SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

During the DepED’s National Research Conference held in Koronodal last April 16 to 18, we were tasked to give a plenary talk about “Cutting Edge Research Methods.” In this talk, we showed how collecting and analyzing data has changed dramatically because of information communications technology (ICT), which has spurred the era of Big Data.

We are drowning in a flood of data, with ICT changing our ways of doing things and learning. We could imagine having access to a huge database where we collect every detailed measure of every student’s academic performance drilling down to every answer he/she makes to an exam question, and add to these are information on the students (from the socio-economic profile of his/her family, to his teachers, to whether or not he/she supplements classroom learning with Internet online learning).

This data could be used to design the most effective approaches to education, starting from reading, writing, and mathematics, to advanced college courses. While we don’t have this database yet, but little by little, we are getting there.

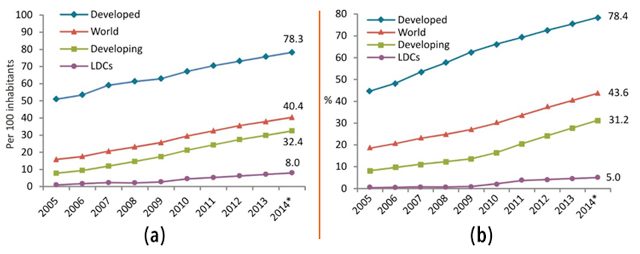

The increasing access to the Internet and social media has been phenomenal.

We are Social, an agency that examines social media data, suggests that as of end of 2014, about 42% of the world’s population had access to the internet, and the online social networking application Facebook registered 1.4 billion active users.

It has also been reported that in the PH, as of January 2014, there were 37.6 million Internet users, of which 34 million were on Facebook. Thus, one in every three Filipinos were on Facebook. Social media is also making various information available to us in various formats. Videos on YouTube are teaching us everything: from how to cook to why you need to study Statistics (#thisisstatistics)

We are drowning in a flood of data, with ICT providing us the means to transmit and exchange data in the form of sound, text, visual images, signals or any other form or any combination of those forms through the use of digital technology.

From the beginning of recorded time until 2003, we created 5 exabytes of data (one exabyte is a billion gigabytes). In 2012, five exabytes were being created every two days; in 2013, this amount of information was being created every ten minutes. ICT has resulted in revolutionizing the way people communicate and for governments and firms to interact and conduct business.

The ICT revolution, most specifically the Internet, has altered the ways people around the world communicate, live, learn, play and work. Even in restaurants, we find menus now being put on tablets for our convenience, and waiters entering our food choices on gadgets.

With the Philippines getting the attention in the world as one of Asia’s fastest growing economies, the presence of a reliable, accessible and affordable Philippine ICT infrastructure is necessary for our participation in the information economy. Without it, the Philippines will once again face the prospect of being marginalized in the global economy. With it, we stand the chance of becoming a cyber-tiger in the new economy.

Digital divide

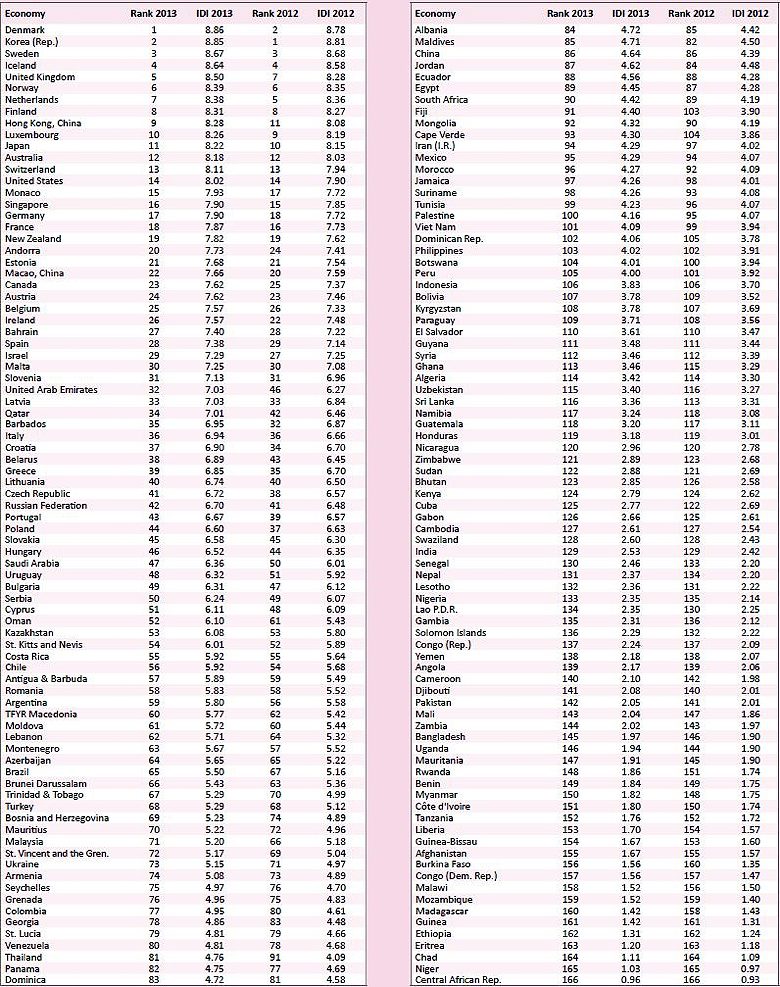

In November last year, the International Telecommunication Union, a specialized agency of the United Nations for ICT, released its Measuring the Information Society Report 2014 which contains an ICT Development Index (IDI) in the years 2012 and 2013 for 166 countries.

The IDI combines 11 indicators (Table 1) into one composite aggregate measure to monitor and compare developments in ICT. In general, the IDI presents the level of ICT developments among countries over time. Governments, researchers and the general public can use the IDI to measure the digital divide and compare ICT performance across countries.

Table 1. Indicators used in the Computation of the IDI

|

Access sub-index |

Use sub-index |

Skills sub-index |

|

Indicators on ICT infrastructure and access: 1. fixed-telephone subscriptions 2. mobile cellular telephone subscriptions 3. international Internet bandwidth per Internet user 4. Percentage of households with a computer 5. percentage of households with Internet access |

Indicators on ICT intensity and usage: 1. individuals using the Internet 2. fixed (wired)-broadband subscriptions 3. wireless-broadband subscriptions |

Indicators on ICT capability or skills: 1. adult literacy 2. gross secondary enrolment 3. gross tertiary enrolment |

Source: International Telecommunication Union (ITU)

Top countries in ICT development

Among the 166 countries covered in the ITU report, Denmark topped the list followed by South Korea and Sweden.

In Asia and the Pacific, Hong Kong (China), Japan, Australia and Singapore ranked highest after South Korea. The ITU suggested that the IDI exhibits a strong relationship with many indicators for tracking the Millennium Development Goals. The ITU report showed a very clear disparity on ICT development between developed and developing countries.

The average index of developing countries remained almost half that of developed countries. The gap is more pronounced in the availability and uptake of wireless-broadband and fixed broadband services. Meanwhile, the international Internet bandwidth in many developing countries remains at very low levels, which is of particular importance to sustain ICT growth.

Table 2. ICT Development Index and Rank, 2013 and 2012 Source: ITU

The report also found that developing countries, despite exhibiting progress, are not advancing enough to catch up with the pace of ICT development in developed countries. It even found continued rise in disparities in ICT development within the group of developing countries.

Figure 1. Percentage of (a) households with Internet access and (b) Individuals using the Internet, by level of development, 2005-2014

ICT access and usage in the Philippines

The ITU showed that in 2013, the Philippines practically maintained its rank (103rd place from 102nd in 2012) despite advances in the areas of access and use of ICT. The country’s ICT connectivity was further improved through the installation of the Boracay-Palawan Submarine Cable System completed in the second quarter of 2013.

Of the 10 members of the Association of Southeast Asian Nations, the Philippines consistently ranked 6th since 2010, trailing behind Singapore, Brunei Darussalam, Malaysia, Thailand and Vietnam (Table 3).

Table 3. ICT Development Index of ASEAN member states, 2010-2013

|

2010 |

2011 |

2012 |

2013 |

|||||

|

Rank |

Index |

Rank |

Index |

Rank |

Index |

Rank |

Index |

|

|

Brunei Darussalam |

50 |

4.89 |

56 |

4.93 |

63 |

5.36 |

66 |

5.43 |

|

Cambodia |

119 |

1.88 |

121 |

2.05 |

127 |

2.54 |

127 |

2.61 |

|

Indonesia |

97 |

3.01 |

97 |

3.14 |

106 |

3.7 |

106 |

3.83 |

|

Lao PDR |

120 |

1.84 |

122 |

1.99 |

130 |

2.25 |

134 |

2.35 |

|

Malaysia |

57 |

4.63 |

57 |

4.81 |

66 |

5.18 |

71 |

5.2 |

|

Myanmar |

129 |

1.65 |

132 |

1.7 |

148 |

1.75 |

150 |

1.82 |

|

Philippines |

94 |

3.04 |

98 |

3.14 |

102 |

3.91 |

103 |

4.02 |

|

Singapore |

10 |

7.47 |

14 |

7.55 |

15 |

7.85 |

16 |

7.9 |

|

Thailand |

89 |

3.29 |

94 |

3.42 |

91 |

4.09 |

81 |

4.76 |

|

Viet Nam |

86 |

3.41 |

86 |

3.65 |

99 |

3.94 |

101 |

4.09 |

|

No. of countries |

155 |

157 |

166 |

166 |

||||

Note: 2010 figures are from the 2012 report, 2011 figures are from 2013 report, and 2012 and 2013 figures are from the 2014 report. Source: ITU

Telephone density, measured as the number of fixed telephone subscriptions per 100 inhabitants, has been practically similar in the Philippines, i.e., from 3.74 out of 100 persons in 2011 to 3.61 and 3.2 in 2012 and 2013, respectively (Table 4). This placed the country only ahead of Myanmar and Cambodia.

Table 4. Fixed telephone subscriptions (per 100 population) among ASEAN member states, 2005- 2013

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|

|

Brunei Darussalam |

22.81 |

21.40 |

20.86 |

20.82 |

20.42 |

19.95 |

19.64 |

17.21 |

13.58 |

|

Cambodia |

0.25 |

0.19 |

0.27 |

0.31 |

0.38 |

2.50 |

3.63 |

3.93 |

2.78 |

|

Indonesia |

6.02 |

6.51 |

8.46 |

12.97 |

14.66 |

17.01 |

15.84 |

15.39 |

12.30 |

|

Lao P.D.R. |

1.57 |

1.56 |

1.58 |

2.08 |

1.60 |

1.61 |

1.65 |

6.77 |

10.37 |

|

Malaysia |

16.89 |

16.49 |

16.22 |

16.53 |

16.28 |

16.30 |

15.73 |

15.69 |

15.26 |

|

Myanmar |

1.00 |

1.13 |

0.91 |

0.99 |

0.86 |

0.95 |

1.00 |

0.99 |

1.00 |

|

Philippines |

3.92 |

4.16 |

4.43 |

4.51 |

4.46 |

3.57 |

3.74 |

3.61 |

3.20 |

|

Singapore |

41.03 |

40.17 |

39.34 |

38.69 |

38.90 |

39.30 |

38.87 |

37.48 |

36.35 |

|

Thailand |

10.73 |

10.73 |

10.63 |

11.17 |

10.87 |

10.29 |

10.01 |

9.55 |

9.04 |

|

Viet Nam |

– |

9.99 |

12.90 |

16.90 |

19.76 |

16.14 |

11.32 |

11.22 |

10.13 |

Source: ITU

In 2012, the number of cellular mobile telephone subscriptions surpassed the total number of persons in the Philippines. There were around 105 mobile cellular telephone subscriptions for every 100 population in 2012, with mobile penetration remaining practically similar at 104 in 2013 (Table 5).

Note that there are more mobile subscriptions than people since some people have more than one subscription. In addition, we suspect overcounting of mobile subscriptions with each telco trying to claim they are number one, not paying attention to whether a subscription is truly active. Why do we count subscriptions rather than subscribers?

To count subscribers, we would have to remove double counts, but telcos do not have information about identities of pre-paid subscribers. Only post-paid subscribers have to register with the telcos, and of course each telco will probably not be willing to share their databases of customers with the other telcos!

Clearly, it is important for a policy on the full registration of cellular subscribers, including pre-paid ones, and for that matter a full implementation of a national ID system. But such registration systems should also discuss legal issues of privacy, which are already being discussed at the global level.

In the ASEAN region, Table 5 shows that Singapore tops the list of having the highest mobile-cellular telephone density at 155.9 in 2013, with Myanmar at the bottom with only 12.8.

In 2013, the Philippines though ranks 8th in the ASEAN region in mobile penetration, only higher than Lao PDR and Myanmar. In 2005, the Philippines ranked 4th but over the years it has been overtaken by Cambodia, Vietnam and Indonesia, which in 2013 ranked 4th, 5th and 6th, respectively.

Table 5. Mobile cellular telephone subscriptions (per 100 population) among ASEAN member states, 2005- 2013

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|

|

Brunei Darussalam |

63.32 |

80.44 |

95.99 |

102.79 |

104.69 |

108.62 |

109.02 |

113.95 |

112.21 |

|

Cambodia |

7.95 |

12.70 |

18.79 |

30.39 |

44.31 |

56.74 |

94.19 |

128.53 |

133.89 |

|

Indonesia |

20.90 |

28.02 |

40.43 |

60.01 |

68.92 |

87.79 |

102.46 |

114.22 |

125.36 |

|

Lao P.D.R. |

11.36 |

17.12 |

24.59 |

32.94 |

51.61 |

62.59 |

84.05 |

64.70 |

68.14 |

|

Malaysia |

75.63 |

73.93 |

87.07 |

101.50 |

108.47 |

119.74 |

127.48 |

141.33 |

144.69 |

|

Myanmar |

0.26 |

0.42 |

0.49 |

0.72 |

0.97 |

1.14 |

2.38 |

7.06 |

12.83 |

|

Philippines |

40.52 |

49.07 |

64.52 |

75.37 |

82.26 |

88.98 |

99.09 |

105.45 |

104.50 |

|

Singapore |

97.53 |

103.78 |

125.19 |

132.30 |

138.69 |

145.40 |

150.12 |

152.13 |

155.92 |

|

Thailand |

46.46 |

60.90 |

80.17 |

93.43 |

99.51 |

108.02 |

116.33 |

127.29 |

140.05 |

|

Viet Nam |

11.29 |

22.03 |

52.02 |

85.70 |

111.37 |

125.29 |

141.60 |

147.66 |

130.89 |

Source: ITU

Internet usage slightly increased in 2013. There were around 37 percent of the population accessing the Internet, up from 36.2 percent in 2012 (Table 6). This landed the Philippines in 5th place vis-à-vis ASEAN neighbors.

Table 6. Percentage of Individuals using the Internet among ASEAN member states, 2005-2013

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|

|

Brunei Darussalam |

36.47 |

42.19 |

44.68 |

46.00 |

49.00 |

53.00 |

56.00 |

60.27 |

64.50 |

|

Cambodia |

0.32 |

0.47 |

0.49 |

0.51 |

0.53 |

1.26 |

3.10 |

4.94 |

6.00 |

|

Indonesia |

3.60 |

4.76 |

5.79 |

7.92 |

6.92 |

10.92 |

11.11 |

14.70 |

15.82 |

|

Lao P.D.R. |

0.85 |

1.17 |

1.64 |

3.55 |

6.00 |

7.00 |

9.00 |

10.75 |

12.50 |

|

Malaysia |

48.63 |

51.64 |

55.70 |

55.80 |

55.90 |

56.30 |

61.00 |

65.80 |

66.97 |

|

Myanmar |

0.07 |

0.18 |

0.22 |

0.22 |

0.22 |

0.25 |

0.98 |

1.07 |

1.20 |

|

Philippines |

5.40 |

5.74 |

5.97 |

6.22 |

9.00 |

25.00 |

29.00 |

36.24 |

37.00 |

|

Singapore |

61.00 |

59.00 |

69.90 |

69.00 |

69.00 |

71.00 |

71.00 |

72.00 |

73.00 |

|

Thailand |

15.03 |

17.16 |

20.03 |

18.20 |

20.10 |

22.40 |

23.67 |

26.46 |

28.94 |

|

Viet Nam |

12.74 |

17.25 |

20.76 |

23.92 |

26.55 |

30.65 |

35.07 |

39.49 |

43.90 |

Source: ITU

Fixed-broadband subscription per 100 population exhibited remarkable increase to 9.12 per 100 persons in 2013 from 0.14 in 2005 (Table 7). Broadband has been successful building a healthy subscriber base in the country. The increase, however, is on a downward trend. Surprisingly, the Philippines placed second among ASEAN member nations, only trailing behind Singapore.

Table 7. Fixed (wired)-broadband subscriptions (per 100 inhabitants) among ASEAN member states, 2005-2013

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

2013 |

|

|

Brunei Darussalam |

2.21 |

2.39 |

3.05 |

4.35 |

5.08 |

5.42 |

5.70 |

4.81 |

5.71 |

|

Cambodia |

0.01 |

0.02 |

0.06 |

0.12 |

0.21 |

0.25 |

0.15 |

0.20 |

0.22 |

|

Indonesia |

0.05 |

0.09 |

0.34 |

0.42 |

0.78 |

0.95 |

1.12 |

1.21 |

1.30 |

|

Lao P.D.R. |

0.01 |

0.01 |

0.02 |

0.05 |

0.07 |

0.09 |

0.10 |

0.11 |

0.13 |

|

Malaysia |

1.87 |

2.85 |

3.82 |

4.83 |

5.55 |

6.49 |

7.43 |

8.41 |

8.22 |

|

Myanmar |

0.00 |

0.01 |

0.01 |

0.02 |

0.04 |

0.04 |

0.03 |

0.12 |

0.18 |

|

Philippines |

0.14 |

0.30 |

0.56 |

1.16 |

1.87 |

1.84 |

5.37 |

7.89 |

9.12 |

|

Singapore |

14.60 |

17.08 |

18.94 |

21.12 |

23.58 |

24.98 |

25.61 |

25.44 |

26.03 |

|

Thailand |

0.85 |

1.36 |

1.96 |

3.13 |

3.96 |

4.90 |

5.74 |

6.52 |

7.36 |

|

Viet Nam |

0.25 |

0.60 |

1.50 |

2.35 |

3.64 |

4.12 |

4.27 |

4.90 |

5.62 |

Source: ITU

Available data from ITU show that in 2010, at least 13 in every 100 households in the Philippines had access to a computer, higher than Cambodia’s 9.3 (Table 8). Singapore and Malaysia is considerably higher at 85 and 65 households with a computer.

Meanwhile, in 2010, only 10.1 percent among the households in the Philippines has Internet access, even lower compared to 12.5 in Vietnam. Of course, the information from the Philippines is sourced from a 2010 survey, whereas other countries are more recent.

Table 8. Percentage of Households with Computer and Percentage of Households with Internet Access: ASEAN, Various years

|

Percentage of households with: |

||||

|

Computer |

Year of latest available data |

Internet access |

Year of latest available data |

|

|

Brunei Darussalam |

– |

65.0 |

2010 |

|

|

Cambodia |

9.3 |

2013 |

5.5 |

2013 |

|

Indonesia |

15.6 |

2013 |

5.7 |

2013 |

|

Lao P.D.R. |

– |

3.4 |

2010 |

|

|

Malaysia |

65.1 |

2013 |

64.7 |

2013 |

|

Myanmar |

– |

– |

||

|

Philippines |

13.1 |

2010 |

10.1 |

2010 |

|

Singapore |

85.0 |

2012 |

84.0 |

2012 |

|

Thailand |

29.1 |

2013 |

23.2 |

2013 |

|

Viet Nam |

16.0 |

2011 |

12.5 |

2010 |

Source: ITU

High cost of ICT services in PH

The relatively weak uptake of ICT services in the Philippines, aside from inadequate ICT infrastructure, can be attributed to relative high cost associated with it. In comparison with ASEAN neighbor countries, ICT services in the Philippines are among the highest (Table 9).

Table 9. Prices of selected ICT services in PPP$ per month, 2013

|

Fixed Telephone |

Mobile cellular |

Fixed Broadband |

Mobile broadband, postpaid handset-based |

Mobile broadband, prepaid handset-based |

Mobile broadband, postpaid computer-based |

Mobile broadband, prepaid computer-based |

|

|

Brunei Darussalam |

18.91 |

29.6 |

78.28 |

33.72 |

30.11 |

33.72 |

24.09 |

|

Cambodia |

9.81 |

16.16 |

30.55 |

7 |

7 |

12.73 |

12.73 |

|

Indonesia |

9.54 |

16.38 |

48.92 |

12.54 |

5.7 |

12.54 |

11.4 |

|

Lao PDR |

12.01 |

17.84 |

41.65 |

12.82 |

0 |

16.02 |

0 |

|

Malaysia |

17.99 |

14.2 |

41.52 |

23.91 |

23.91 |

30.2 |

30.2 |

|

Myanmar |

– |

– |

– |

– |

– |

– |

– |

|

Philippines |

36.15 |

22.24 |

51.59 |

25.77 |

25.77 |

51.38 |

25.77 |

|

Singapore |

9.1 |

9.04 |

20.58 |

32.97 |

12.4 |

20.58 |

0 |

|

Thailand |

14.55 |

12.61 |

52.85 |

24.51 |

24.51 |

32.71 |

36.31 |

|

Viet Nam |

4.44 |

8.81 |

7.15 |

– |

– |

– |

– |

Source: ITU

Networked Readiness Index

This month, the World Economic Forum, in collaboration with INSEAD, published the Global Information Technology Report 2015 which allows countries to catch a glimpse of the current market conditions as well the state of connectivity across the world. It also helps identify areas of improvement to maximize the full potential of the Internet and other innovations in the ICT sector.

The report estimates the Networked Readiness Index (NRI), which rests on six principles:

- A high-quality regulatory and business environment is critical in order to fully leverage ICTs and generate impact;

- ICT readiness – as measured by ICT affordability, skills, and infrastructure – is a pre-condition to generating impact;

- Fully leveraging ICTs requires a society-wide effort: the government, the business sector, and the population at large each have a critical role to play;

- ICT use should not be an end in itself. The impact that ICTs actually have on the economy and society is what ultimately matters;

- The set of drivers – the environment, readiness, and usage – interact, co-evolve, and reinforce each other to form a virtuous cycle; and

- The networked readiness framework should provide clear policy guidance.

The index is a composite indicator made up of four main sub-indexes, with 10 subcategories or pillars and 53 individual indicators (Table 10).

Table 10. Indicators used to Measure Networked Readiness Index

|

Environment sub-index |

Readiness sub-index |

Usage sub-index |

Impact sub-index |

|

Political and regulatory environment – Effectiveness of law-making bodies – Laws relating to ICTs – Judicial independence – Efficiency of legal system in settling disputes – Efficiency of legal system in challenging registrations – Intellectual property protection – Software piracy rate, % software installed – No. procedures to enforce a contract – No. days to enforce a contract

Business and innovation environment

– Availability of latest technologies – Venture capital availability – Total tax rate, % profits – No. days to start a business – No. procedures to start a business – Intensity of local competition – Tertiary education gross enrolment rate, % – Quality of management schools – Gov’t procurement of advanced technology |

Infrastructure

– Electricity production, kWh/capita – Mobile network coverage, % pop – Int’l Internet bandwidth, kb/s per user – Secure Internet servers/million pop

Affordability

– Prepaid mobile cellular tariffs, PPP $/min. – Fixed broadband Internet tariffs, PPP $/month – Internet & telephony competition, 0–2 (best)

Skills

– Quality of educational system – Quality of math & science education – Secondary education gross enrolment rate, % – Adult literacy rate, % |

Individual usage

– Mobile phone subscriptions/100 pop. – Individuals using Internet, % – Households w/ personal computer, % – Households w/ Internet access, % – Fixed broadband Internet subs/100 pop. – Mobile broadband subs/100 pop. – Use of virtual social networks

Business usage

– Firm-level technology absorption – Capacity for innovation – PCT patents, applications/million pop. – Business-to-business Internet use – Business-to-consumer Internet use – Extent of staff training

Government usage

– Importance of ICTs to gov’t vision – Government Online Service Index, 0–1 (best) – Gov’t success in ICT promotion |

Economic impacts

– Impact of ICTs on new services & products – ICT PCT patents, applications/million pop. – Impact of ICTs on new organizational models – Knowledge-intensive jobs, % workforce

Social impacts

– Impact of ICTs on access to basic services – Internet access in schools – ICT use & gov’t efficiency – E-Participation Index, 0–1 (best) |

Source: World Economic Forum (WEF)

In ASEAN, Singapore topped all countries in leveraging ICT towards development. The Philippines’ standing improved, even surpassing Indonesia (Table 11).

Table 11. Networked Readiness Index of ASEAN member countries, 2012-2015

|

Index |

Rank |

|||||||

|

2012 |

2013 |

2014 |

2015 |

2012 |

2013 |

2014 |

2015 |

|

|

Brunei Darussalam |

4.04 |

4.11 |

4.34 |

– |

54 |

57 |

45 |

|

|

Cambodia |

3.32 |

3.34 |

3.36 |

3.30 |

108 |

106 |

108 |

110 |

|

Indonesia |

3.74 |

3.84 |

4.04 |

3.91 |

80 |

76 |

64 |

79 |

|

Lao PDR |

– |

– |

3.34 |

3.56 |

– |

– |

109 |

97 |

|

Malaysia |

4.80 |

4.82 |

4.83 |

4.85 |

29 |

30 |

30 |

32 |

|

Myanmar |

– |

– |

2.35 |

2.53 |

– |

– |

146 |

139 |

|

Philippines |

3.64 |

3.73 |

3.89 |

3.98 |

86 |

86 |

78 |

76 |

|

Singapore |

5.86 |

5.96 |

5.97 |

6.02 |

2 |

2 |

2 |

1 |

|

Thailand |

3.78 |

3.86 |

4.01 |

4.05 |

77 |

74 |

67 |

67 |

|

Viet Nam |

3.70 |

3.74 |

3.84 |

3.85 |

83 |

84 |

84 |

85 |

Source: WEF

Table 12 shows that laws relating to ICTs in the country are sadly not keeping up with what the present market requires to fully leverage ICT. It even deteriorated. There is a clear need for both the executive and legislative branches to address the lack of ICT legislation.

However, the country improved in protecting intellectual property as well as preventing software piracy, which are considered vital factors driving innovation. The country also displayed a great leap in international Internet bandwidth (measured in kb/s per user) (Table 13).

Table 12. NRI Indicators of the Philippines, 2012-2015

|

Index |

Rank |

|||||||

|

2012 |

2013 |

2014 |

2015 |

2012 |

2013 |

2014 |

2015 |

|

|

Effectiveness of law-making bodies, 1-7 (best) |

2.75 |

3.15 |

3.46 |

3.56 |

112 |

93 |

79 |

73 |

|

Laws relating to ICTs, 1-7 (best) |

3.68 |

4.05 |

3.96 |

3.84 |

84 |

66 |

72 |

78 |

|

Judicial independence, 1-7 (best) |

2.95 |

3.02 |

3.17 |

3.55 |

102 |

99 |

99 |

77 |

|

Efficiency of legal system in settling disputes, 1-7 (best) |

2.87 |

3.19 |

3.61 |

3.71 |

115 |

107 |

76 |

68 |

|

Efficiency of legal system in challenging regs, 1-7 (best) |

2.78 |

3.17 |

3.48 |

3.48 |

118 |

102 |

71 |

56 |

|

Intellectual property protection, 1-7 (best) |

2.80 |

3.24 |

3.59 |

3.71 |

102 |

87 |

78 |

66 |

|

Software piracy rate, % software installed |

69 |

70 |

70 |

69 |

68 |

70 |

70 |

66 |

|

No. procedures to enforce a contract |

37 |

37 |

37 |

37 |

69 |

68 |

67 |

70 |

|

No. days to enforce a contract |

842 |

842 |

842 |

842 |

119 |

121 |

122 |

119 |

|

Availability of latest technologies, 1-7 (best) |

5.16 |

5.22 |

5.31 |

5.06 |

62 |

56 |

47 |

58 |

|

Venture capital availability, 1-7 (best) |

2.58 |

2.72 |

3.06 |

3.33 |

71 |

62 |

40 |

31 |

|

Total tax rate, % profits |

46.5 |

46.6 |

44.5 |

42.5 |

100 |

104 |

104 |

92 |

|

No. days to start a business |

35 |

36 |

35 |

34 |

112 |

118 |

120 |

120 |

|

No. procedures to start a business |

15 |

16 |

15 |

16 |

136 |

142 |

144 |

142 |

|

Intensity of local competition, 1-7 (best) |

5.16 |

5.09 |

5.07 |

5.15 |

47 |

50 |

63 |

61 |

|

Tertiary education gross enrollment rate, % |

28.89 |

28.23 |

28.20 |

28.20 |

76 |

79 |

80 |

82 |

|

Quality of management schools, 1-7 (best) |

4.38 |

4.70 |

4.75 |

4.74 |

55 |

39 |

39 |

40 |

|

Gov’t procurement of advanced tech, 1-7 (best) |

2.82 |

3.14 |

3.38 |

3.67 |

126 |

107 |

85 |

53 |

|

Electricity production, kWh/capita |

674.49 |

675.23 |

727.76 |

727.76 |

104 |

105 |

105 |

103 |

|

Mobile network coverage, % pop. |

99 |

99 |

99 |

99 |

49 |

51 |

58 |

66 |

|

Int’l Internet bandwidth, kb/s per user |

10.72 |

12.36 |

14.27 |

57.61 |

71 |

77 |

86 |

47 |

|

Secure Internet servers/million pop. |

6.67 |

7.55 |

8.62 |

8.06 |

95 |

97 |

96 |

99 |

|

Prepaid mobile cellular tariffs, PPP $/min. |

0.30 |

0.29 |

0.29 |

0.36 |

65 |

73 |

83 |

100 |

|

Fixed broadband Internet tariffs, PPP $/month |

40.40 |

40.30 |

39.32 |

55.63 |

86 |

95 |

95 |

108 |

|

Internet & telephony competition, 0–2 (best) |

2 |

2 |

2 |

2 |

1 |

1 |

1 |

1 |

|

Quality of educational system, 1-7 (best) |

3.83 |

4.14 |

4.28 |

4.55 |

61 |

45 |

40 |

29 |

|

Quality of math & science education, 1-7 (best) |

3.14 |

3.55 |

3.74 |

4.13 |

115 |

98 |

96 |

70 |

|

Secondary education gross enrollment rate, % |

84.82 |

84.82 |

84.60 |

84.60 |

79 |

84 |

87 |

87 |

|

Adult literacy rate, % |

95.42 |

95.42 |

95.42 |

96.29 |

60 |

61 |

64 |

40 |

|

Mobile phone subscriptions/100 pop. |

85.67 |

99.30 |

106.51 |

104.50 |

93 |

84 |

79 |

86 |

|

Individuals using Internet, % |

25 |

29 |

36.24 |

37 |

92 |

91 |

87 |

91 |

|

Households w/ personal computer, % |

13.1 |

13.1 |

16.94 |

18.7 |

100 |

97 |

100 |

102 |

|

Households w/ Internet access, % |

10.1 |

10.1 |

18.9 |

22.9 |

89 |

91 |

92 |

86 |

|

Fixed broadband Internet subs/100 pop. |

1.85 |

1.89 |

2.22 |

9.12 |

89 |

92 |

94 |

68 |

|

Mobile broadband subs/100 pop. |

2.26 |

3.36 |

3.83 |

0.00 |

80 |

94 |

108 |

132 |

|

Use of virtual social networks, 1-7 (best) |

5.75 |

6.05 |

6.20 |

6.23 |

41 |

27 |

22 |

25 |

|

Firm-level technology absorption, 1-7 (best) |

5.06 |

5.17 |

5.22 |

5.07 |

52 |

46 |

40 |

41 |

|

Capacity for innovation, 1-7 (best) |

2.71 |

2.94 |

3.76 |

4.52 |

95 |

86 |

48 |

30 |

|

PCT patents, applications/million pop. |

0.30 |

0.26 |

0.32 |

0.35 |

84 |

80 |

84 |

85 |

|

Business-to-business Internet use, 1-7 (best) |

|

5.23 |

5.17 |

5.08 |

|

51 |

51 |

52 |

|

Business-to-consumer Internet use, 1-7 (best) |

|

4.82 |

4.66 |

4.74 |

|

51 |

63 |

58 |

|

Extent of staff training, 1-7 (best) |

4.42 |

4.55 |

4.55 |

4.61 |

34 |

32 |

27 |

27 |

|

Importance of ICTs to gov’t vision, 1-7 (best) |

3.44 |

3.74 |

3.81 |

3.89 |

100 |

85 |

80 |

69 |

|

Government Online Service Index, 0–1 (best) |

0.39 |

0.50 |

0.50 |

0.48 |

48 |

67 |

67 |

66 |

|

Gov’t success in ICT promotion, 1-7 (best) |

|

4.39 |

4.39 |

4.43 |

|

71 |

70 |

53 |

|

Impact of ICTs on new services & products, 1-7 (best) |

4.49 |

4.82 |

4.80 |

4.63 |

68 |

43 |

42 |

50 |

|

ICT PCT patents, applications/million pop. |

0.12 |

0.09 |

0.11 |

0.12 |

76 |

74 |

74 |

80 |

|

Impact of ICTs on new organizational models, 1-7 (best) |

4.25 |

4.75 |

4.82 |

4.62 |

60 |

33 |

28 |

40 |

|

Knowledge-intensive jobs, % workforce |

19.74 |

19.74 |

22.46 |

23.74 |

73 |

72 |

68 |

65 |

|

Impact of ICTs on access to basic services, 1-7 (best) |

3.87 |

4.08 |

4.10 |

4.01 |

106 |

79 |

74 |

77 |

|

Internet access in schools, 1-7 (best) |

4.03 |

4.08 |

4.15 |

4.34 |

73 |

73 |

74 |

66 |

|

ICT use & gov’t efficiency, 1-7 (best) |

3.66 |

4.07 |

4.12 |

4.07 |

103 |

83 |

71 |

69 |

|

E-Participation Index, 0–1 (best) |

0.19 |

0.21 |

0.21 |

0.57 |

62 |

62 |

63 |

51 |

Source: WEF

Table 13. International Internet bandwidth, kb/s per user, 2012-2015

|

Index |

Rank |

|||||||

|

2012 |

2013 |

2014 |

2015 |

2012 |

2013 |

2014 |

2015 |

|

|

Brunei Darussalam |

25.07 |

21.99 |

39.93 |

– |

42 |

59 |

48 |

– |

|

Cambodia |

28.07 |

13.53 |

13.62 |

9.30 |

40 |

74 |

89 |

104 |

|

Indonesia |

2.95 |

7.20 |

17.06 |

10.12 |

109 |

94 |

77 |

100 |

|

Lao PDR |

– |

– |

9.40 |

10.57 |

96 |

98 |

||

|

Malaysia |

11.44 |

10.65 |

16.42 |

29.46 |

69 |

82 |

79 |

69 |

|

Myanmar |

– |

– |

9.43 |

26.20 |

95 |

72 |

||

|

Philippines |

10.72 |

12.36 |

14.27 |

57.61 |

71 |

77 |

86 |

47 |

|

Singapore |

172.15 |

343.73 |

387.64 |

580.78 |

4 |

2 |

4 |

4 |

|

Thailand |

10.83 |

24.63 |

26.65 |

37.37 |

70 |

53 |

61 |

64 |

|

Viet Nam |

5.55 |

10.00 |

13.36 |

15.90 |

97 |

84 |

90 |

90 |

Source: WEF

Need for better ICT skills

While the Philippines fares relatively poor in ICT access and use, the skills and talents of Filipino IT experts have been viewed to be competitive. Results of a survey by the Far East Economic Review in September 1999, suggested that the Philippines then ranked second to India in terms of quality, cost and availability of skilled IT workers in Asia, making them very much in demand in many parts of the world.

Government and the private sector need to work together toward ensuring that the proper environment exists for ICT to further flourish.

A discussion paper written by Winston Conrad Padojinog, released by the Philippine Institute for Development Studies a decade ago, suggested the need for ICT policies to narrow the digital divide by promoting competition, interconnection and convergence in the ICT sector.

While some progress has been made over the past years, there is still much left to be desired. While the Department of Science and Technology, through the ICT Office, is about to provide free wifi, many point out that it is more important for telcos to work together and with government to considerably improve the speed of Internet and mobile services in the country.

ICT will also need to be diffused better in the education sector. In basic education, there is a need to examine the extent of using ICT in the classroom as we implement the K-12 program.

Higher education students will also need to be more prepared for the ever-growing demands of the information-driven economy, especially in the emerging area of data science. It can readily be observed that ICT has been driving innovative activities, and that the ICT sector constantly needs innovation.

In consequence, the country will need to develop and promote innovation policies so that ICT can be an important element to sustain our economic growth, and to make this growth and prosperity shared by all Filipinos. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.