SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

Dear Mr. Tax Whiz,

I hope you can end my misery in dealing with the Bureau of Internal Revenue (BIR).

Last year, I applied for an Authority to Print (ATP) for Collection Receipt but it was repeatedly denied because the Revenue District Officer (RDO) wanted me to first secure a Charge Invoice in lieu of my existing Sales Invoice.

I have asked several accountants, including BIR examiners from different RDOs, and even called the BIR National Office, but they all gave different answers.

In fact, I was told by BIR National Office that the approval of ATP for Collection Receipt as supplementary receipt of Sales Invoice will depend on the RDO, where the business is registered as every RDO has “different” interpretations of revenue issuances.

Since last year, I have been waiting for reconsideration and my clients are already demanding that we issue a collection receipt.

My company is engaged in wholesale/retail business, which currently issues Sales Invoices only as this has been our practice ever since. Before, we used to issue a Sales Invoice then official receipt, but the previous commissioner changed this and we were advised that if we issue a Sales Invoice we did not have to issue an Official Receipt.

One RDO said that the ATP for Collection Receipt as supplementary receipt will be approved only if the company will also print Charge Invoices as the principal receipt to replace our Sales Invoice.

Another RDO said otherwise, claiming that the ATP for Collection Receipt should be approved since Revenue Memorandum Circular (RMC) 2-2014 states that Sales Invoice (either Cash or Charge) is considered as principal receipt.

Hence, the company can print a Collection Receipt as a supplementary receipt as long as it has a Sales Invoice.

Why do they make it difficult for us to comply? While others are not even registered taxpayers and thus not paying taxes, the BIR makes it impossible for us to comply and pay our taxes correctly.

It is as if the BIR is waiting for us to make mistakes so they can penalize us.

It is just so frustrating. I hope you can also tell us what information should be disclosed in the invoice or receipt.

Inday

*****

Dear Inday,

Thank you for your trust and courage to write us a letter so others who are experiencing the same dilemma will also be enlightened.

To be honest, I share the same sentiment as yours. The BIR needs to simplify the compliance requirements to make it easy so more taxpayers will register and pay their taxes correctly.

Now to address your concerns. If your RDO insists to not approve your ATP, you can write the Regional Director or Commissioner Billy Dulay himself to appeal your request.

The BIR should have not approved the ATP of your Sales Invoice in the first place if it does not satisfy their requirements for to print Collection Receipt.

Per RMC 2-2014, commercial receipts/invoices such as collection receipts, delivery receipts, job orders, and other similar documents that form part of the accounting records of the taxpayer and/or issued to their customers will be considered “supplementary evidence” only. But the “principal” evidence in the sale of goods shall be the Sales Invoice (Cash or Charge).

Therefore, the BIR should not make it an issue whether you are using Sales Invoice or Charge Invoice since they approved the printing of Sales Invoice which will require Collection Receipt upon settlement of receivables.

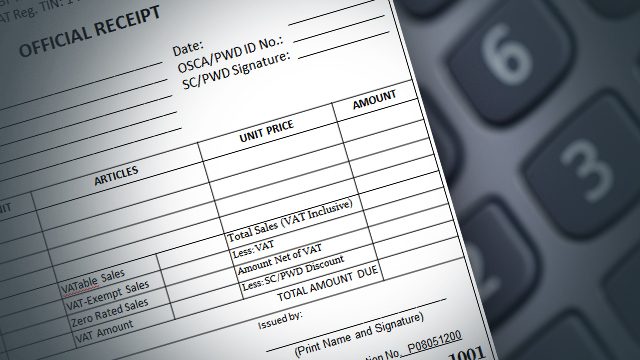

Regarding the information to be contained in the invoice or official receipt, the following should be indicated:

1. A statement that a seller is VAT-registered followed by TIN.

2 . Total amount which the purchaser pays or is obligated to pay to the seller with the indication that such amount includes the VAT. Provided, that the amount of tax shall be shown as a separate item in the invoice or receipt.

3. The name, business style, address, and TIN of the buyer in case of sales amounting to P1,000 or more. – Rappler.com

Got a question about taxes? #AskTheTaxWhiz! Tweet @rapplerdotcom or email us at business@rappler.com.

Mon Abrea is a former BIR examiner and an advocate of genuine tax reform. He serves as chief strategy officer of the country’s first social consulting enterprise, the Abrea Consulting Group, which offers strategic finance and tax advisory services to businesses and professionals. Mon’s tax handbook, Got a Question About Taxes? Ask the Tax Whiz! is now available in bookstores nationwide. Follow Mon on Twitter:@askthetaxwhiz or visit his group’s Facebook page. You may also email him at consult@acg.ph.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.