SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

The common definition of oligarchy refers to a government run by a small group of powerful individuals. The Greek philosopher Plato, however, referred to oligarchs as “greedy men” reluctant to pay their fair share of taxes.

In oligarchies, Plato further warned, the majority are poor and disempowered, while a small ruling class consolidates power and subverts laws to press their own interests over the common good.

More recent conceptions of oligarchs refer to a wealthy class – usually but not exclusively in business – that exercise control over key parts of the economy and could exert strong influence over the government itself. Russia’s Magnificent 7 who controlled much of Russia’s banking system in the post-Soviet Union transition period, and China’s princelings who are comprised of children of the original high-ranking Communist officials during the country’s cultural revolution are among the possible examples.

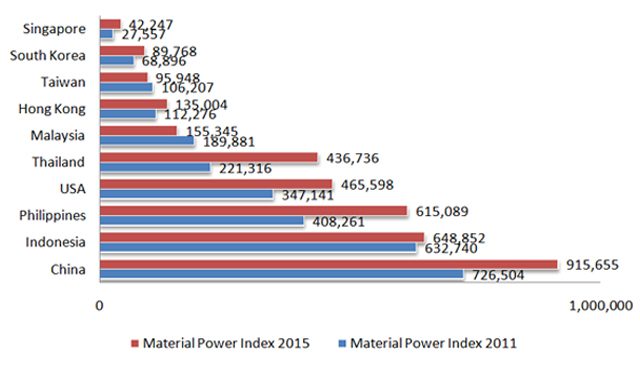

How dominant (or potentially dominant) are the oligarchs in their respective economies? Figure 1a, for example, shows the “material power index” developed by Jeffrey Winters of Northwestern University. This indicator is the ratio of the average wealth of the top 40 richest individuals and the GDP per capita of the country.

Furthermore, figure 1b provides a snapshot of “oligarchic intensity” as measured by the total wealth of the top 40 wealthiest individuals in each of the selected economies, expressed as a share of total GDP. Between 2011 and 2015, most countries in the sample experienced an increase in both oligarchic intensity and the material power index, suggesting increasing wealth (relative to the over-all economy) among this small group of individuals.

The Philippines stands out due to the dramatic increase in its “material power index” during this period. Put differently, the country’s top 40 richest individuals experienced a dramatic increase in wealth in the past 5 years – growth outpacing that of the average income of the Filipino.

Figure 1A. Material Power Index across Selected Economies

Figure 1B. Oligarchic Intensity across Selected Economies

The international research on oligarchs paints a complex picture of their role in development. Several studies concede that oligarchs in Ukraine and Russia may have managed their respective firms much more effectively than either the government or non-oligarchic businessmen. Yet even as oligarchic countries could grow fast initially, analysts like Daron Acemoglu of MIT contend that democratic systems will eventually outperform oligarchies, largely since the latter creates the incentives to protect against competition and stunt innovation.

Hitting where it hurts

Perhaps it’s in this light that President Duterte seems to have called them out. “Ang plano talaga is, destroy the oligarchs that are embedded in government. Yan sila, I’ll give you an example, publicly – Ongpin, Roberto.“

President Duterte’s recent tirade against oligarchs in general and Ongpin in particular has already generated a swift response from the financial market. Following the President’s comments on the ills of online gambling in early August, PhilWeb shares plunged resulting in paper losses of about Php 14 billion at the time of writing this piece.

In his public comments, President Duterte has emphasized specific problematic characteristics of oligarchs—they obtain government contracts using political connections, and they engage in illegal activities to gain an advantage such as insider-trading. Scholars of Asian industrialization such as Paul Hutchcroft of Australia National University, called this either “booty capitalism” or “crony capitalism.”

Figure 2. Philweb’s Trading Price (September 2015 to August 2016)

Lessons from Putin and Park

Vladimir Putin of Russia also tried to curb the economic and political influence of oligarchs in the Russian economy. In 2000, Putin offered the oligarchs an unwritten but widely known pact they could not refuse. If they agreed to pay proper taxes and ceased to meddle in politics (i.e. against Putin), Putin agreed to desist from expropriating their assets. As most Russians supported the exproriation of oligarchic wealth, Putin had no trouble arresting and exiling Mikhail Khodorkovsky, owner of Yukos the oil company, when he openly criticized the Putin administration’s corruption and supported the opposition. In this particular case, it was less clear who was worse for Russia’s development—Putin or the oligarch who misbehaved in his eyes.

Similarly, Park Chung-hee of South Korea was swept into power thanks to deep disapointment in the corrupt regime of Syngman Rhee. By then the already prospering heads of the chaebols were also widely seen by the public to have grown their wealth and influence through corruption. Park began his campaign against oligarchs by forcing Lee Byung-chol, head of Samsung, to pay fines in 1963. In the succeeding years, despite numerous arrests, the chaebols remained intact and influential.

In its effort to industrialize the country, the Korean government eventually resorted to another tactic – subsidizing the chaebols in exchange for spearheading the country’s industrialization and export-led growth strategy. Competition in global markets eventually sharpened the chaebols and provoked them to boost their competitiveness in the interest of survival.

Competition is key ingredient

Oligarchs are not unlike the political dynasties. Both are essentially there due to lack of competition – one in the economy and the other in the political sphere. In some cases, these two spheres collide in ways that corrupt both the public and private sectors, due to rent-seeking, corruption and blocking of key reforms.

These are some of the perverse ties that retard competition and cripple economic competitiveness. Ultimately, threats and jail are less effective against the recurrent pattern of oligarchic behavior – including rent-seeking and corruption – since taking one out will only open the door for a new oligarch to take over if there are no deep reforms. (Just like fat dynasties are replaced by slim dynasties that eventually become fat too, in the absence of deep political reforms.)

There is only one true cure for oligarchy and the rule of a few – the advent of strong competition in both the market economy and the political sphere.

While there are many factors behind this, at least in the market economy, the key inputs include institutional innovations like a strong and independent competition authority. As long as this functions independently and effectively, it can contribute to a much more level playing field, preventing the abuse of market power among other anti-competitive behaviors. For industries characterized by natural monopolies, a competition authority can also help to regulate this.

In addition, pursuing a more open economic environment could also welcome new players that bring more competitive pressure on large firms. Instead of rent-seeking, these large firms can turn their sights on a tried and tested formula for success – innovation, investment and competitive products and services. Nothing wrong with being wealthy, as long as it’s coherent with our nation’s progress. – Rappler.com

The views expressed in this article are the author’s and do not necessarily reflect those of the Ateneo de Manila University. Rodelyn Rodillas provided inputs and research assistance for this article.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.