SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Bureau of Internal Revenue (BIR) launched the digital taxpayer identification number (TIN) ID to make it easier for the public to get a TIN instead of lining up at revenue district officers.

The Digital TIN ID is part of the BIR’s Online Registration and Update System (ORUS), where individuals can get a TIN number or update their information.

One can access the services by visiting orus.bir.gov.ph. Simply follow the steps and provide the required information.

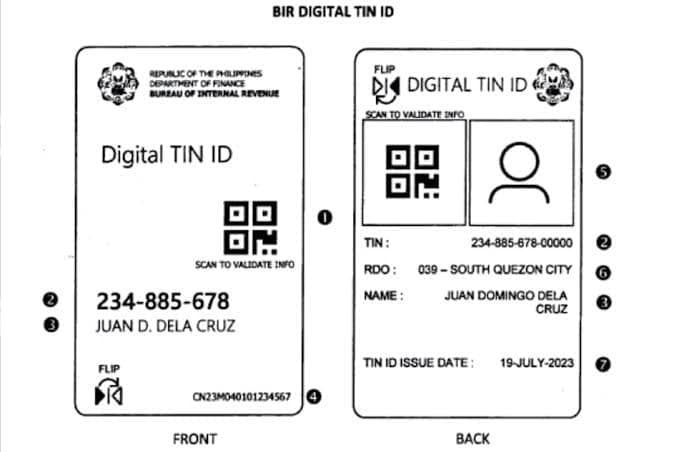

The following are several key features of the new Digital TIN ID:

- It serves as a reference for the Taxpayer Identification Number of the taxpayer and as a valid government-issued identification document accepted in various government agencies, local government units, banks, employers, and other institutions. Its authenticity can be verified online via the ORUS system using the QR Code provided.

- Unlike physical TIN cards, the Digital TIN ID does not require a signature. The authenticity of the Digital TIN ID can be verified online through the ORUS just by scanning the QR code appearing in the Digital TIN ID using a mobile device camera.

- Individual taxpayers with existing TIN can apply for the Digital TIN ID through ORUS. Users must enroll their accounts on the ORUS.

- The Digital TIN ID is a permanent identification document. Both the physical TIN card and Digital TIN ID remain valid, and holders need not secure a physical card if they possess a Digital TIN ID.

Taxpayers who are applying for the Digital TIN ID are required to update their email address at the Revenue District Office (RDO) where they are registered. To do that, they should accomplish and submit Form S1905 – Registration Update Sheet via email to the concerned RDO or through BIR’s eServices – Taxpayer Registration Related Application Portal.

The system will require one to upload photos. Clear, appropriate, and recent images that resemble the individual accurately should be followed.

The BIR reminded Filipinos that the Digital TIN ID is free and not for sale. Taxpayers availing of the services of online sellers of TIN ID assistance risk the possibility of getting a fake TIN, which may impact on their future transactions with the BIR.

“With this new system, we can eliminate the practice of fixers and scammers selling TIN online while giving taxpayers a convenient alternative in getting a TIN, instead of lining up at our Revenue District Offices,” said BIR Commissioner Romeo Lumagui Jr.– Rappler.com

Add a comment

How does this make you feel?

![[Ask the Tax Whiz] Withholding tax under Ease of Paying Taxes law](https://www.rappler.com/tachyon/2022/11/tax-papers-shutterstock.jpg?resize=257%2C257&crop=205px%2C0px%2C900px%2C900px)

There are no comments yet. Add your comment to start the conversation.