SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

VIENNA, Austria – Saudi Arabia will make a deep cut to its output in July in addition to a broader OPEC+ deal to limit supply to the end of 2024 as the group faces flagging oil prices.

The following explains the OPEC+ agreement reached on Sunday, June 4, and its effect on supply.

What was agreed for 2023?

OPEC+, which groups the Organization of the Petroleum Exporting Countries and allies led by Russia, already had in place oil output cuts of 3.66 million barrels per day (bpd), amounting to 3.6% of global demand.

The figure comprises a 2 million bpd cut agreed last year from August 2022 production levels, and a further 1.66 million bpd of voluntary cuts from nine OPEC+ countries.

OPEC+ did not increase the 2023 production cuts.

But on Sunday, Saudi Arabia pledged an additional voluntary oil output reduction of 1 million bpd for the month of July, which could be extended.

As a result, the country’s output will drop to 9 million bpd in July from around 10 million bpd in May.

What was agreed for 2024?

The OPEC+ alliance on Sunday chose to focus on a lower production target for 2024.

As well as extending the group’s existing supply cuts of 3.66 million bpd for another year, it agreed to reduce overall production targets from January 2024 by a further 1.4 million bpd versus current targets to a combined 40.46 million bpd.

Including additional voluntary production cuts, which the nine partaking countries extended to the end of 2024, this results in an even lower target of 38.81 million bpd.

In real terms, this is around 500,000 bpd lower than April 2023 production, when compared with International Energy Agency (IEA) figures.

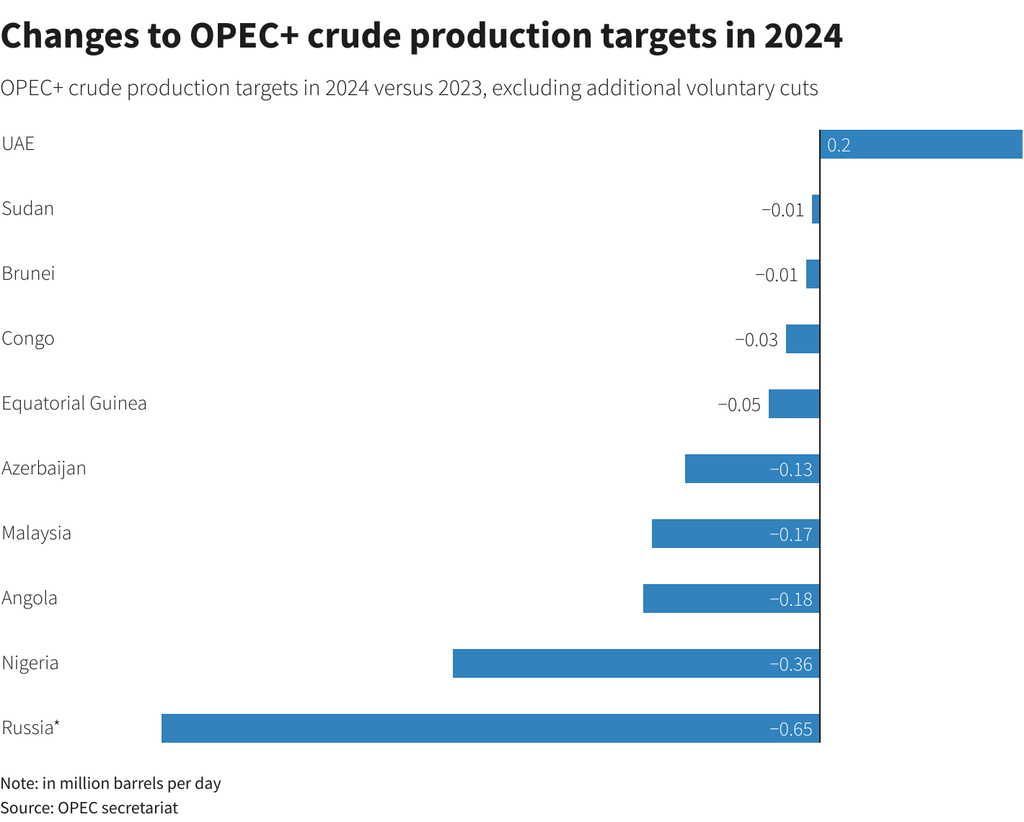

As part of Sunday’s agreement, the United Arab Emirates received a higher production target.

Meanwhile, targets for Russia, Nigeria, and Angola were reduced to bring them in line with declining production levels.

What’s the short-term impact?

Analysts, including at OPEC and the IEA, already expected supply to tighten in the second half of 2023 with the current OPEC+ production policy in place.

As Saudi Arabia has a track record of fully delivering on its output commitments, analysts see the deal’s initial impact as lowering supply.

Rystad Energy said it expects the Saudi cut to deepen the market deficit to more than 3 million bpd in July, “which could add upside pressure in the coming weeks.”

“The oil balance will tighten due to the voluntary Saudi reduction, which was announced for July but could be extended if deemed necessary,” Tamas Varga of oil broker PVM said.

Saudi domestic crude use rises to as high as 1 million bpd in summer months when demand for air conditioning drives power consumption.

2024 supply

JP Morgan estimated the OPEC+ decision will reduce supply in 2024 by almost 1.1 million bpd compared to its previous expectations.

“Almost all of this reduction would come from the larger producers in the alliance, and very little would come from smaller members, as their production capacity will likely remain below their quotas,” the bank said in a report. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.