SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

I heard about a tax on documents. Is there really such a thing? I mean, a tax imposed on documents like financial reports or a memorandum of agreement (MOA)? I have read that your foundation, CSR Philippines, has been signing MOAs with different organizations in support of your advocacy for SME development and genuine tax reform. Do you pay taxes for signing a MOA?

Yes, there’s a tax imposed on documents. It’s called the Documentary Stamp Tax (DST). DST is a tax on documents, instruments, loan agreements, and papers evidencing the acceptance, assignment, sale or transfer of an obligation, right or property incident thereto.

However, a memorandum of agreement (MOA) and financial reports are not subject to DST. For the complete list of documents subject to DST, here’s a BIR link.

Although it is true that CSR Philippines signs MOAs with its partners like Go Negosyo, Association of Filipino Franchisers, Incorporated (AFFI), YesPinoy Foundation, and most recently, the Tax Management Association of the Philippines (TMAP), we are not required to pay DST for the signed MOAs.

Our finance director is not a Certified Public Accountant (CPA), but he oversees our Accounting Department, including the preparation of our annual financial statements and income tax return (ITR). Our external auditor mentioned that the Professional Board of Accountancy (BOA) issued a resolution requiring the submission of a certificate by the responsible CPAs on the compilation of services for the preparation of financial statements and notes. What is this BOA resolution about? Is this applicable to all companies? How does this affect our filing of annual ITR?

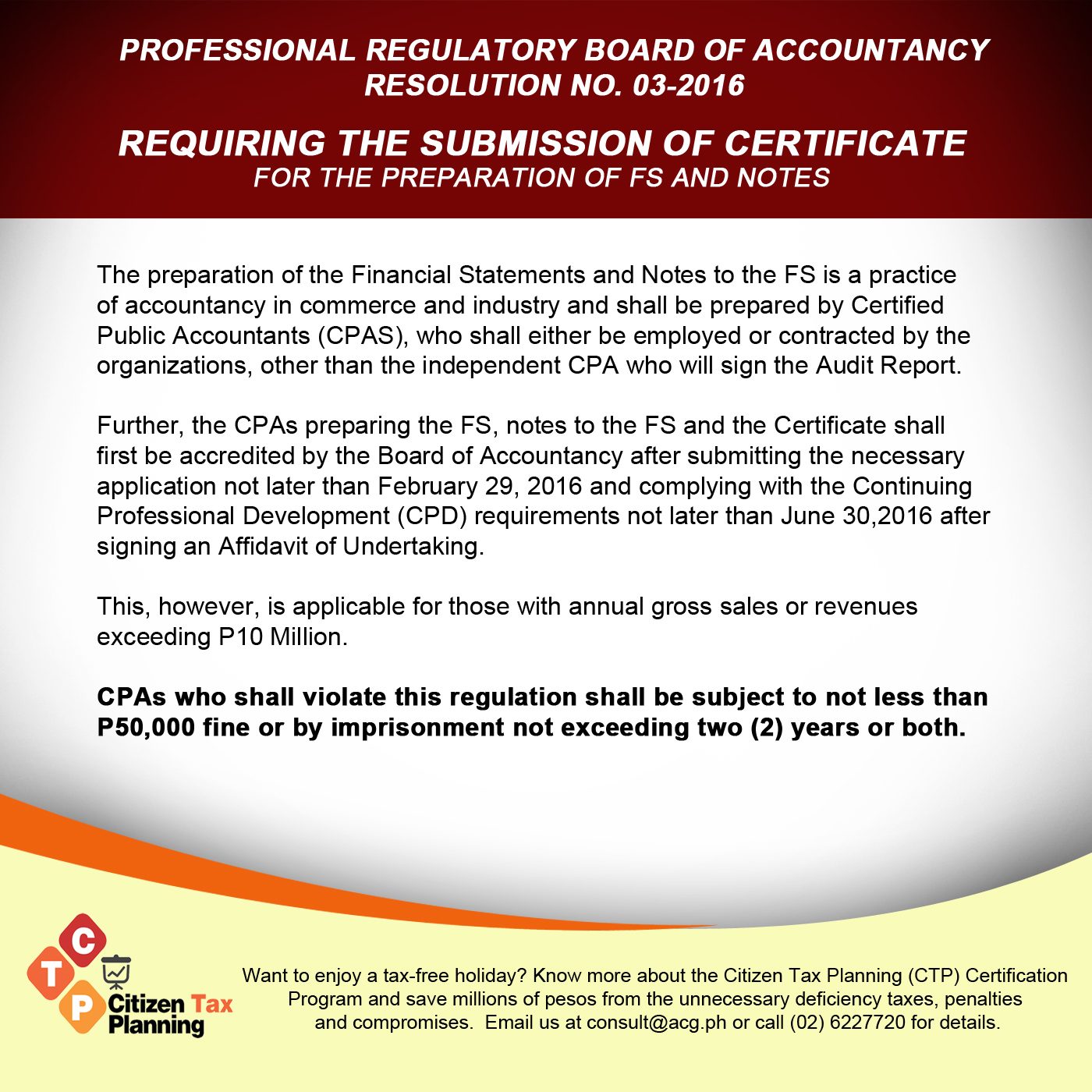

This is the Professional Board of Accountancy Resolution 3-2016 signed on January 19, 2016 and released as BIR Revenue Memorandum Circular 21-2016 dated February 11, 2016. It reiterates the requirements prescribed to address the need to have professional competence in the preparation of financial statements, to address the self-review threats or risks in external auditing of financial statements, and to pinpoint responsibility in the preparation of the financial statements as allowed and required under the Accountancy Law and the Code of Ethics for CPAs.

The certificate should be prepared only by issuers of financial statements which or who have gross sales or revenues exceeding P10 million for a particular accounting year.

The rules shall apply for financial statements ending December 31, 2015 and subsequent periods ending May 30, 2015, but on an optional basis. For all financial statements ending June 30, 2016 and all subsequent periods, it will be on a mandatory basis.

For a copy of the resolution and Q&A issued by the Board of Accountancy, visit www.boa.com.ph.

I am an employee of a multinational company and have been for over 10 years now. After finishing college, this is all I ever wanted – to be part of a big company. But after more than a decade of working hard with so much dedication to my job, I feel I have lost 10 years of my professional career. I don’t have savings or investments unlike my friends, and I have past due credit card balance amounting to 5 times my monthly salary. What should I do? Even if I get promoted, which is unlikely, any increase in my salary will be taxed so it still won’t be enough for savings or investment. I know some people who joined networking or put their savings in high-yielding investments but ended up losing everything either due to taxes or being scammed. I don’t want to be very rich as I may have to pay more taxes. How do I deal with my taxes if I start investing and consider starting a business?

First, as my good friend and financial planning advocate always tells her viewers, first pay off your credit card balance. It will save you a lot, more than what your savings could earn for you. Salve Duplito co-hosts the daily show on financial education, On The Money on ANC, with Edric Mendoza. I highly recommend that you watch their show, read up, and educate yourself on how best to handle your finances.

If you rely solely on your compensation income, you will really be taxed heavily or at least one-third of it is withheld. But being rich does not necessarily mean paying more taxes if you invest wisely, as passive income like dividends and royalty income are subject to lesser tax at 10% to 20%.

If you want to learn how to increase your income, grow your investments, build your business, and deal with your taxes, join us at the Wealth Summit 2016, the biggest financial planning event of the year.

The summit is set for Friday, March 4, at the Philippine International Convention Center (PICC) in Pasay City.

You may visit www.trulyrichclub.com for details.

Our bestselling tax handbook, “Got A Question About Taxes? Ask the Tax Whiz!” will also be available so you can get answers to the most frequently asked tax questions. – Rappler.com

Mon Abrea is a former BIR examiner and an advocate of genuine tax reform. He serves as chief strategy officer of the country’s first social consulting enterprise, the Abrea Consulting Group, which offers strategic finance and tax advisory services to businesses and professionals. Mon’s tax handbook, Got a Question About Taxes? Ask the Tax Whiz! is available in bookstores nationwide. Follow Mon on Twitter: @askthetaxwhiz or visit his group’s Facebook page. You may also email him at consult@acg.ph.

Add a comment

How does this make you feel?

![[OPINYON] Takoyaki tattoo at ang business model ng pang-iinis](https://www.rappler.com/tachyon/2024/04/20240410-Takoyaki-tattoo.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.