the International Monetary Fund said on Thursday, March 28.

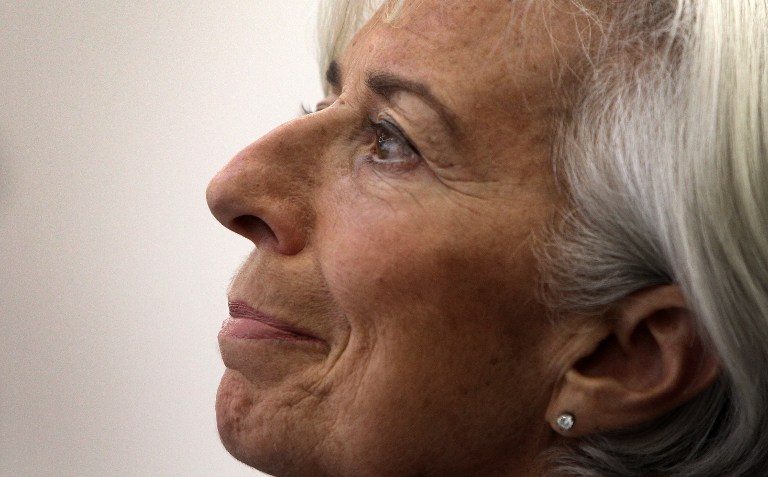

IMF Managing Director Christine Lagarde told a Paris conference that the currency union “is not resilient enough” to emerge unscathed from “unexpected economic storms.”

Lagarde acknowledged that the currency union was now “more resilient than a decade ago when the global financial crisis struck.

“But it is not resilient enough,” she said.

“Its banking system is safer, but not safe enough. Its economic well-being is greater overall, but the benefits of growth are not shared enough,” Lagarde told the gathering, which was organized by the French central bank.

The warning comes as signs are multiplying of slower economic growth, especially in powerhouse Germany and the bloc’s second-biggest economy, France.

On Friday, March 29, indications of a weak first quarter for the eurozone mounted as a closely-watched survey pointed to March output being dragged further down by manufacturing weakness.

Manufacturers in the 19-nation single currency bloc “reported their steepest downturn for 6 years” as pressure mounted from trade wars and Brexit fears, data company IHS Markit said.

On Wednesday, March 27, the European Central Bank added to growth worries when its chief Mario Draghi hinted that interest rates would stay low for longer than previously anticipated, to stimulate growth and inflation.

‘Show new resolve’

“Some can rightfully argue that Europe has been slow to produce a fully developed financial ecosystem,” Lagarde warned, saying Europe was still wounded from the last crisis.

“These events left painful economic scars on many households and companies, sowing the seeds of economic disparity across member countries and within,” she said, adding that “now is the time to give euro area finance another big push.”

She called for the eurozone to “show new resolve and complete the banking and capital markets unions, so it can harvest the benefits now and in the future.”

On banks specifically, she said “we need a European banking system that can bend in a storm without breaking, we need a banking system that will truly diversify risks across the ecosystem and irrigate growth.”

She urged eurozone leaders “to reignite the discussion, to negotiate in good faith and make the difficult compromises to unlock the full potential of the banking union.”

She also said banks needed to establish a “common deposit insurance” which would act as a “vital shade tree” when risks rose.

Such a system should be financed by banks, not taxpayers, she urged.

A single European capital market would also help act as a “spare tire” for the eurozone economy, Lagarde said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.