SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Bureau of Internal Revenue (BIR) filed criminal complaints against four “ghost” corporations behind an elaborate scheme involving fictitious receipts that resulted in the government losing as much as P25.5 billion in taxes.

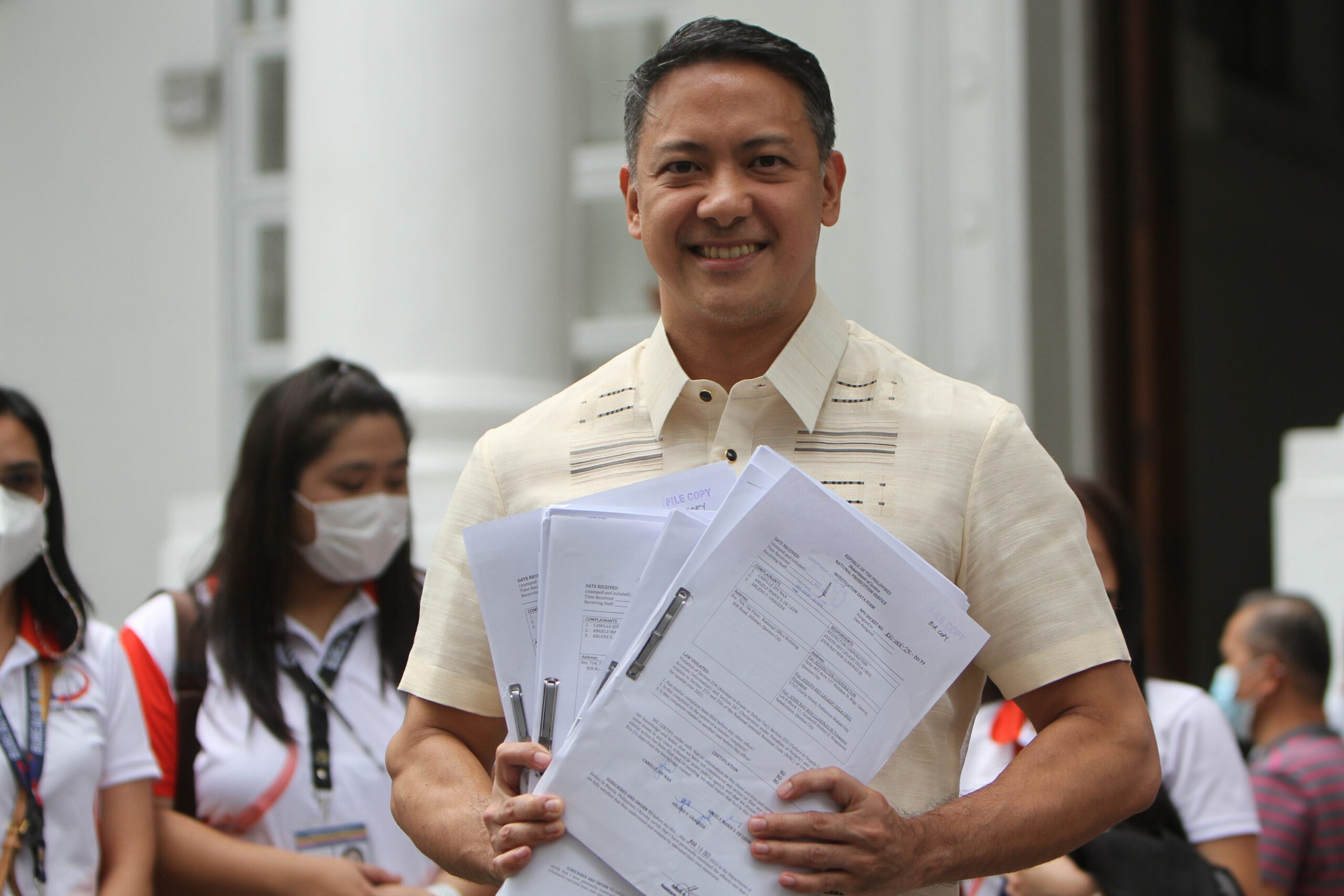

BIR Commissioner Romeo Lumagui Jr. lodged the complaints before the Department of Justice on Thursday, March 16, after finding four companies violating sections of the National Internal Revenue Code.

In December 2022, the BIR raided the offices of the unnamed companies in a condominium unit in Quezon City and found that their sole purpose was to sell fake sales invoices to buyers for the claiming of anomalous purchases.

The BIR also did not name the buyers of the fictitious receipts, but noted that it already has the list of both buyers and sellers.

“The financial magnitude of this syndicate issuing fictitious receipts is alarming. They are profiting from businesses through convincing their clients to ghost our tax authority,” Lumagui said. – Rappler.com

Add a comment

How does this make you feel?

![[Ask The Tax Whiz] Output VAT credit on uncollected receivables: What taxpayers must know](https://www.rappler.com/tachyon/2022/11/tax-papers-hand-shutterstock.jpg?resize=257%2C257&crop_strategy=attention)

![[Ask The Tax Whiz] What’s new on invoicing requirements under the Ease of Paying Taxes law?](https://www.rappler.com/tachyon/2024/06/tax-whiz-receipts.jpg?resize=257%2C257&crop=459px%2C0px%2C720px%2C720px)

![[Ask the Tax Whiz] Withholding tax under Ease of Paying Taxes law](https://www.rappler.com/tachyon/2022/11/tax-papers-shutterstock.jpg?resize=257%2C257&crop=205px%2C0px%2C900px%2C900px)

There are no comments yet. Add your comment to start the conversation.