SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – PhilRem Service Corporation is being investigated for a possible tax evasion case, after the Bureau of Internal Revenue (BIR) found out that the company is paying the wrong taxes for acting as a remittance firm when in fact it is registered as a land transportation contractor.

“We are looking into it. It goes without saying that there has to be a consequence. There’s something amiss. I’m sure if there is something wrong, there will be fines and penalties,” BIR Commissioner Kim Henares said on the sidelines of the 5th Senate hearing into the $81-million Bangladesh Bank fund heist, when asked if her office will file a tax evasion case against the firm.

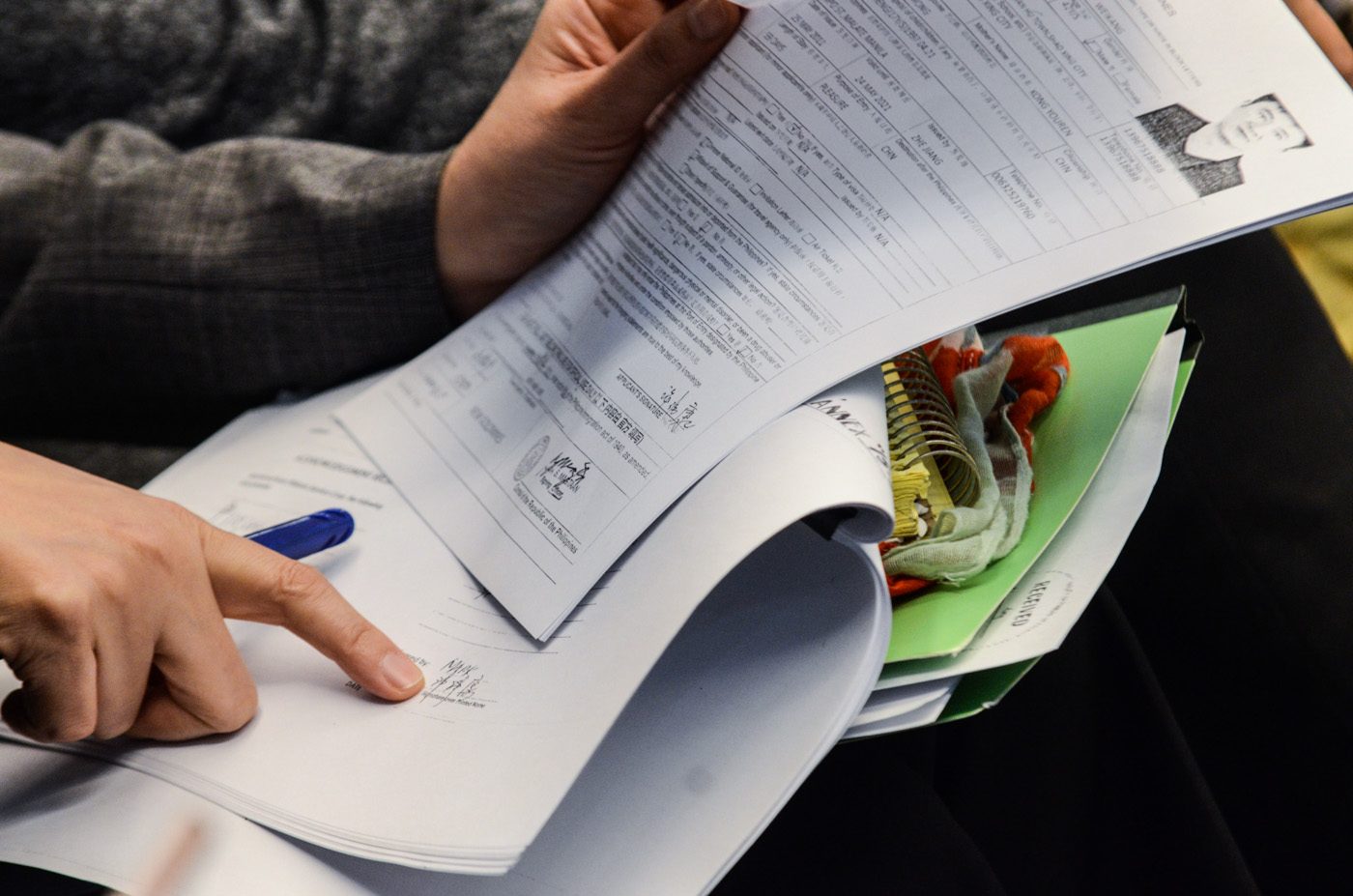

The $81-million stolen money were transferred into casinos from the Rizal Commercial Banking Corporation (RCBC) via money transfers from PhilRem. (READ: Bank heist probe: Questions, contradictions hound PhilRem)

In its filings with the Securities and Exchange Commission (SEC), PhilRem said it is primarily established to engage in the business of remittance of money currency from abroad to be delivered to different parts of the Philippines.

But Henares said during the Senate hearing that “something is wrong with its business registration.”

According to the BIR chief, PhilRem amended its articles of incorporation in 2005, but it did not update its registration with the BIR.

“PhilRem’s business registration says they are a land transportation contractor, not a money changer and remittance company,” Henares told the Senate committee. “The taxes they paid are wrong.”

During the hearing, Henares also pointed out that the affidavit of PhilRem messenger Michael Palmares showed violation of tax regulations for the company. (READ: SWIFT system and the $81-M money laundering issue)

“It is not a legitimate receipt. It does not follow BIR’s requirements. There is no address, TIN (tax identification number),” Henares said, adding that “all receipts should be registered with BIR.”

Liable for contempt?

Senator Teofisto “TG” Guingona III said the committee is “studying the possibility” of holding PhilRem liable for contempt for its inconsistent testimonies.

“According to Kim Henares, acknowledgment receipts looked like all were done on the same day. So it looks like the evidence showed was manufactured,” Guingona told reporters.

For the Senate blue ribbon committee chairman, PhilRem seems to be “not telling the whole truth.”

“The owners of PhilRem were not consistent on their statements. They are not saying the whole truth. We will not take this lightly. We will not allow this committee to be lied to,” he said.

The senator said the focus of the 6th Senate hearing on the Bangladesh Bank fund heist on Tuesday, April 19, will be “PhilRem’s inconsistencies.”

“It will be all about their inconsistencies: Deliveries of the money, amounts, dates, and places. We will cross-check,” Guingona said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.