SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

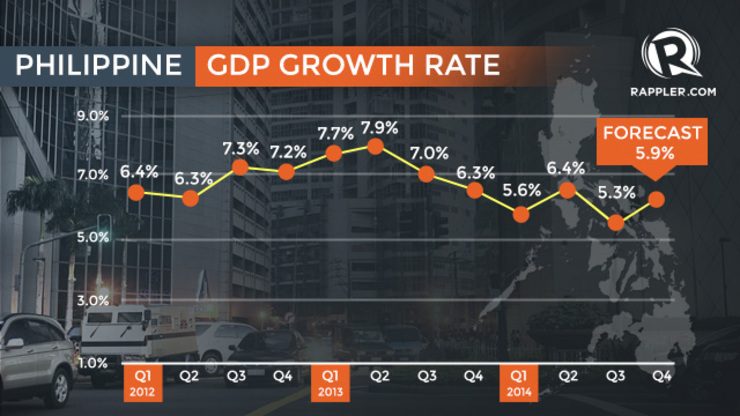

The government is still hopeful though that for the 6.5% to 7.5% full-year target to be achieved, an 8.2% growth is needed in the 4th quarter of this year. But that is a tall order, National Economic and Development Authority (NEDA) director-general Arsenio M. Balisacan admitted on Thursday, November 27.

The economic experts shared a more guarded optimism for the country’s economic growth for 2014, and what to look forward to in early 2015.

For Hongkong and Shanghai Banking Corporation Limited’s (HSBC) Global Research, the slowdown in last quarter’s growth points to immense opportunities for the economy to grow, “especially if investment picks up.”

But investment, especially public spending on key infrastructure needs, is not growing fast enough, HSBC resident economist Trinh Nguyen said in a report.

Government is receiving flak for spending below program despite the need to accelerate disbursements to support reconstruction and rehabilitation in typhoon-affected areas.

From January to September this year, government expenditures amounted to P1.46 trillion ($325.09 billion)*, 16% below the target of P1.73 trillion ($385.22 billion).

Maybank Kim Eng Economic Research also said that government spending dragged domestic demand. “As expected, net export growth decelerated but gain in domestic demand was not sufficiently strong to offset,” the bank’s resident economist Luz Lorenzo said in a report.

Infrastructure vital to growth

Maybank said the drag from the public sector was evident in government consumption, which went down 2.6% on the expenditure side while public administration services also fell 2.9% on the production side.

HSBC specifically pointed to the decline in custom imports as a symptom of infrastructure challenges, evident in Manila’s port congestion woes.

Government spending and investment are also volatile, and HSBC cited the controversy over the Disbursement Acceleration Program (DAP) as indicating government expenditure is unlikely to contribute to growth in the upcoming quarters.

A combative President Benigno Aquino III faced the nation in July and criticized the Philippines’ top justices for ruling against his administration’s spending program. He maintained that DAP was necessary to correct flaws in the budget system and to fast track government’s priority projects.

Referring to what Budget Secretary Florencio Abad said, Maybank said the country’s 2015 budget of P2.6 trillion ($57.89 billion) already factored in the Supreme Court ruling “which will help normalize government spending next year.”

Hope in investments

Investment, however, is “one bright spot for the economy,” HSBC said.

But HSBC said the investment pace will likely decelerate in the coming quarters.

“Thus far, the public-private partnership (PPP) initiative has been lackluster, with the President (Aquino) having to re-bid one out of the 8 projects awarded,” HSBC said.

The report was referring to the Cavite-Laguna expressway project (CALAX), a major PPP, which President Aquino has decided to rebid in response to the petition of San Miguel Corporation’s infrastructure arm. But Aquino said the rebid was the “only fair option” to all parties. Ayala’s AC Infrastructure and Aboitiz Land originally won the bid for the P35.4-billion ($787.59 million) project.

Maybank noted though that investments in construction and durable equipment rebounded strongly in the 3rd quarter, thus it is expecting that robust growth in fixed investments to be sustained, “as government spending normalizes and as the private sector continues to deliver on expansion plans.”

Private consumption to remain resilient

In a “fearless forecast” for 2015 forum on November 21, Australian Peter Wallace, founder of the Wallace Business Forum that provides management consultancy services and advocates for policy changes, quipped that his wife’s shopping fuels the Philippine economy.

But private consumption is the most resilient component of GDP, HSBC said.

“We expect private spending to sustain growth into 2015 and even accelerate in 2016,” HSBC said.

Such is attributed to the steady inflow of remittances that sustains the demand of households in the Philippines for key items such as food (39% of total expenditure) and housing, water, and electricity (22.5% of total spending).

“Shopping keeps [this country] going, which jobs creation should be,” Wallace pointed out.

There is a limit to consumption-oriented growth, especially when income growth channels are limited, but HSBC said that the future domestic demand is king, especially in contrast to the deceleration in the developed world and China.

“The Philippines has plenty of demand and what it really needs is more investment to relieve supply-side constraints. Without this, it will be difficult for the economy to achieve escape velocity,” HSBC said.

Private consumption is expected to be bolstered by improved purchasing power by the 4th quarter of 2014, attributed to falling commodity prices, including crude oil prices, Maybank said.

Lowered expectations

But considering the last quarter’s economic growth performance, HSBC said, “A growth of greater than 7% is difficult to sustain in the Philippines without reforms to address supply-side constraints,” Nguyen said in the HSBC report.

Year-to-date, the economy grew 5.8%, thus the HSBC forecast for 2014 full-year growth is 5.9%, while 2015 expansion is set at 6.1%. That is 2.3% lower than the 8.2% the country supposedly needs as growth number for the 4th quarter to achieve the overall growth rate target for 2014.

Maybank also set the same – down from its previous forecast of 6.7%. For 2015, Maybank also lowered its GDP growth forecast to 7% from 7.5%.

“However, with the 2015 budget in place, the public sector will probably contribute more significantly in 2015 at the same time that improved purchasing power leads to stronger private consumption,” Maybank said.

HSBC said that the Bangko Sentral ng Pilipinas will also do what it can to help by keeping policy rates on hold, to be known by December 11 when a policy meeting is set. – with reports from Lynda C. Corpuz / Rappler.com

*($1 = P44.95)

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.