SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

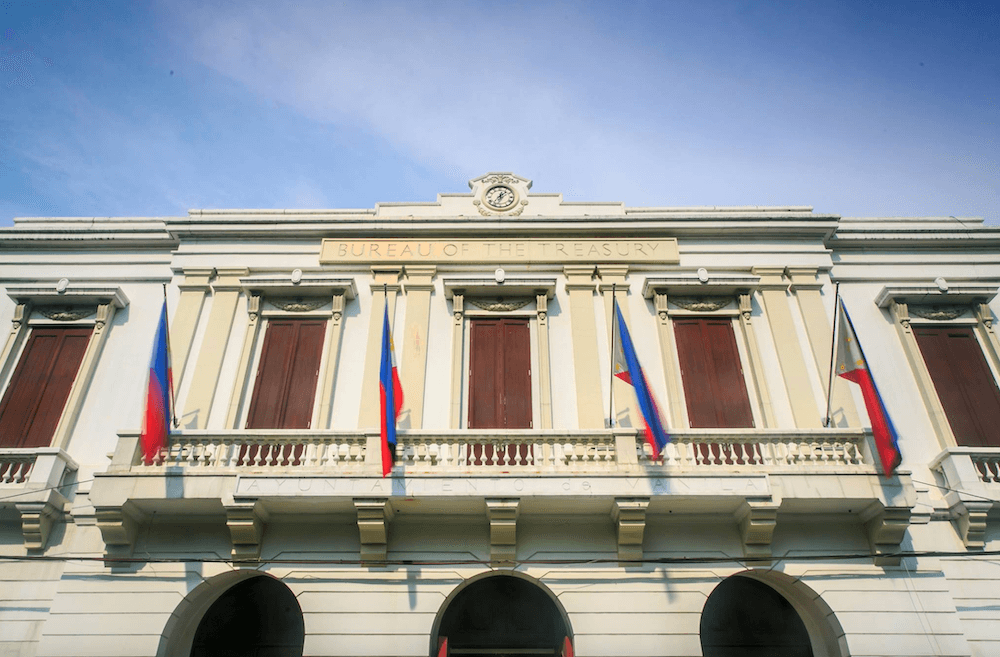

MANILA, Philippines – The Philippine government is set to launch on Tuesday, September 26, US dollar denominated retail treasury bonds (RTBs), Finance Secretary Benjamin Diokno said.

In a briefing on Friday, September 22, Diokno said they are considering an initial offering of at least $1 billion, but may raise it after seeing strong demand.

The government last issued a US-denominated RTB in 2021. For 2023, it is aiming to raise $2 billion from RTBs.

Deputy Treasurer Sharon Almanza said the offer will have a tenor of 5 or 10 years.

The minimum investment for the RTB is $200. The offer period is from September 27 to October 6.

Investors will receive coupon payments tax-free, making it a “good investment,” according to Diokno.

In the same briefing, Diokno announced that the Treasury is planning its maiden issuance of sukuk, a sharia-compliant bond-like instrument used in Islamic finance.

Diokno, alongside other members of President Ferdinand Marcos Jr.’s economic team, recently conducted a road show in the Middle East to promote sukuk.

The sukuk will likely have an offer size of $1 billion and is targeted to be launched by the fourth quarter.

Former national treasurer Rosalia de Leon, prior to her appointment to the central bank’s Monetary Board, earlier said the sukuk issue could carry a 5-year or 10-year maturity. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.