SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – It has been roughly a year since I wrote about The top 10 stocks in the PSEi for 2014.

This was when we saw the market move up 22.66% and was pretty much bullish. Fast forward a year after, we see the Philippine Stock Exchange Index (PSEi) moving in the opposite direction. What was once in a massive uptrend is now facing an 8-month downtrend.

For those who do not use charts and technical analysis, a downtrend is characterized by a phase in the market when sellers overwhelm buyers. Markets correct downward when there are more investors willing to sell at a much lower price than investors willing to buy higher.

That is how plain as it can be. Markets drop based on the principles of supply and demand. When phases like this occur, it would be best to stay away from the market, prepare as much cash, and get ready when the market starts again to reverse.

Bearish market

There have been misconceptions to buy at a downtrend since stocks appear to be relatively cheaper than where they were before.

Here is my take on that: since the market is still headed down, we do not know how low can it still go. Since we do not know how low can it go, it would be better to wait until we see a floor come out.

My goal as a trader and investor is not to buy when the market is falling but rather to buy when it has stopped falling, it has reversed, and is back up.

As of this writing, the PSEI is currently down -5.03%, year to date, as of December 18, 2015.

The market is bearish, in spite of it making a run at the first 4 months of 2015 and hitting a peak of 8,127 on April 10, 2015. (READ: Aquino rings in PSE celebrations)

What does it mean? It means that if you invested directly in time deposits and bonds at the start of the year and held on to them up to this point, these investments would have performed better than generally investing in stocks.

That is why it is important not only to select good companies but also follow the market on where the trend is headed. Remember, if you have invested in a PSEi index fund or First Metro Philippine Equity Exchange Traded Fund Incorporated for the year, your portfolio is still most likely in the red.

PSEi performance in 2015

But if you are new into stocks and are wondering what is PSEi, it is an index composed of 30 stocks with a variety of companies representing financial, mining, holding firms, industrial, properties, oil, and services sectors of the PSE.

These 30 stocks are averaged according to their market capitalization. The bigger the market capitalization, the greater the weight in the PSEi, since the index serves as the benchmark for the overall performance of the country’s stock market.

If you drill down and look at the individual stocks in the PSEi, you will see that 18 of the 30 stocks are relatively down, with Bloomberry Resorts Corporation (BLOOM, -64.19%); International Container Terminal Services, Incorporated (ICT, -40.04%); San Miguel Corporation (SMC, -36.18%); Petron Corporation (PCOR, -33.96%); and Philippine Long Distance Telephone Company (TEL, -30.35%), rounding up the top 5 losers year-to-date, among indexed stocks.

Last year, we saw 26 of the 30 PSEi stocks were up and a bunch of them made massive moves up like First Gen Corporation (FGEN), which moved up 101%; Universal Robina Corporation (URC) which moved 72%; and JG Summit Holdings, Incorporated (JGS) which went up by 68%. But this year’s gainers are mostly tame and not as strong compared to the top 10 stocks last year.

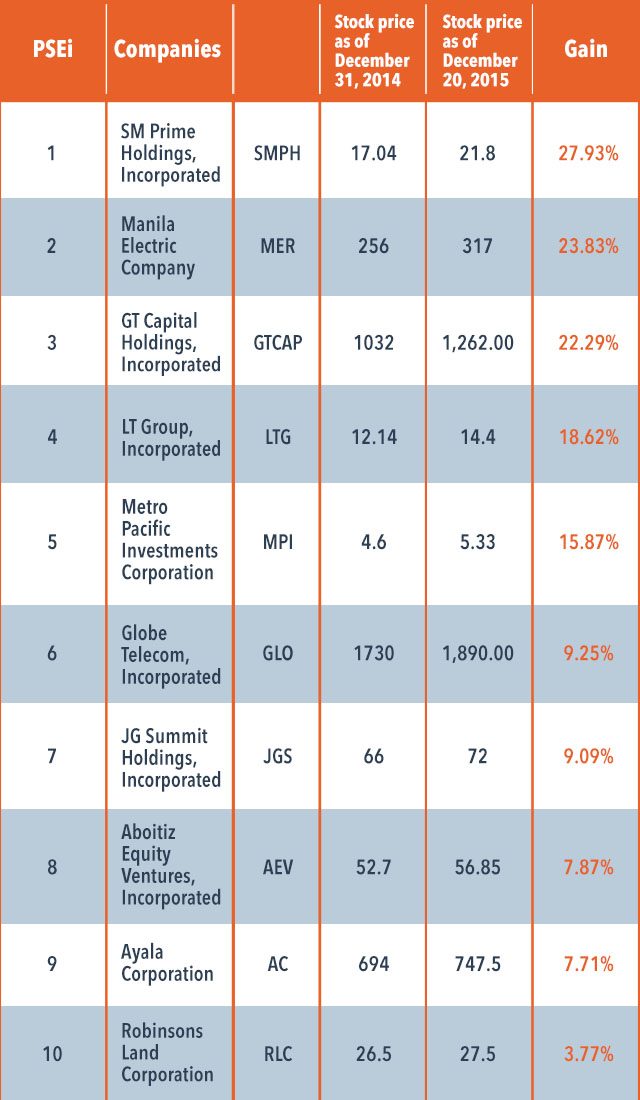

Here are the top 10 gainers in the PSEI from the start of the year as of December 20, 2015:

In a bearish market, returns like this are generally welcome. It may be not as high flying as last year’s returns but for those who selected wisely, they now are riding on the backs of better than market returns.

Will the same stocks continue to go up next year? No one knows.

Do we need to predict it? Not at all, as our goal as investors is not to predict where the market is going but rather to follow where the trend is headed. Your goal is to stick to your winning stocks and ride them until you maximize your gains.

As we bring 2015 to a close, and if you see your stocks in the red, try to assess and study which areas in your stock selection and timing would need changes. Study your trading plan, tweak certain aspects of it, and see how you can integrate it this 2016.

Do not make your past mistakes define your financial future, rather, use them as a stepping stone to take you to the next level.

I believe your greatest days as a stock investor are yet to come! Have a Merry Christmas, God bless you, and may your 2016 be your best year yet! – Rappler.com

Marvin Germo is a registered financial planner, a bestselling author, personal finance consultant, and a stock market trader and investor. He has around 8 years of experience in the Philippine financial industry. He specializes in technical analysis and position trading. Read his blog. Follow him on Twitter: @marvingermo

Marvin Germo is a registered financial planner, a bestselling author, personal finance consultant, and a stock market trader and investor. He has around 8 years of experience in the Philippine financial industry. He specializes in technical analysis and position trading. Read his blog. Follow him on Twitter: @marvingermo

Businessman, bull, and bear image concept from Shutterstock

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.