SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Properties were among the best performing stocks during the 1st half of 2019 and analysts are predicting that the sector will perform even better throughout the rest of the year.

The properties index grew an impressive 17.8% from January to June, beating the benchmark Philippine Stock Exchange index (PSEi) and just placing 2nd behind services at 18.6%.

Piper Tan, research analyst of Philstocks, is betting on properties, as demand for retail, residential, and office space are still on the bright side.

Tan said drivers for the properties sector include outsourcing, online gambling, and overseas Filipinos’ remittances. The government’s infrastructure push is also seen to benefit the sector.

Once the regulations for the real estate investment trust take off in the Philippines, Tan said the future would be even brighter for the properties sector.

Here are Tan’s 3 picks:

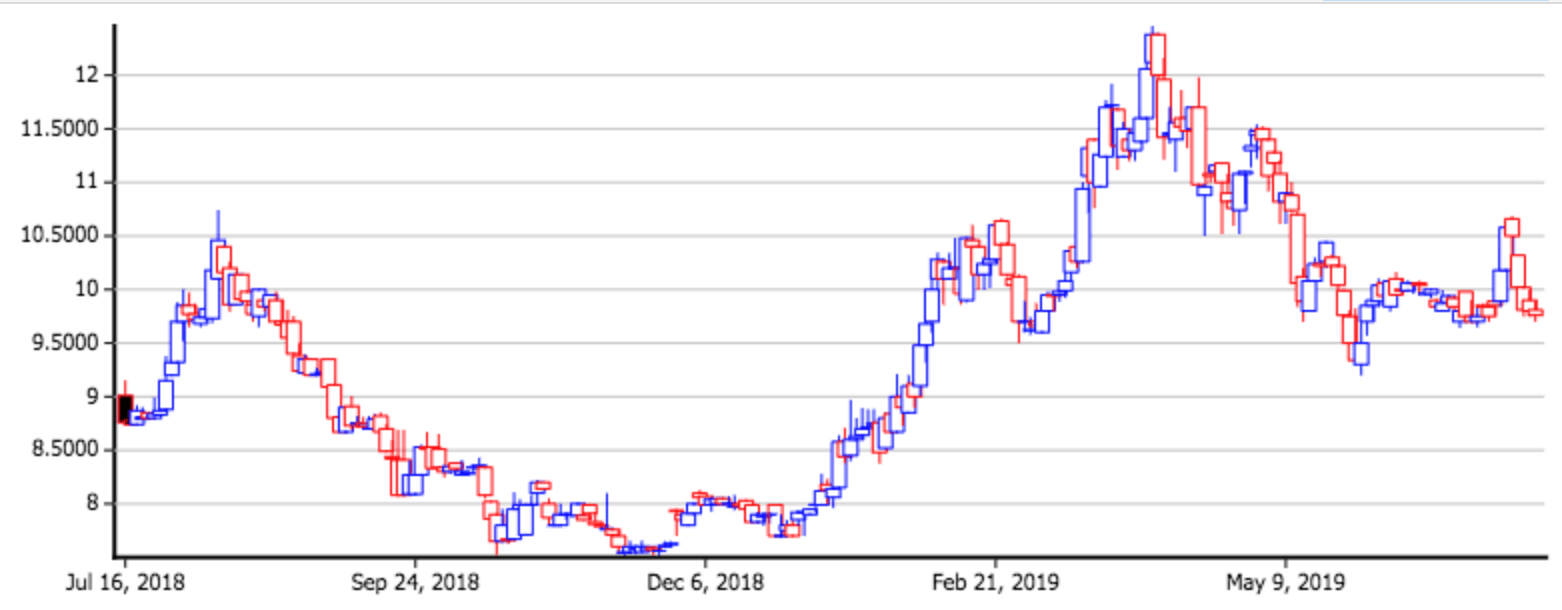

DM Wenceslao (DMW)

Target price: P15 to P17 per share

This company was the only one that braved 2018’s bear market and pushed through with its initial public offering (IPO).

Tan said that while DMW struggled at first and even fell below its IPO price last year, the stock is gaining strength. (READ: DM Wenceslao’s MidPark Towers gains P4.3 billion in pre-selling)

DMW is said to benefit from the growth in the Bay Area in Pasay City, where most of its buildings are being constructed.

“We are not looking at DMW for today, but banking for future growth. The Bay Area is the emerging central business district and surpassing the rates at Ortigas, and is near the airport, there will be a train station there soon, and there is a booming casino industry there,” Tan said.

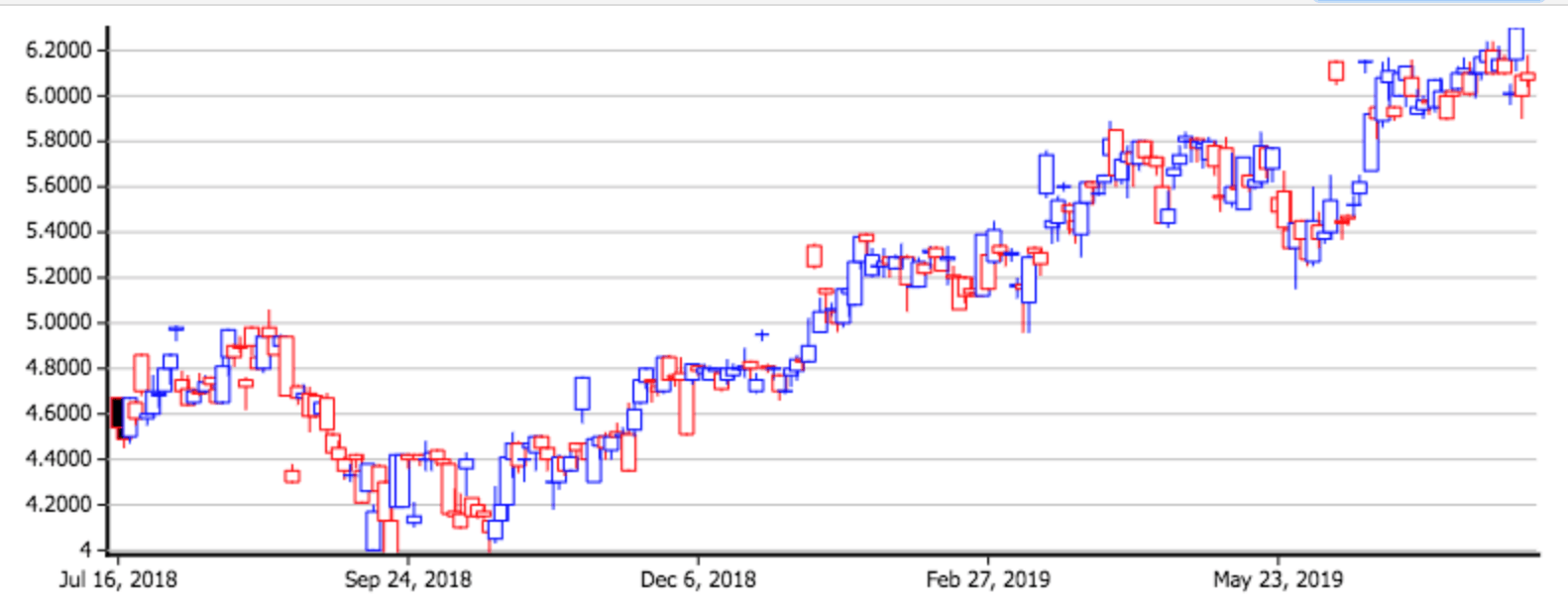

Cebu Landmasters (CLI)

Target price: P7.20 per share

Tan picked Cebu Landmasters for its dominance in the Visayas and Mindanao. With the government’s Build, Build, Build program, development in the regions are seen to be an upside for CLI.

CLI has developments in the cities of Davao, Iloilo, and Bacolod.

“Its presence in Visayas and Mindanao is so large, it ate the market share of other national developers like SM Prime, Ayala, Robinsons, and even Vista Land,” Tan said.

Megaworld (MEG)

Target price: P7.10 per share

MEG is among the cheapest in the PSEi counters, which is why Tan is recommending the buy. (READ: Megaworld plans more developments in Visayas, Mindanao)

“It is not a blue chip and its market cap is not as big as the others in the counter (Robinsons Land, SM Prime, Ayala Land), which is why we are seeing strong growth for Megaworld,” Tan said.

Megaworld has a strong foothold in Metro Manila and is branching out to areas outside the capital region. With 15 townships outside Metro Manila and 9 within the capital region, Megaworld said it wants to increase its presence further outside Luzon. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.