SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask the Tax Whiz] How to compute income tax under the new income tax table for 2023?](https://www.rappler.com/tachyon/2021/06/shutterstock-bills-taxes-calculator-ls.jpg)

1. I am an employee who receives only compensation income from my employer. What are the things that I need to consider in computing my taxes?

Before computing your tax due as an individual, you need to determine if you are a minimum wage earner. As a minimum wage earner, your salary is exempt from tax, as well as your holiday pay, overtime pay, night shift differential pay, and hazard pay. The National Wages and Productivity Commission of the Department of Labor and Employment provides a list of what constitutes minimum wage per region.

Next, you have to identify whether the benefits you receive (e.g., de minimis benefits, 13th month pay, etc.) fall within the P90,000 threshold. Any benefits you receive beyond the P90,000 threshold would form part of your taxable income.

So, overall, to compute your taxable income as a purely compensation income earner, here is a quick guide:

Net taxable Income = Basic Pay + Additional Pay Less Government Contributions (SSS, Philhealth, and Pag-ibig)

To better understand the computation of taxable income, here are some illustrations:

Illustration # 1

The following is the information of Employee A who is a non-minimum wage earner and a pure compensation employee for taxable year 2023:

- Annual salary: P300,000

- Overtime: P10,000

- Rice subsidy: P24,000

- 13th month pay: P25,000

- Government contributions: P30,000

In the computation above, the rice subsidy and the 13th month pay are both excluded from the computation of net taxable income. The rice subsidy is a de minimis benefit and is excluded because, under our tax laws, rice subsidies are exempt for up to P2,000 per month (or P24,000 per year). The 13th month pay is likewise exempt because 13th month pay and other benefits received by an employee within the year are exempt from tax if they do not exceed P90,000 in total.

Moreover, mandatory contributions such as SSS, PhilHealth and Pag-IBIG are deducted in computing the net taxable compensation income of employees.

Illustration # 2:

The following is the information of Employee B who is a minimum wage earner and a pure compensation employee for taxable year 2023:

- Annual Salary: P150,000

- Overtime: P5,000

- 13th month: P12,500

- Government Contributions: P15,000

For the taxable year 2023, Employee B’s taxable income is zero since Employee B is a minimum wage earner whose basic salary is exempt from income tax. The additional pay from Overtime is also exempt from tax for minimum wage earners. Further included in the exemptions for minimum wage earners are holiday pay, night shift differential, and hazard pay.

Illustration # 3:

Assuming Employee B is a non-minimum wage earner and purely compensation employee with the same information above.

Since he is not a minimum wage earner, Employee B’s annual salary and overtime would now be included in the computation of taxable income.

2. Using the new tax table for 2023, how to compute the total tax due?

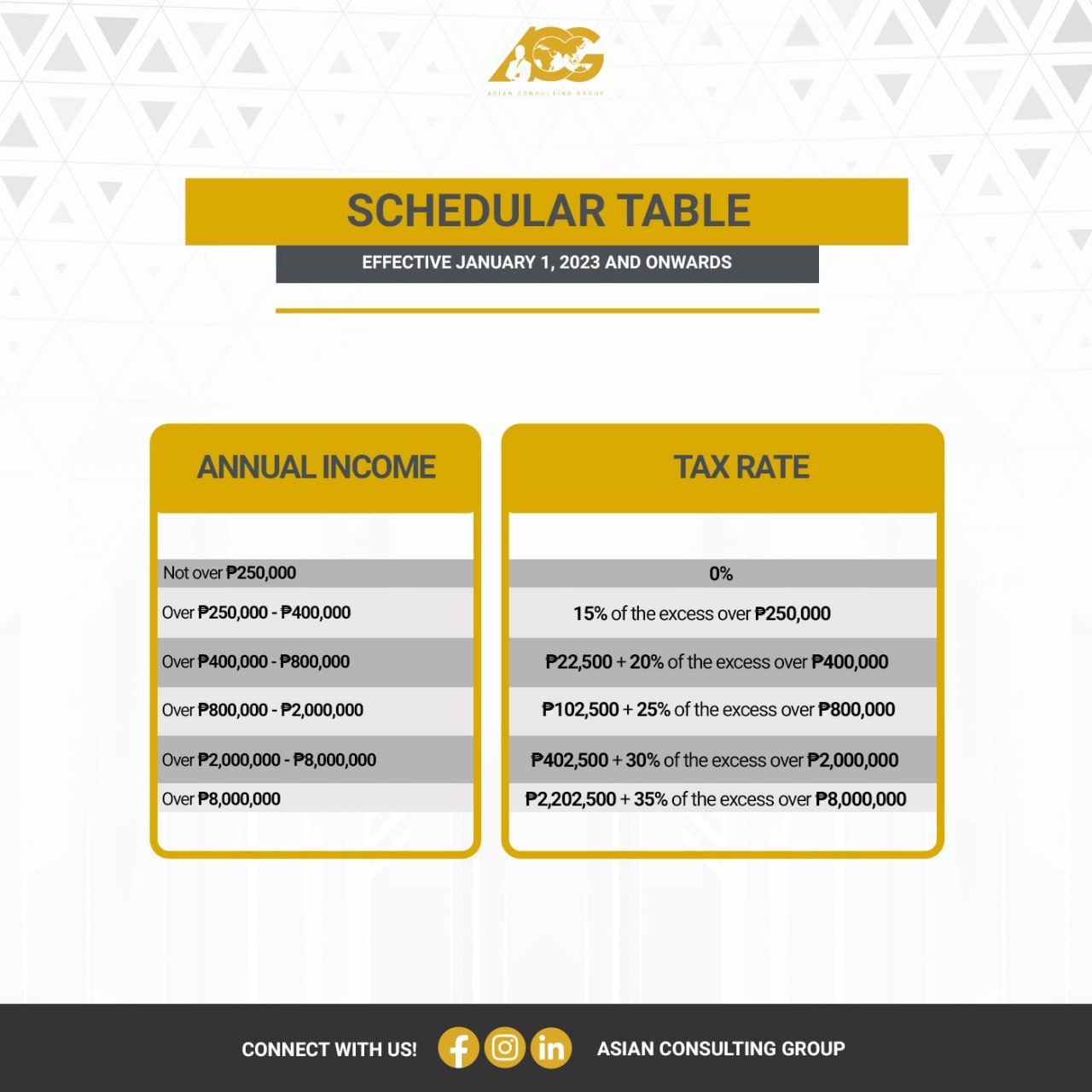

For proper guidance, here is the revised tax table for 2023, to compute the annual tax due from preceding illustrations:

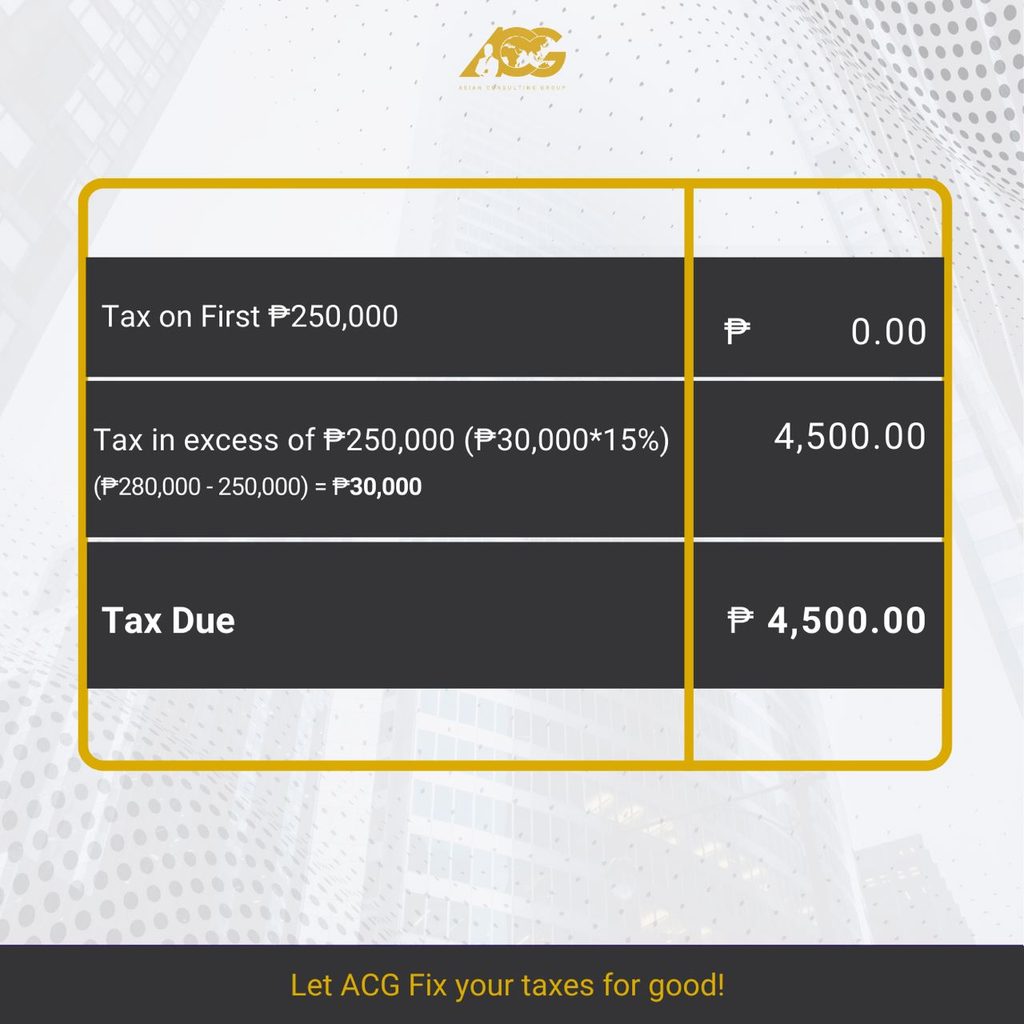

For Illustration 1, the computed taxable income is P280,000, Hence, the taxable income is within the range of P250,000 to P400,000. The taxable due is computed by multiplying the excess of P250,000 to 15%, as computed below:

For Illustration 2, the tax due is zero since a minimum wage earner is exempt from income tax.

For Illustration 3, the tax due is also zero since the computed net taxable income is P140,000, which is below the P250,000 threshold.

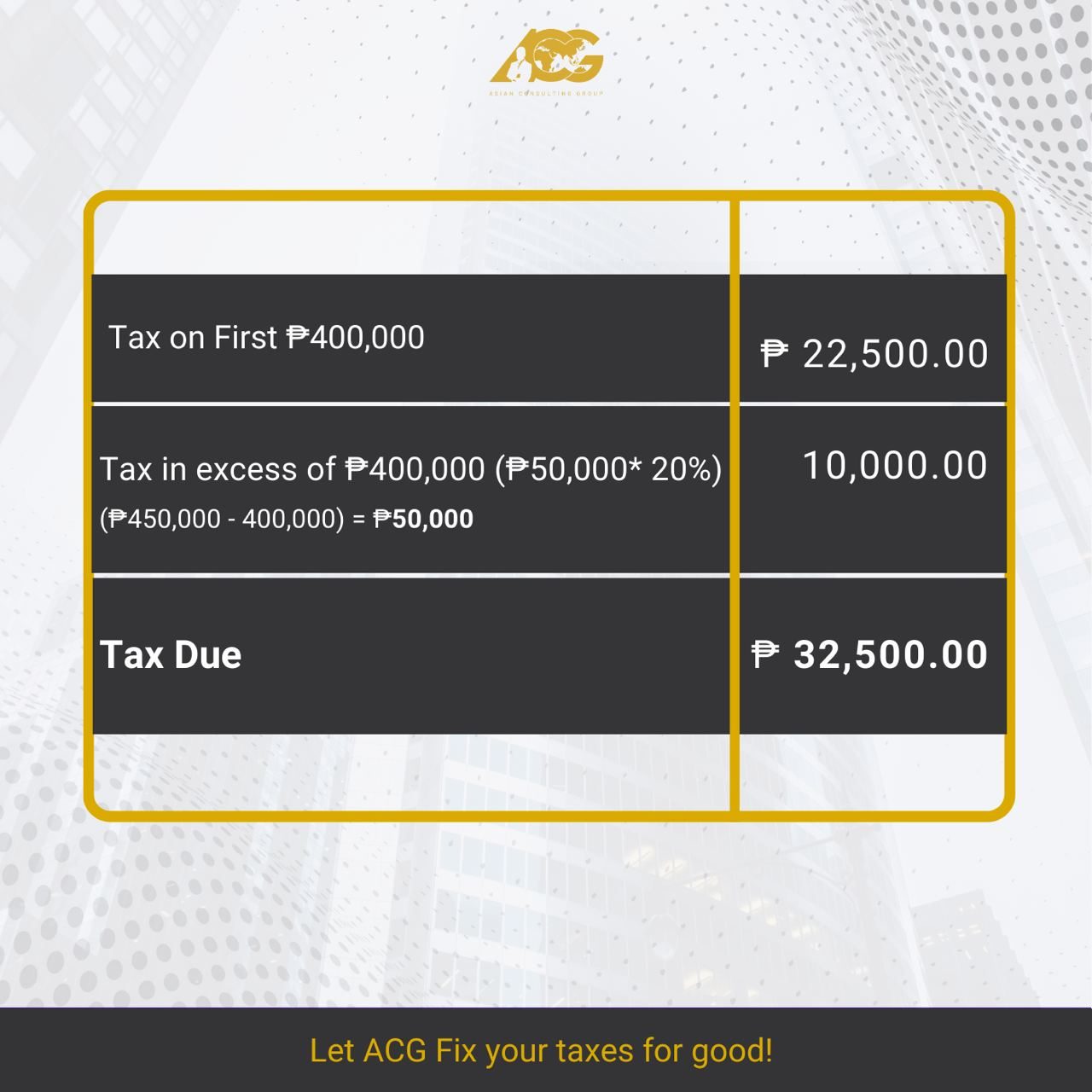

Assuming the computed taxable income for the year is P450,000, the computation of taxable income is as follows:

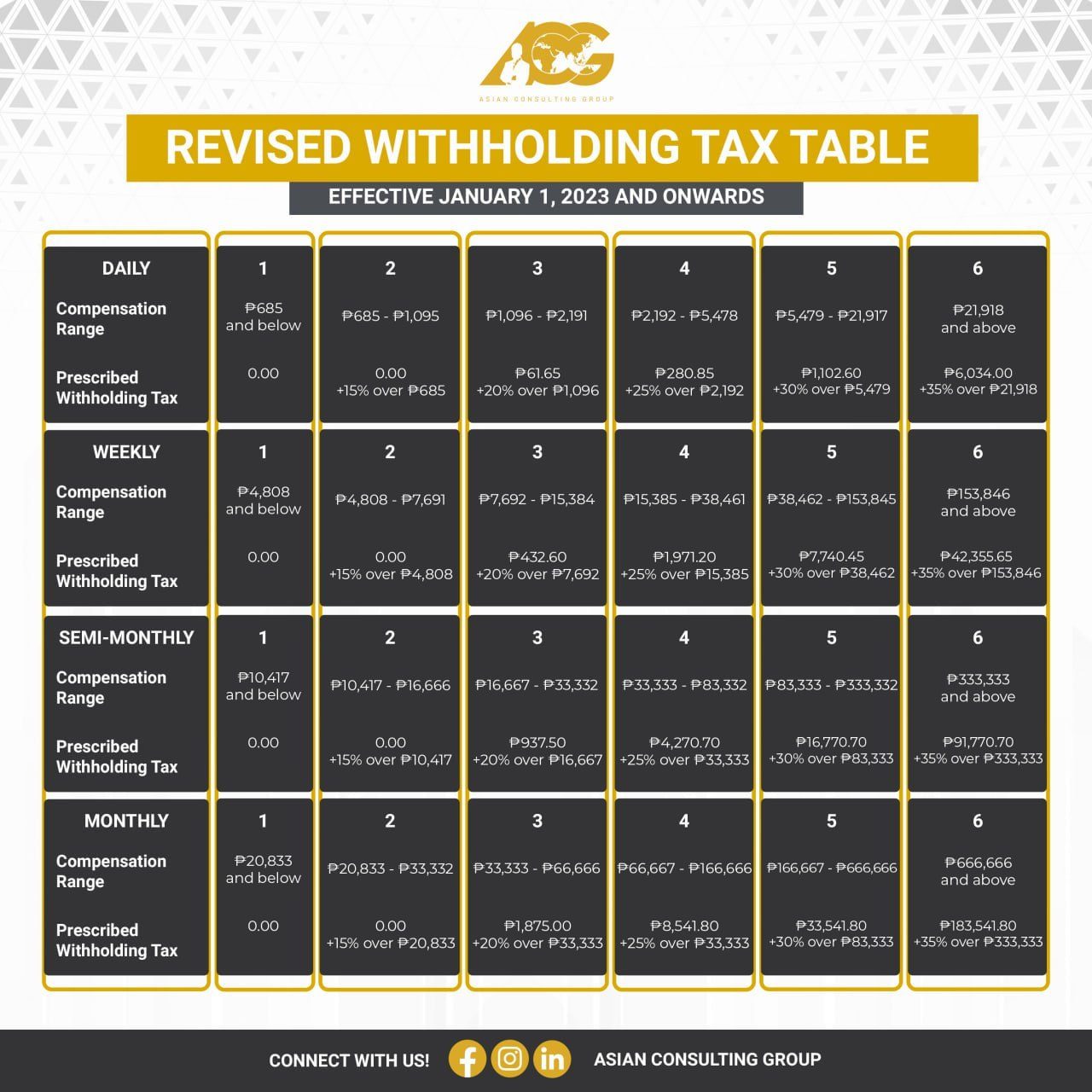

3. Our employer is paying us semi-monthly. What is the applicable tax table that we should use in computing our tax due?

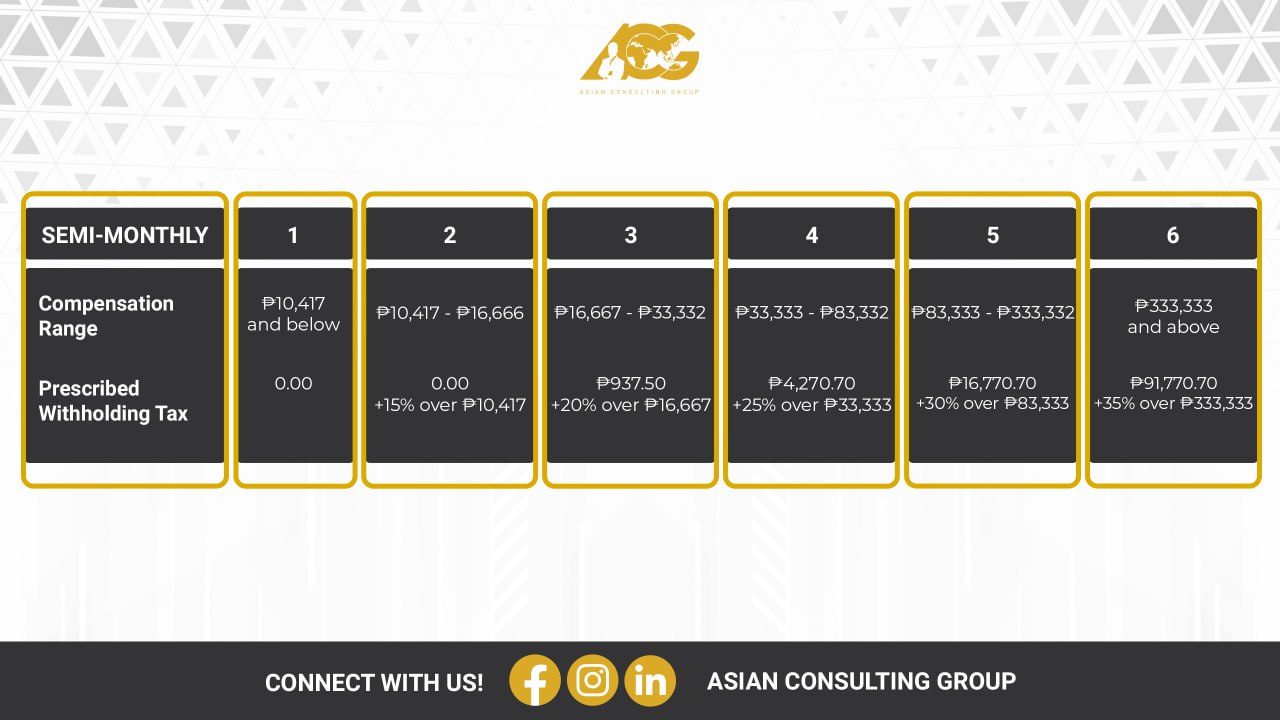

In computing your semi-monthly tax due, here is the tax table from RR 11-2018 Annex E:

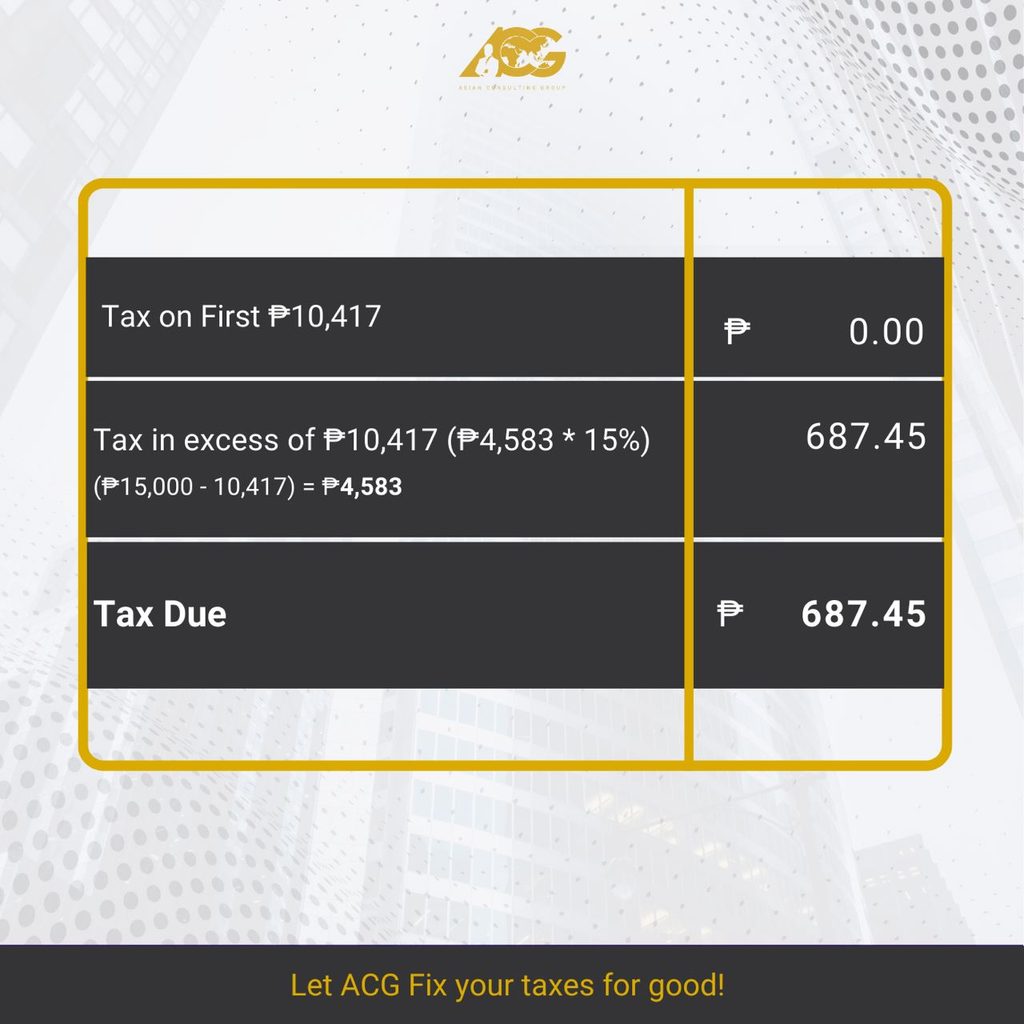

For example, if your net taxable income is P15,000 on the first cut-off, your tax due for a particular cut-off is computed as follows:

In the illustration above, the net taxable income is within the range of P10,417-P16,666. Hence, the prescribed withholding tax is zero on the first P10,417 and P687.50 for salaries in excess of P10,417.

For employees paid daily, weekly, semi-monthly, bi-monthly, and monthly, you may refer to this tax table below:

4. How is the tax due different compared to the old tax table?

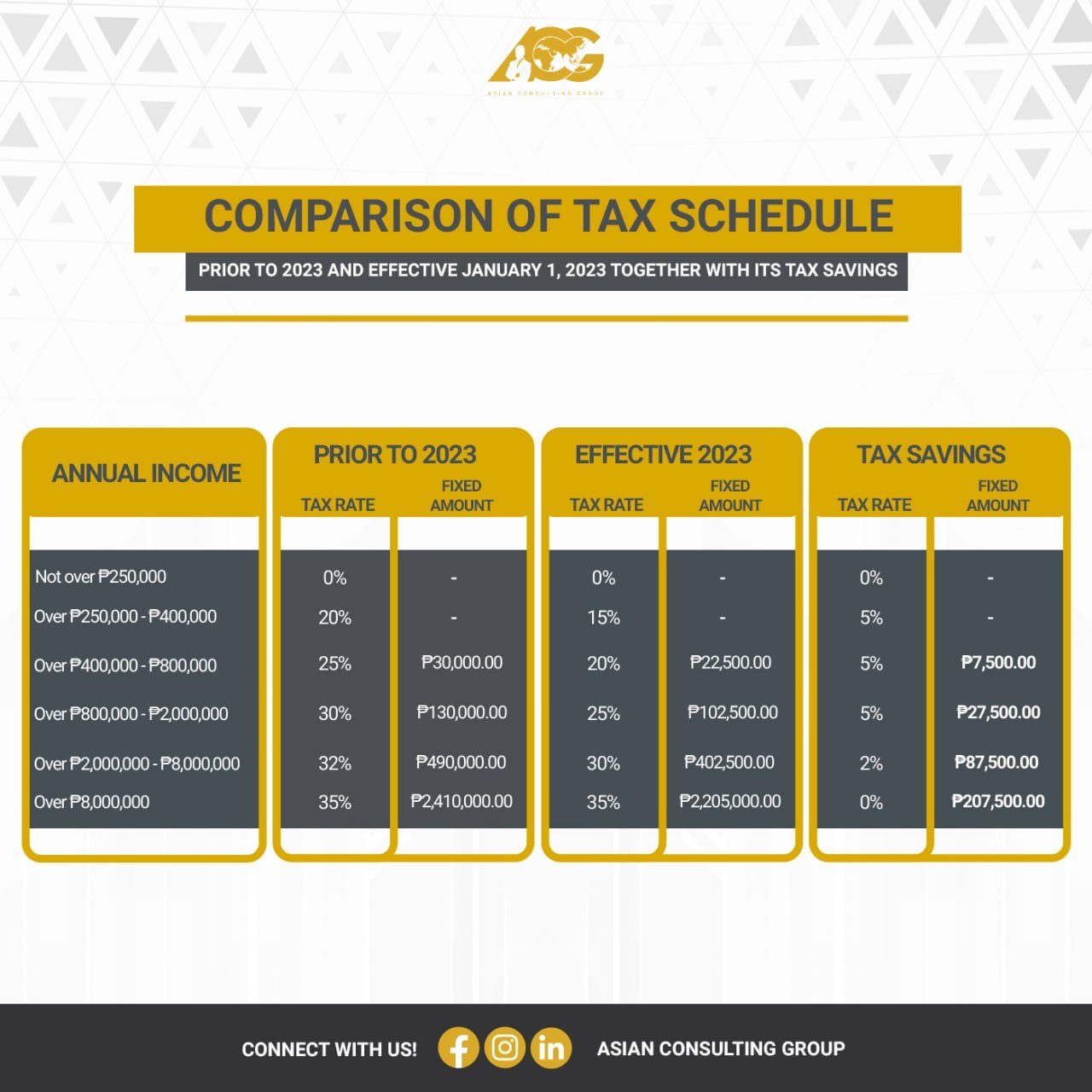

Compared to tax due prior to 2023, the taxable income below P250,000 remains exempt from income tax.

For compensation between P250,000 to P400,000, the tax rate was reduced by 5% from (20% to 15%) in excess of 250,000.

For compensation income from P400,000 to P800,000, the tax rate was reduced by 5% (from 25% to 20%) and the fixed amount was decreased by P7,500 (from P30,000 to P22,500). Hence, the total tax to be imposed would be P22,500 on the first P400,000 and 20% in excess of P400,000.

For compensation between P800,000 to P2,000,000, the tax rate was also reduced by 5% (from 30% to 25%) and the fixed amount was decreased by P27,500.00 (from P130,000 to P102,500). Hence, the total tax to be imposed would now be P102,500 on the first P800,000 and 25% in excess of P800,000.

For compensation between P2,000,000 to P8,000,000, the tax rate was also reduced only by 2% (from 32% to 30%) and the fixed amount was decreased by P87,500 (from P490,000 to P402,500). Hence, the total tax to be imposed would be P402,500 on the first P2,000,000 and 30% in excess of P2,000,000.

For compensation above P8,000,000, there is no change in the tax rate but the fixed amount of tax on the first P8,000,000 was still reduced by P207,500 (from P2,410,000 to P2,205,000).

Below is the comprehensive summary of the tax rate changes from 2022 to 2023, together with an overview of the tax savings due to these changes:

For other questions on how to compute your income tax, you may download TaxWhizPH Mobile app and use the unli-chat feature and get answers to your questions. You may also book a consultation through the app. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.