SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

A few days ago news about the peso’s diminished purchasing power circulated widely in social networks.

The Association of Labor Unions (ALU) recently pointed out that as of December 2016 the value of the peso dropped to 67 centavos, the “lowest in 8 years.” (The actual figure for 2016 was 69 centavos.)

Because of this, the highest minimum wage of P491 supposedly lost a staggering P127 in terms of purchasing power. This implies more hardships for the millions of minimum wage earners who already struggle to make both ends meet daily.

In response to this news, some netizens took the peso’s lower purchasing power as a sign of worsening economic conditions, and even blamed it on the Duterte government. Others said that if President Rodrigo Duterte was not at the helm, “the value of the peso would have been much lower.”

In this article I’d like to clarify a number of things about the purchasing power of the peso. In particular, there were fundamental omissions made in the reports that need to be brought to light.

Purchasing power of the peso

First, let’s establish what the “purchasing power of the peso” means.

Consider a person called Maxine who has P100 in cash. Suppose Maxine lives in an economy which produces only ice cream. If a scoop of ice cream sells for P25, then Maxine can buy 4 ice creams at most. But if the price of ice cream rises to P50 each, then Maxine can buy only 2 ice creams at most.

Hence, the purchasing power of Maxine’s P100 halved when the price of ice creams doubled. Generally, higher cost of living erodes the purchasing power of the peso. These concepts are really two sides of the same coin.

But comparing these concepts over time is not straightforward: comparisons make sense only when we use a so-called “reference year.”

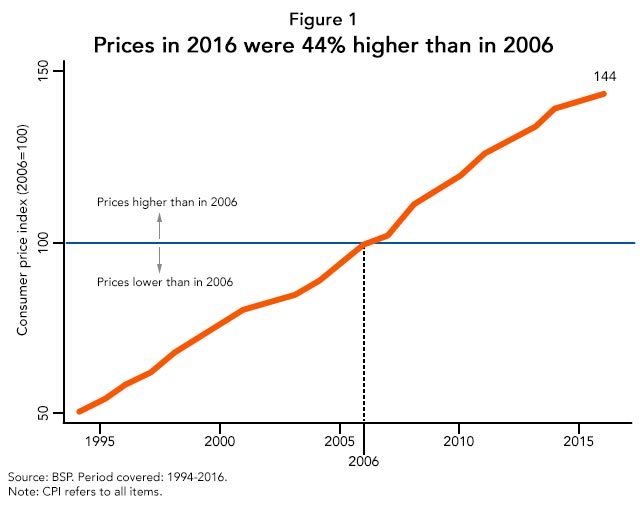

Figure 1 below shows the cost of living in the Philippines over time. Whereas prices were pegged at 100 in 2006, prices were at 144 in 2016. This simply means that prices in 2016 were 44% higher relative to prices in 2006 (the reference year used in many government statistics).

In the same manner, it only makes sense to compare the purchasing power of the peso over time using a reference year.

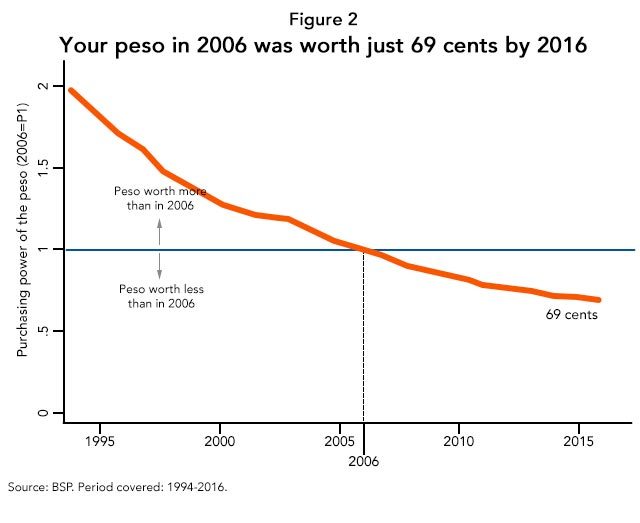

Figure 2 below shows the purchasing power of the peso using 2006 as the reference year. If you had one peso in 2006, it would buy you only 69 cents worth of goods and services by 2016 because prices rose in the decade between them. In other words, your peso in 2016 was worth 69 cents relative to its value in 2006.

Sorting out the facts

Sorting out the facts

Using these basic ideas, let’s try to assess the claims made in the controversial news item.

First, the report made no mention whatsoever of the all-important 2006 reference year. Your peso is not worth 69 cents today. Instead, it was your peso back in 2006 that’s worth 69 cents today. There’s a subtle but crucial difference between these two statements.

In fact, the peso was worth 69 cents many times before. For example, back in 2008 the peso was also worth 69 cents relative to the year 2000. In 2000, the peso was worth 66 cents relative to the year 1994.

This highlights the fact that comparing the purchasing power of the peso makes sense only when we compare it to a reference year.

Second, perhaps a more important concern than the peso’s purchasing power is how fast prices are going up. If prices are going up too fast compared to people’s incomes, then it can spell more hardship for Filipinos.

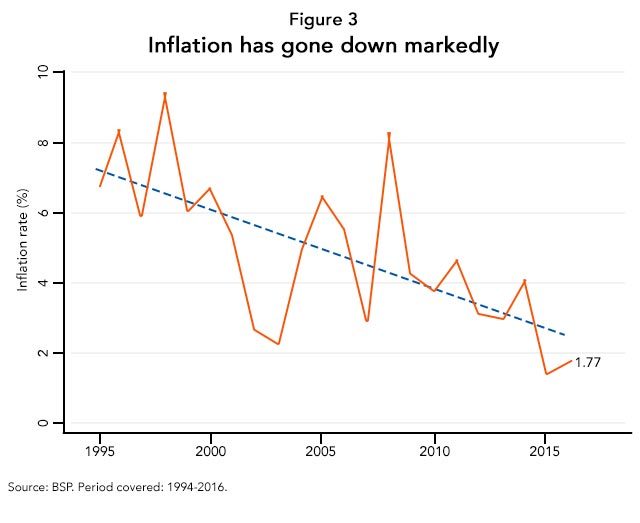

Thankfully, prices have decelerated in recent decades. Figure 3 shows that the annual inflation rate has gone down markedly since the 1990s. Whereas prices rose annually by 6% to 10% in the 1990s, prices rose by just 1.78% as of 2016.

Third, it was claimed in the reports that workers’ minimum wages have stagnated compared to the rising cost of living.

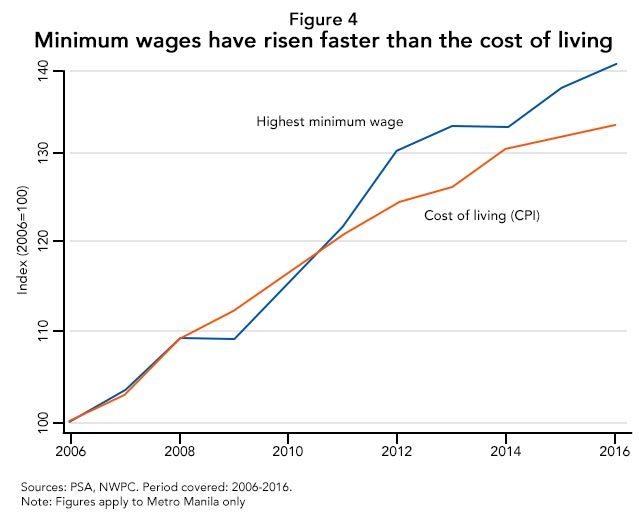

But Figure 4 shows that the highest minimum wage has, in fact, been able to keep up with the cost of living, and even outpaced it. From 2006 to 2016 the cost of living rose by around 33%. But at the same time the minimum wage increased by 40%. Hence, it’s quite a stretch to say that minimum wages have been largely stagnant relative to the cost of living.

With respect to the minimum wage, I think there are two larger issues at play. First, how are minimum wages determined in the first place, and are they sufficient to meet the needs of the average worker’s family?

Second – and more importantly – how do we find ways to employ Filipinos in jobs that pay well above the minimum wage? Here, productivity is key: workers’ earnings depend largely on their ability to get high-paying jobs in high-productivity sectors. For this we need to promote entrepreneurship, attract investments, and create an environment conducive for doing business.

Conclusion: It’s all relative

All in all, fears about your peso’s diminished value are overblown. Your peso was already worth 69 cents back in history, and it will be worth 69 cents again 50, 100, or 200 years from now. It all depends on the reference year you choose.

Perhaps what’s more troubling is the continuing need to promote more economic and financial literacy among Filipinos. We interact in the economy daily, yet we sometimes feel we know little about it. A deeper understanding of the economy’s workings – including the precise meaning of “purchasing power of the peso” – wouldn’t go amiss. – Rappler.com

The author is a PhD student and teaching fellow at the UP School of Economics. His views do not necessarily reflect the views of his affiliations.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.