SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Vantage Point] NGCP – what’s wrong with it?](https://www.rappler.com/tachyon/2024/01/whats-wrong-with-ngcp-january-30-2024.jpg)

Panay Island welcomed the New Year in total darkness. The 135-megawatt (MW) of Palm Concepcion Power Corporation tripped, causing a massive blackout in the entire island.

The Senate, which is probing the National Grid Corporation (NGCP) for possible malfeasance in its operations, took note of the statement made by Energy Secretary Raphael Lotilla who blamed the NGCP for the power outage. Lotilla said the incident would have not happened if only the NGCP completed its interconnection project on time. The energy chief said that NGCP should have proactively dealt with the situation.

From my vantage point, this is expected from a company whose profit is being dwarfed by the dividends it gives out to its shareholders.

In May last year, the spokesperson of the NGCP admitted to lawmakers that the company’s dividends outstripped even the company’s net income. Earning only P22 billion in 2014, the company generously doled out P24 billion to its shareholders.

Upon questioning, NGCP spokesperson Cynthia Alabanza could only say that the company’s dividends and net income may not necessarily line up. “Our profits or dividend are taken from retained earnings which have accumulated over the year so it’s not a one is to one.” Her reasoning made the situation look worse. As far as I know, a company exercising prudence ploughs back retained earnings to its coffers to cover its capital expenditures. For me, prudence goes beyond the common sense of being fiscally conservative. It means that management must continually safeguard the company from being overvalued.

SGP overvalued

Perhaps it would be prudent if we delved into the books of NGCP’s major shareholder, Synergy Grid & Development Phils., Inc. (SGP), to see where the company’s financial status stands.

SGP is the investment holding company owned equally by Henry Sy, Jr. and Robert Coyiuto, Jr. which controls 60% of NGCP, which is the sole and exclusive operator of the country’s nationwide transmission network. It links power generators and distribution utilities that deliver electricity to end-users across Luzon, Visayas and Mindanao.

SGP-controlled NGCP generates about 94% of its revenues from power delivery services, while the remaining 6% comes from system operation and metering services. NGCP derives about 46% of its revenues from Meralco alone, the biggest distribution utility customer in the country, while the remaining 63% comes from other customers, such as electric cooperatives [which includes PCPC], private and government utilities, and economic zones.

Vantage Point and US-based hedge fund manager Eric Jurado of the International Investor did some pencil-pushing to come up with these findings:

As of January 22, 2024, SGP’s current share price is overvalued by 24.1%. The share currently hovers at P7.78, besting its estimated fair value of P6.27, with a notable 20% margin of safety tucked into the valuation. This means that investors are buying SGP’s shares at a premium compared to its true worth, as indicated by the overvaluation percentage.

The idea of a 20% margin of safety highlights a purist approach, offering a cushion against market fluctuations, errors, and possible improbabilities and serving as a valuable metric for investors assessing SGP’s risk-reward profile at its current market price.

As of September 30, 2023, SGP’s debt totaled P190 billion, besting its equity by 25.6%. The continued negative free cash flows since 2020, necessitating debt financing, resulted in a P53.9 billion growth in total debt.

SGP, however, seems to have the capacity to manage its debts with its earnings before interest and taxes (EBIT) of P30.9 billion comfortably shielding by 5.5 times its net interest expense of P5.6 billion.

Also, operating cash flow (prior to capital expenditures) of P40.7 billion adequately addresses 21.5% of total debt. “Assuming a static total debt and operating cash flow scenario and no further capital expenditures, this implies that the company could theoretically repay its debt in less than five years, offering a glimmer of financial hope,” Jurado said.

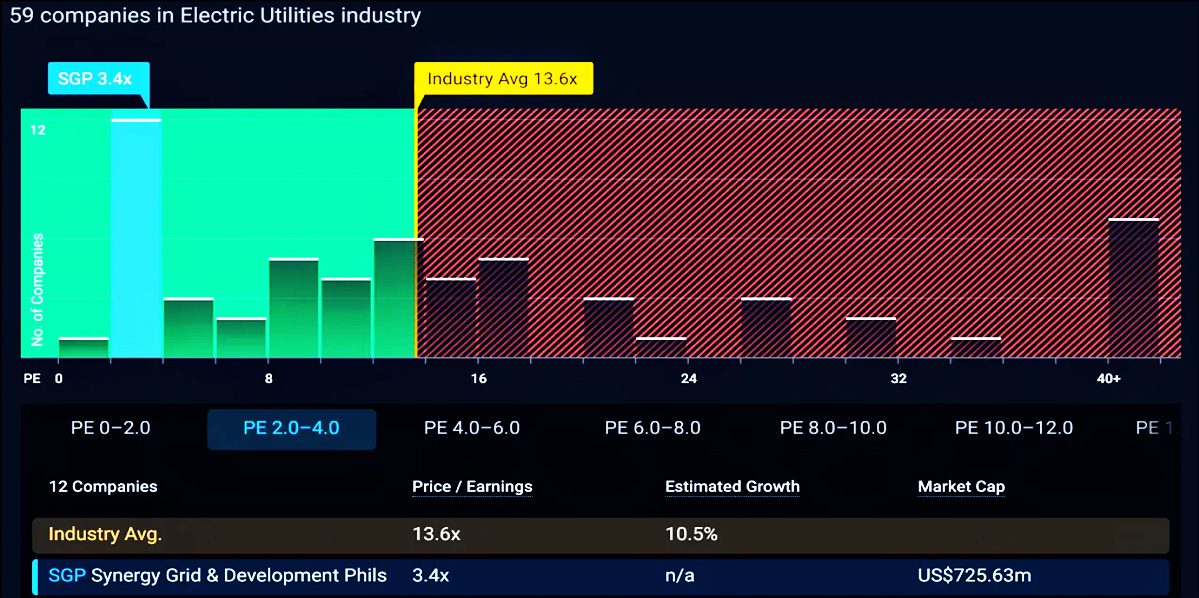

Analyzing SGP’s share price-to-earnings ratio (PE) relative to its industry provides a broader context for evaluating its valuation. Jurado said this approach offers the advantage of a more extensive pool of comparable companies, allowing investors to gain insights into how SGP fares within the industry.

But the caveat is that the comparison comprises companies in different countries, in diverse business segments of the industry, and at various stages of their life cycle. While the method facilitates a more comprehensive understanding of SGP’s relative valuation, we must be mindful of the varied developmental stages within the industry, recognizing that companies in different countries, business segments, and at life cycles may have distinct risk profiles and growth trajectories influencing their respective valuation metrics.

As per Jurado’s computation, the comparison shows that SGP’s share price stands at 3.4 times its earnings, positioning it significantly below the average of the 59-company Asian electric utilities industry, which is 13.6 times their average earnings. This substantial 75% difference underscores a potential undervaluation of SGP relative to its industry peers. The comparatively lower PE ratio may indicate that the market is pricing SGP shares more conservatively, suggesting a potential opportunity for investors seeking shares with favorable valuation metrics and an upside within the sector.

Past 5 years

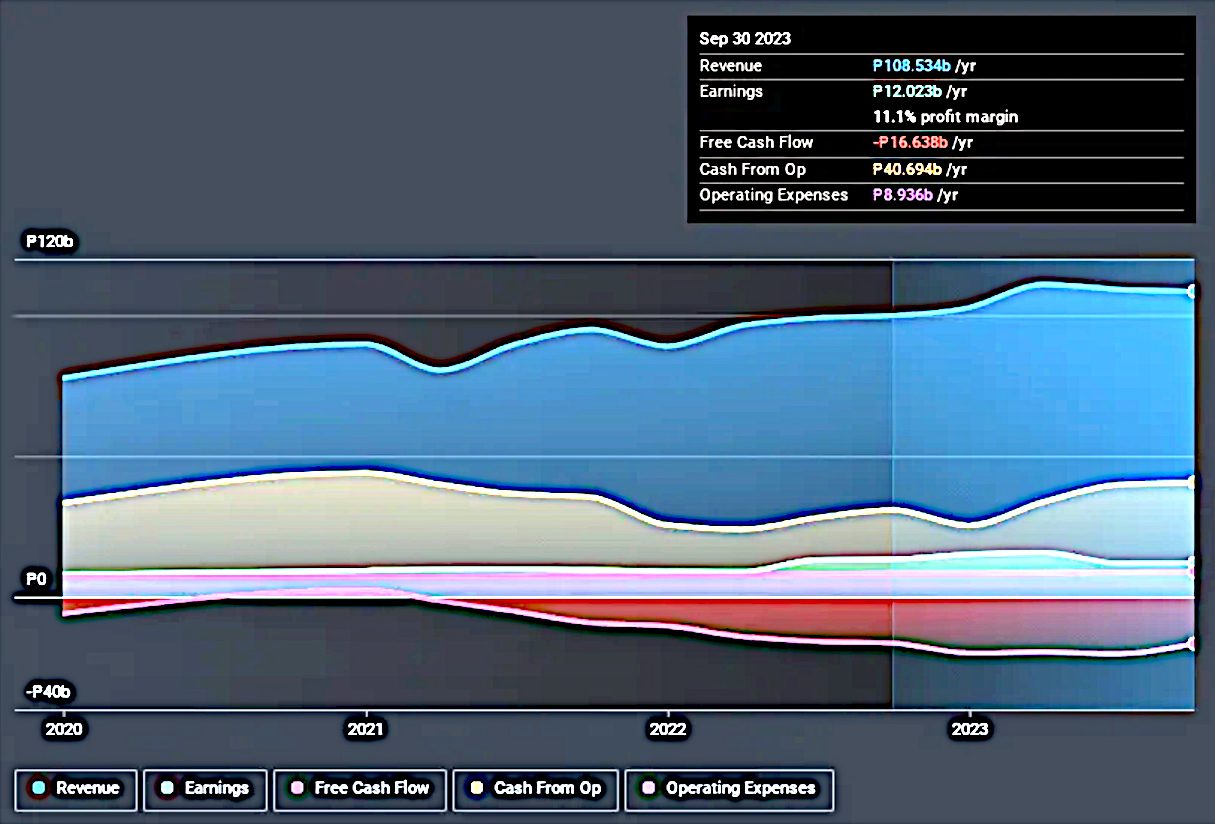

SGP has demonstrated striking earnings growth, inflating at an average annual rate of 15.3% over the past five years to P12.0 billion in the 12 months ending September 2023. This outdid the 0.6% yearly earnings growth observed in the Asian electric utilities industry.

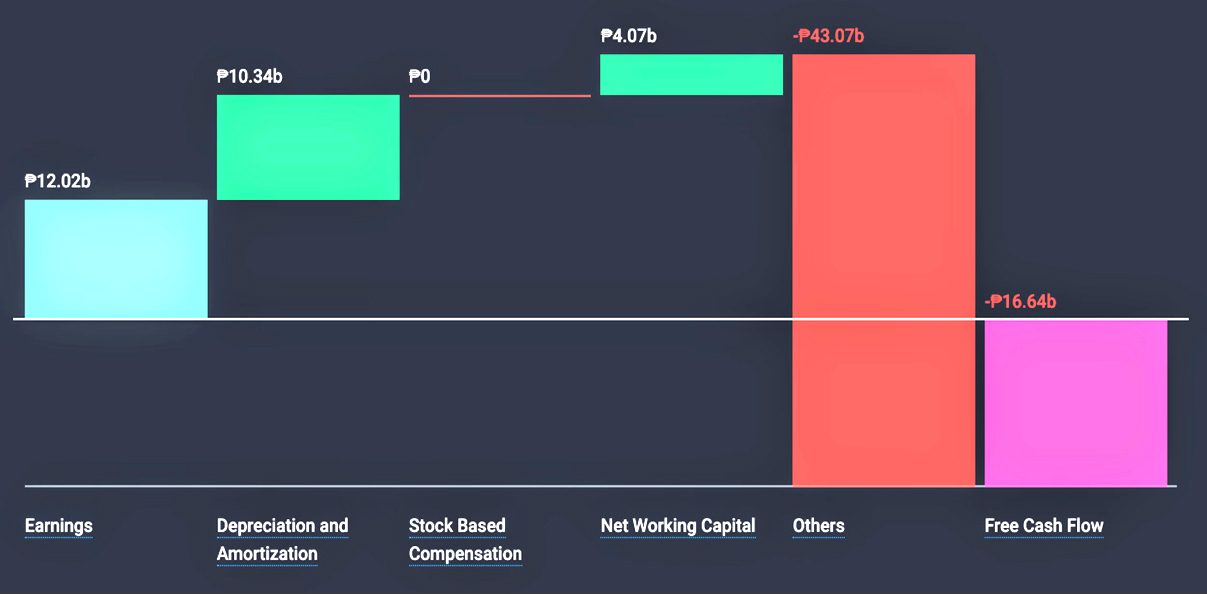

Concurrently, the company has sustained a robust revenue increase, averaging 9.8% per year. Notably, SGP’s net profit margin remains consistent, registering at 11.1%, aligning closely with its four-year historical average of 11.4%. However, this only captures half of SGP’s true earnings picture. Despite its robust earnings performance, SGP faced a challenge as it generated negative free cash flow amounting to PHP -16.6 billion in the most recent 12-month period.

SGP’s Earnings vs. Free Cash Flow Performance for the 12 Months Ending September 2023

This was primarily attributed to a substantial net amount of P43.1 billion in capital expenditures that were required to build the nation’s power grid infrastructure, outpacing its cash inflows, leaving the company with insufficient free cash flow to distribute as dividends to shareholders or effectively reduce its debt.

Since 2019, SGP has predominantly generated negative free cash flows, primarily attributed to substantial (but required) capital expenditures:

- 2019: PHP -6.0 billion

- 2020: PHP +2.5 billion

- 2021: PHP -10.4 billion

- 2022: PHP -20.0 billion

- September 2023 (12 Months): PHP -16.6 billion

Total (4.75 years): P -46.4 billion

Consequently, SGP had to continually resort to debt financing to bridge the gap.

Company’s share price

The value of a business is fundamentally tied to its ability to generate positive free cash flows. The persistent negative free cash flows experienced by SGP have become a burden on its market performance, with the company’s share price sizably declining 34.8% in the past year. Fared against larger timeline, this downturn is even more pronounced, as SGP’s share price has plummeted by a staggering 98% since May 2021.

The impact on Investor confidence is undeniable as SGP continues to find generating positive free cash flows challenging, considering how cash profitability plays a crucial role in determining the company’s market valuation.

While showcasing robust growth in earnings and revenues, SGP suffers from continued negative free cash flows, which worsened its total debt burden. In Jurado’s opinion, SGP’s dividend-paying status, coupled with an overvaluation of its share price and the market’s anticipation of declining earnings, raises caution among investors.” I can however see hints of upside valuation considering the company’s low price-to-earnings ratio compared to the industry average.

NGCP’s follies

In recent years we have seen an increasing number of concerns and criticisms surrounding NGCP’s operations. It has become evident that there are several key areas where the organization falls short, leaving the public questioning the effectiveness and transparency of this vital institution.

There is this lingering perception that NGCP has never been transparent in its operations. Critics argue that the organization has not been forthcoming with crucial information regarding its financial transactions, maintenance schedules, and grid operations. NGCP’s opacity raises questions about its commitment to openness.

The NGCP’s ownership structure has been a contentious issue since its privatization in 2009. With a majority ownership stake held by State Grid Corporation of China (SGCC), concerns have been raised about the implications of having a critical part of the Philippine energy infrastructure in the hands of a foreign entity. The fear is that national security and sovereignty could be compromised if decisions are influenced by external interests.

There have been accusations that NGCP is showing favoritism in its treatment of power producers and distribution utilities. Critics argue that certain companies receive preferential treatment in terms of grid access and maintenance schedules, potentially leading to an uneven playing field in the energy sector. This alleged bias can hinder fair competition and limit the development of a robust and dynamic power market.

Also, reports of inadequate maintenance practices by NGCP, as the case of Panay blackout showed, badly translate to power outages and disruptions. This has not only inconvenienced consumers, but has also resulted in economic repercussions that affect businesses and industries reliant on a stable power supply. – Rappler.com

*Graphs provided by the International Investor

2 comments

How does this make you feel?

![[ANALYSIS] Why do we pay higher power rates when we have power outages?](https://www.rappler.com/tachyon/2024/07/tl-higher-power-rates-higher-power-outages.jpg?resize=257%2C257&crop=401px%2C0px%2C1080px%2C1080px)

![[Vantage Point] Philippine economic reforms run into headwinds](https://www.rappler.com/tachyon/2024/05/ph-economic-headwind-may-2024.jpg?resize=257%2C257&crop_strategy=attention)

![[ANALYSIS] Promoting PPP via a sufficiently empowered media](https://www.rappler.com/tachyon/2024/04/PPP-and-media.jpg?resize=257%2C257&crop=365px%2C0px%2C720px%2C720px)

![[In This Economy] Here’s a new paper by UP economists on economic charter change](https://www.rappler.com/tachyon/2024/04/TL-foreign-direct-investments-apr-12-2024.jpg?resize=257%2C257&crop=299px%2C0px%2C720px%2C720px)

![[ANALYSIS] Not all REITs are created equal](https://www.rappler.com/tachyon/2024/06/tl-not-all-reits-are-created-equal-06012024.jpg?resize=257%2C257&crop=233px%2C0px%2C720px%2C720px)

![[ANALYSIS] Search for stocks that continue to sizzle](https://www.rappler.com/tachyon/2024/04/search-stocks-that-sizzle-April-5-2024.jpg?resize=257%2C257&crop_strategy=attention)

Thanks to Val Villanueva for another enlightening article about our Energy Sector. Thanks also to the well-prepared graphs, which helped me as a reader understand it. Will all these known NGCP’s follies, what is the action of the DOE and President Marcos Jr.? Secondly, when will they act? Will they wait until a nationwide brownout covers our country before acting so?

Correction: With all these known NGCP follies … (sorry).