SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

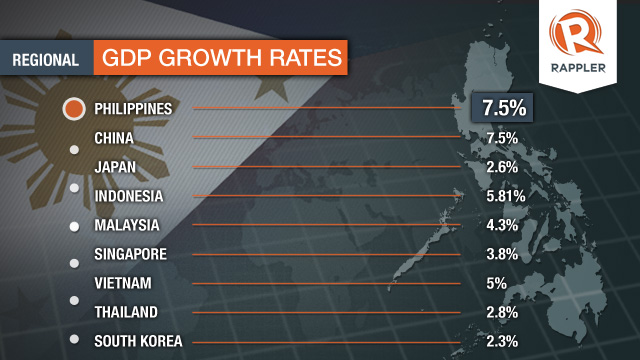

MANILA, Philippines (4th UPDATE) – The Philippines remained the fastest-growing economy in Southeast Asia with a gross domestic product (GDP) growth of 7.5% in the 2nd quarter, the National Statistical Coordination Board (NSCB) announced Thursday, August 29.

Driven by the resilient services sector and improvements in manufacturing, Socioeconomic planning secretary Arsenio Balisacan said the Philippines’ April-to-June economic expansion was at par with the growth of regional powerhouse China.

The Philippines’ 2nd-quarter growth was slower than the 7.7% revised growth recorded in the first.

But Balisacan said it was “significant” because it marked the 4th consecutive quarter that the country grew above 7%.

Economic growth in the first half stood at 7.6%, faster than the 6.4% achieved in the first half of 2012, NSCB secretary general Jose Ramon Albert announced.

Watch the video report:

A ‘rebalancing’ in process

The local economy was still dependent on the services sector, which accounted for 57.9% of GDP. Industry sector’s share was 32.7%, and agriculture, the top employer, contributed 9.4%.

Trade and real estate supported the services sector, which grew 7.4%.

Trade rose 7.3%, while real estate, renting and business activities posted a 9.5% growth, indicating continued expansion of business process outsourcing, said Albert.

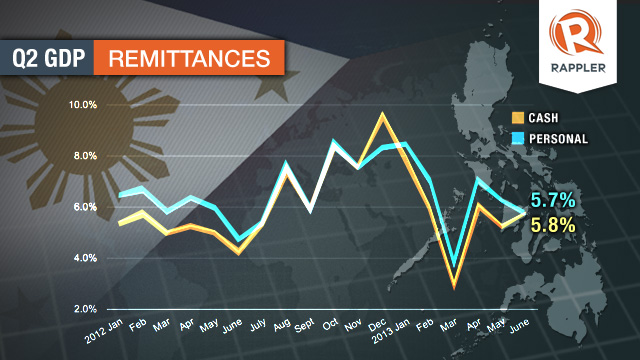

Services have also been consistently fueled by consumption-led economic activities and, recently, investments by overseas Filipino workers (OFWs).

Remittances have remained strong despite fiscal issues faced by western countries that host most of the OFWs, but growth has slowed down.

While the services sector lifted the economy the most by contributing 4.3 percentage points to the overall 7.5% growth, the spotlight was on the industry sector, which has been picking up.

The Philippines, dragged by high energy prices, restive labor and regulated wages in the past decades, is getting back in the radar of job-generating investors, noted Balisacan.

“The composition of our growth shows signs of an economy that is in the process of rebalancing, moving from being largely consumption-driven to becoming investment-led and industrialized, with the ability to provide high-quality jobs for Filipinos,” he said.

“For the past 3 quarters, capital formation has been growing more rapidly than household consumption and the growth of industry has so far outpaced that of the services sector. Notable are the double-digit growth rates in fixed capital and the manufacturing subsector in the last quarter,” he added.

Industry grew an impressive 10.3%, and contributed 3.3% percentage points to the GDP number. Construction, which stepped up again during the quarter, grew by a whopping 17.4%.

Balisacan said construction will remain key driver in coming years. “In all major forms of infrastructure, we have huge backlog.”

Manufacturing grew 10.3%, maintaining the industry’s recovery, which started a few quarters ago, when Japanese, Korean, and other foreigners decided to plow their job-generating investments back into the Philippines after heavy flooding in Thailand and the earthquake-tsunami disaster in Japan.

Balisacan said, “with the rebound of industry sector, stable and productive jobs will be generated. He added persistent unemployment will also be addressed.

“Within manufacturing, food processing, furniture and household appliances like radio and TV, basic metals, and machinery posted significant growth, indicating greater use of skilled labor,” he noted.

How the Philippines’ impressive GDP growth rate is translating into jobs is a major concern among analysts and economists watching the country.

Agriculture, mining

Agriculture, which remains the main employer in the country, performed poorly. For the first time since the first quarter of 2012, the sector contracted. Its 0.3% decline pulled down the GDP by 0.03 percentage points.

The officials attributed this to the 25.9% contraction in corn output and 1.8% decline in palay. These “may be due to the intense heat experienced in Ilocos and Cagayan Valley regions and farmers harvesting their crops in advance in anticipation of the drought,” Balisacan explained.

About 624,000 jobs were lost in agriculture-related activities, compared to about 224,000 and 380,000 additional jobs generated in the industry and services sectors, respectively. Balisacan cited the April 2013 labor force survey for these indicators.

“The seasonality in the agriculture sector poses a challenge to growth and employment, and this is why we will need to diversify agricultural production and move towards further processing of agricultural products, particularly food,” he stressed.

Mining and quarrying remained laggards, declining by 2.7% during the quarter. This reflected investors decisions to cut on their investments as the Aquino government reviews and pursues legislative reform on the revenue-sharing scheme between government and the mining industry.

Recently, the global miners behind Tampakan gold-copper mine in South Cotabato in Mindanao decided to downsize pre-commercial operations. The investment in the mine, which is supposed to start operations after President Benigno Aquino III steps down in 2016, is potentially the country’s biggest foreign investment with operators planning to put in up to US$5.9 billion, which in turn is expected to boost the Philippines’ GDP by 1% every year.

Govt, household spending

On the demand side, household and government spending as well as construction were the key growth drivers.

Household consumption, which contributed 3.6 percentage points to growth, rose 5.2% in the second quarter.

Government spending (2 percentage points contribution to growth) surged 17%, while construction (1.3 percentage points) rose 15.6%.

Election, 2013 targets

The mid-term polls in May, which were expected to boost spending, did not materially contribute to economic growth.

Balisacan said election spending played a “minimal role” in the second quarter.

Albert said presidential elections are usually the ones that have big impact to the economy.

With the 2nd-quarter growth, Balisacan said the 6% to 7% target for 2013 will likely be surpassed.

Officials are aiming to hit a growth rate of 7% to 8% every year until 2016 to lift more out of poverty and provide more jobs. – with reports from Judith Balea, Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.