SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

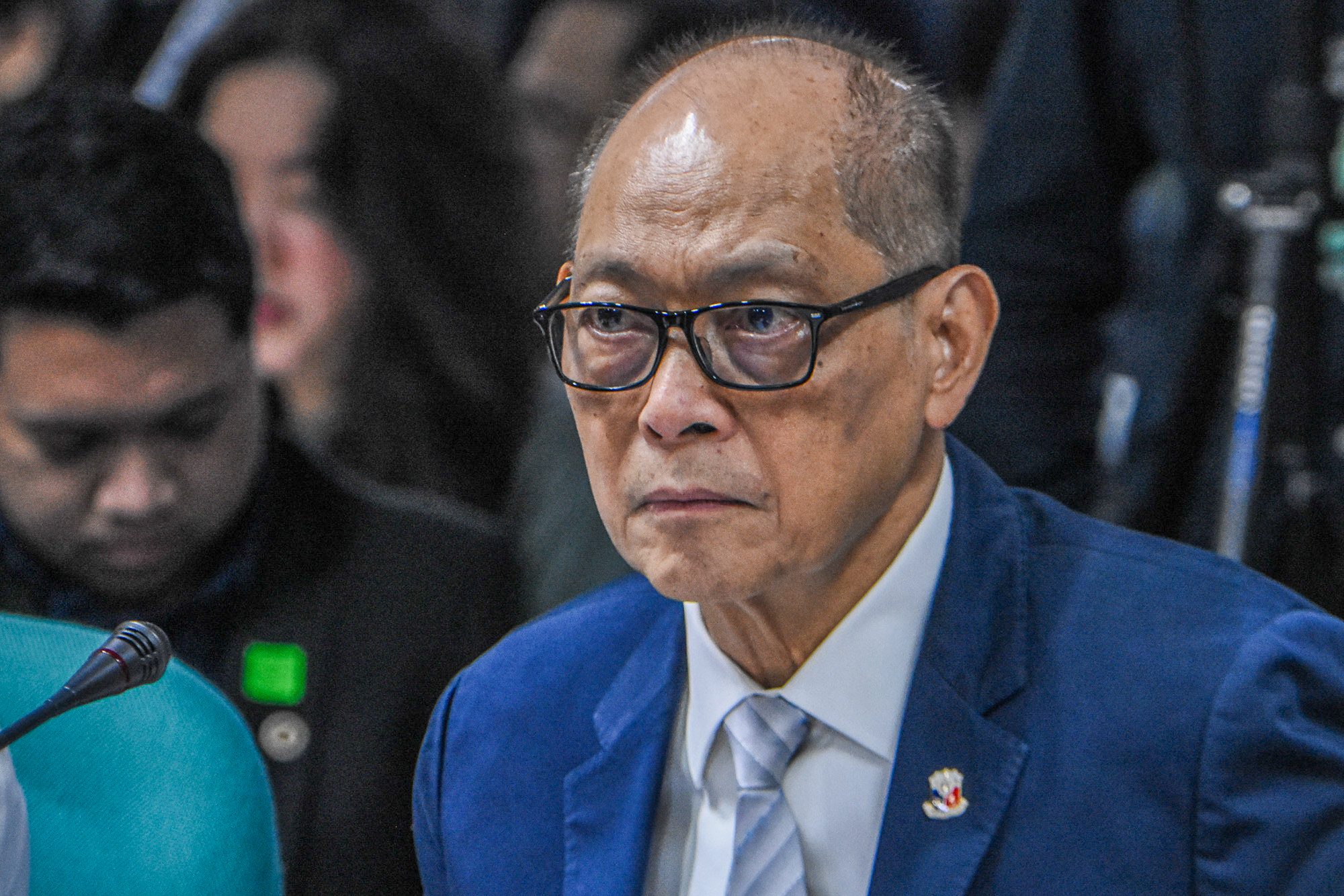

MANILA, Philippines – Finance Secretary Benjamin Diokno warned that suspending taxes on petroleum products would only benefit the rich and adversely impact government coffers.

Diokno’s statement comes a day after House leaders and oil executives held a closed-door meeting amid skyrocketing oil prices, with House Speaker Martin Romualdez noting that Congress is open to suspending excise tax and value-added tax (VAT) on fuel products.

In an email to reporters on Tuesday, September 19, the Department of Finance (DOF) said a suspension would only benefit the top 10% of Filipino households which consume nearly half of the country’s fuel, compared to the poorest households which only consume around one-tenth of total oil consumption.

The DOF estimated that the government would lose P72.6 billion, equivalent to 0.3% of gross domestic product (GDP), in total excise tax (P41.4 billion) and VAT (P31.2 billion) in the fourth quarter should these be suspended. If the taxes would be suspended for the rest of the year, losses would balloon to P280.5 billion.

The DOF added that these funds have already been programmed under the 2023 budget to fund social services and infrastructure projects.

Foregone revenues would also push up the Philippines’ deficit levels, from 6.1% to 6.4% of GDP in 2023, and would mean additional borrowings and interest payments. This would also widen the debt-to-GDP ratio from a projected 61.4% to 61.7%.

“When you formulate policy, you always think of what’s the greatest good for the greatest number,” Diokno said.

To alleviate inflation pressures, the DOF is proposing the timely distribution of targeted subsidies to vulnerable sectors like jeepney operators, farmers, and fisherfolk.

“We recognize public sentiment to address the elevated fuel prices. However, as government, it is our responsibility to be cautious in implementing policies that could negatively impact the macro-fiscal stability and sustainability of the country,” Diokno said.

Oil prices have accelerated for 11 straight weeks, hurting importers like the Philippines, as oil producers like Russia and Saudi Arabia cut production. – Rappler.com

Add a comment

How does this make you feel?

![[In This Economy] Is the Marcos government unlawfully dipping into PhilHealth funds?](https://www.rappler.com/tachyon/2024/07/marcos-government-philhealth-funds-july-12-2024.jpg?resize=257%2C257&crop=425px%2C0px%2C1080px%2C1080px)

There are no comments yet. Add your comment to start the conversation.