SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask the Tax Whiz] Regular audit vs VAT audit](https://www.rappler.com/tachyon/2022/11/tax-papers-shutterstock.jpg)

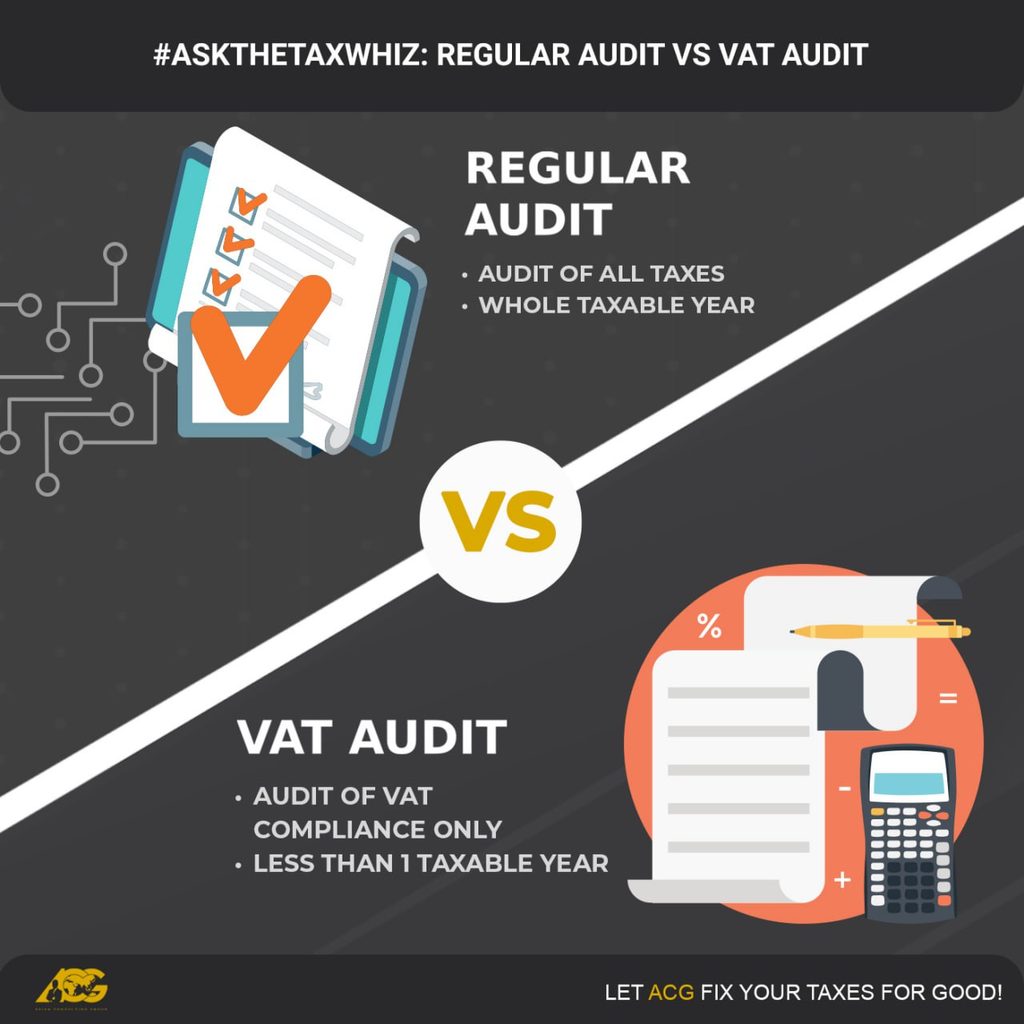

What is the difference between regular audit and VAT audit? Is there a possibility that a taxpayer can be subjected to both audits for the same year?

The key distinction lies in the type of taxes being audited. If a taxpayer is subject to a regular audit, it means that the examination of books of accounts and other accounting records includes All internal revenue taxes. In the case of a VAT audit, the Bureau of Internal Revenue (BIR) will only audit VAT compliance for a specific period, typically less than one year.

Yes. There is a possibility of receiving two Letters of Authority (LOAs) for both regular audit and VAT audit in the same year. However, it’s crucial to note that the subsequent LOA should not include the tax type that is already under audit by the BIR. This means that if there’s already a VAT audit, the regular audit for the same taxable year will no longer include VAT in their assessment.

What are the common issues that need to take note when receiving an LOA for an all taxes or VAT audit?

When receiving a Letter of Authority, it is essential to consider the types of taxes being audited by the BIR, the specific taxable period, the jurisdiction of the Revenue District Office, and the authorized person scrutinizing the accounting records. This awareness helps taxpayers understand which documents to present based on the provided checklist. If an LOA is issued to your office, you should ensure a timely response by presenting the books and other accounting records to their office. Once an assessment is issued, ensure that the protest is submitted on time.

If an “All Taxes Audit” is issued, you should ensure that the books of accounts and accounting records are accurate and timely declared in the tax returns filed, and that expenses are properly substantiated. Additionally, taxpayers required to withhold tax should also make sure that the tax withheld is properly remitted monthly and quarterly.

For the VAT audit, the BIR will be auditing a particular period of less than one year. The scrutiny will focus on sales and purchases. To prepare for this, make sure that your sales declaration is timely declared and properly classified as VATable Sales, VAT exempt sales, and zero-rated Sales. If you are claiming VAT exemptions or VAT zero-rating, you need to be able to present the special requirements.

For purchase transactions, you should verify if the input VAT claimed on the VAT return is properly supported with invoices. If you have importations, secure the importation documents from the Bureau of Customs.

In addition to filing VAT returns, taxpayers are also required to comply with the quarterly Summary List of Sales and Importations. This list can be used by the tax authority in assessing your taxes based on third-party information. You should ensure that all the declarations mentioned above are properly reported in these attachments.

Do you need clarifications on Regular and VAT audit? ACG provides a free consultation, type down any tax concerns on the live chat feature on the website. Visit acg.ph, and let us assist you in resolving any tax cases and BIR audits.

– Rappler.com

Add a comment

How does this make you feel?

![[Ask the Tax Whiz] Withholding tax under Ease of Paying Taxes law](https://www.rappler.com/tachyon/2022/11/tax-papers-shutterstock.jpg?resize=257%2C257&crop=205px%2C0px%2C900px%2C900px)

There are no comments yet. Add your comment to start the conversation.