SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines (UPDATED) – When President Benigno Aquino III rejected the proposal to increase the monthly pension of more than 30 million Social Security System (SSS) members, many were angered and disappointed.

After all, millions of retirees were looking forward to it after the 16th Congress okayed a P2,000 across-the-board pension hike. Aquino however put his foot down and said no to an increase because it would lead to bankruptcy on the part of the state-run insurance agency.

The SSS supported the President, saying that a hike would shorten its fund life. Is there truth to this reasoning and does it have sufficient basis?

Fund life over the years

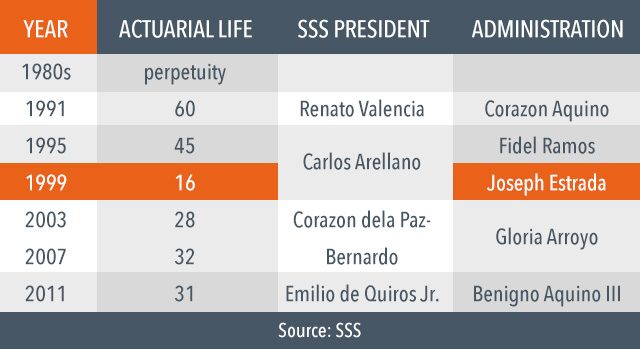

At present, the actuarial life or fund mortality of the SSS is expected to last until 2042. This means current pensioners will be able to receive monthly allowances up until they turn 90, or even 100.

This is actually shorter than in the 1980s when fund life was expected to last for 70 years, reaching up to 2051. This was not sustained because of the frequent pension increases in the 1980s.

“Noong 1991, nag-compute sila ng actuarial figure kung hanggang kelan ang life ng fund. Lumalabas hanggang 60 years pero increase pa rin sila ng increase, sometimes more than twice a year every 4 years,” former SSS President Corazon dela Paz-Bernardo told Rappler in a phone interview.

(In 1991, they computed an actuarial figure to see the life of the fund. They counted up to 60 years but they kept on increasing [pensions], sometimes more than twice a year every 4 years.)

Dela Paz-Bernardo’s administration shouldered the effects of the 1999 crisis when she was appointed SSS chief in August 2001.

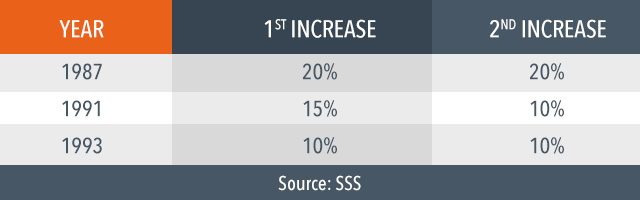

Between 1980 to 1999, there were 3 years (1987, 1991, and 1993) when the pension rate was increased twice, so that by the 1990s up to 1999, a continuous decline in the actuarial life of the SSS became evident.

Data from the SSS show that fund life was down to 45 years in 1995 from the previous 60 years in 1991. This further declined, reaching its worst state in 1999 with a step-down of almost 30 years compared to 1995.

Coming up to 1999, there were a total of 17 pension hikes with no amendments to the contribution rates.

Given these, there is reason to fear that for those aged 20 and above, the SSS may be bankrupt by the time they reach retirement.

Raise contributions of members

As early as 1999, the Commission on Audit (COA) proposed a contribution raise by members in the state pension firm.

In its 1999 audit report, the COA recommended, “Increase contribution rate. At present, the contribution rate is only 8.4% of the monthly salary credit as compared with 21% required by the other government pension fund.”

Both former and current SSS presidents made the same suggestion as a compromise to accommodate a pension hike.

“The public needs to accept that the [current] resources are not enough to fund [the increase unless we raise the SSS contributions,” Dela Paz emphasized in Filipino.

“SSS members contribute very little to meet the needs of a decent life.” She added, “Many [of them] only pay on the basis of the [minimum] P1,000 income. So that is P100. How can an SSS member live off that contribution alone?”

While current chief Emilio de Quiros Jr earlier said they would have to raise the monthly salary credit from 11% to 15.8%, it will cost average earners an additional P1,000.

Make collections efficient

But increasing contribution rates alone would not be effective if the SSS does not have efficient collections from members.

Bayan Muna Party-list Representative Neri Colmenares earlier accused the SSS of maintaining a low collection rate of 35% to 38% that is why it is unable to provide for sufficient funding for the pension hike.

According to the lawmaker, who filed the proposal for a pension increase in the House of Representatives, a “10% increase in collection efficiency will go a long way in increasing its investment fund.”

The SSS, however, said they are performing at an 88% collection rate, way ahead of Colmenares’ claim.

“Given SSS contribution collections of P103.1 billion against the collectibles of P116.6 billion, the SSS collection efficiency is at 88 percent,” De Quiros said in a statement.

“The alleged 38 percent often cited by legislators as collection efficiency is what we call coverage ratio, computed as the number of actively paying members at 12 million over the total members of SSS at 33 million,” he noted.

But historical data show that the SSS has had an average contribution deficit of P7.5 billion for 12 years (2000-2011), which is equivalent to the average pension of 2.3 million members.

This means the total amount of its operating expenses and benefits payout exceeded the amount it had collected from members, possibly hindering the swift extension of its fund life.

Given that member contributions account for 75% of its total revenue, efficient member collection should remain as the heart and soul of SSS operations.

Idle assets

But besides improving member contributions and collections, COA also told the SSS its idle assets could be a source of millions of pesos.

Annual COA reports from 1999 until 2014 show that the independent state auditor had repeatedly spotted uncollected revenues from some of its assets.

In its 2014 audit alone, COA found P17.956 billion worth of idle assets. According to the state auditor, SSS could have rented out 102 condominium units, 16 residential houses, and 169 parking lots.

“SSS has foregone an estimated rental income of P198.118 million on a significant number of properties valued at P17.956 billion for being idle or [having] no lesses, but incurring fixed costs such as condominium dues, electricity, water,” the report said.

This could have covered the P2,000 increase of almost 100,000 pensioners. As COA noted: This has further deprived the SSS of “additional funds to be extended as social protection and benefits for its members and beneficiaries.”

Improving the efficiency of collections, raising revenues by increasing member contributions, making wiser use of assets, and being prudent about pension increases could steer the SSS to safer ground. Not all of these, however, are popular choices. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.