SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

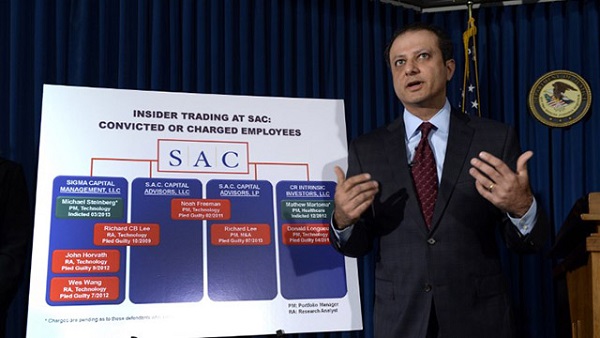

Is this a sign of stricter times to come? Federal authorities, under fire for lax oversight over Wall Street, is taking action. SAC Capital Advisors is one of Wall Street’s most successful firms, but it has also been the focus of government scrutiny the past decade because of its outsize trading. Now, federal authorities have made an unprecedented move, announcing criminal charges against the hedge fund on Thursday. That could threaten its survival. Federal prosecutors called SAC “a veritable magnet of market cheaters” and allege the firm and its units allowed “systematic” insider trading that earned hundreds of millions of dollars in profit for the firm owned by billionaire, Steven A.. Cohen. The indictment offers the most detailed account of how the firm works and shows executives may have known about – but failed to prevent – insider trading.

Read more on NY Times.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.