SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – When the clock strikes 12 in one of the tallest skyscrapers in the Bonifacio Global City business district, two office floors shut their lights to start lunch break. As other employees go for their power naps, the energy remains high at the 26th floor corner office of Dennis Uy, the baby-faced boss.

Uy, an emerging tycoon from Davao City, was all smiles and bubbly when he ushered us into his office, which has a commanding view of the bustling district at the heart of Metro Manila. A consummate entrepreneur, Uy was holding marathon interviews ahead of the maiden share sale of Chelsea Logistics Holdings Corporation, the third company he controls listed on the Philippine Stock Exchange (PSE).

Uy is media shy and has turned down requests for interviews on camera, but has agreed to do sit-down chats with journalists, a compromise with his handlers who advise him about how the public perceives him.

After all, while his provincial-lad-conquers-Manila business story has been an inspiration to wannabees, his association with President Rodrigo Duterte, a fellow Davaoeño who he supported during the 2016 presidential race, clouds some of his entrepreneurial achievements.

In the first year of Duterte in office, Uy has been one of the country’s most productive entrepreneurs, bagging and growing companies left and right. Aside from Duterte, Uy has also earned the trust of the Philippines’ richest family, the Sys, who backed him up in his foray into shipping and logistics. (READ: How the Sy family and Dennis Uy became business partners)

With several deals and contracts sealed in just one year, the spotlight is indeed on the 43-year-old low-key businessman from Davao City.

The empire builder

A self-made businessman from the province just a little over a decade ago, Uy has made a big leap. In the past months, he has been rubbing elbows with Filipino billionaires with venerable family names like Ayala, Sy, and Aboitiz during government-sponsored business events. He has also been a staple private-sector delegate during Duterte’s many foreign visits, from China to Russia.

His own wealth is nothing to sneeze at. Entrepreneur Philippines estimated his and his family’s net worth to be in the vicinity of P22 billion, or around $430 million.

Based on the wealth estimates of Forbes, which compiles the list of 50 richest Filipinos, the Uys’ wealth is even more than that of mining tycoon Manuel Zamora ($300 million), US President Donald Trump’s Philippine partner Jose Antonio ($195 million), and the triumvirate owners of media firm GMA Network (Gilberto Duavit, $185 million; Menardo Jimenez, $180 million; Felipe Gozon, $160 million).

Uy’s wealth is also bigger than two of the youngest in the Forbes rich list: the 43-year-old Michael Cosiquien ($265 million) and Edgar Saavedra ($255 million), founders of infrastructure giant Megawide, builder of the Mactan-Cebu International Airport.

According to Forbes, the average age of those in the Philippine Rich List is 73.

Uy has never been in any rich list, but, with his recent moves to beef up his empire with firms required to be more financially transparent, he will likely be included in several elite lists soon.

The investing public has known of his stakes in oil retailer Phoenix Petroleum Philippines Incorporated, which had a market value of over P16 billion as of Friday, August 11. The August listing of shipping and logistics firm Chelsea Logistics and Uy’s recent acquisition of a controlling stake in listed 2GO Group Incorporated have further made the value of his aggressively growing business empire more publicly known.

Chelsea and its subsidiary 2GO had a market capitalization of P18.2 billion and P53 billion, respectively, as of August 11.

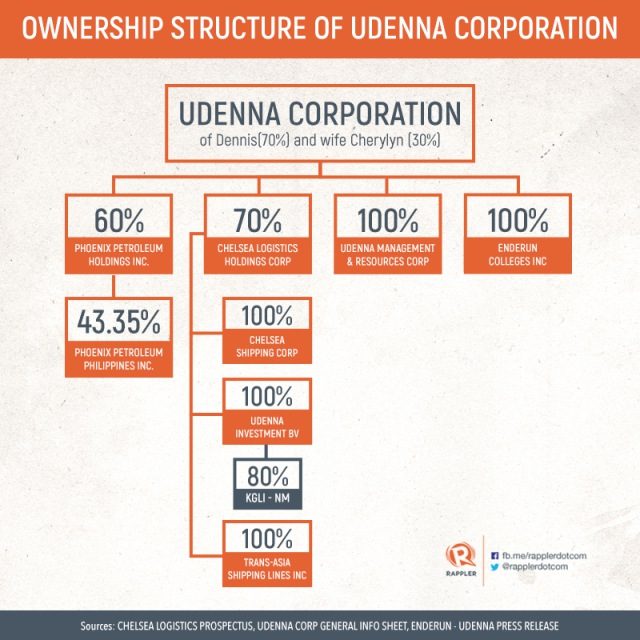

Uy’s business empire is housed under Udenna Corporation, his holding company, and the parent of Phoenix Petroleum and Chelsea Logistics. “Udenna” is a word play on his own name: Dennis Ang Uy. “Every time people ask [what Udenna means], I joke it is the Greek name for handsome,” he shared with a hearty laugh.

He put up Udenna in 2002. He had just quit his family’s businesses in Mindanao then, and was ruminating on how to make it on his own. Without a masterplan, he just went with the flow, growing the business slowly and under the radar.

He first burst into the national limelight when Udenna’s first unit, oil retailer Phoenix Petroleum, went public in 2007. Phoenix, which initially operated outlets in Mindanao, has since grown to become the 2nd biggest independent petroleum retailer nationwide in terms of market share. The latest oil supply and demand report from the Department of Energy showed Phoenix eating up 5.7% of petroleum market share in 2016, next to Seaoil’s 5.9%.

Then came the frenzied mergers and acquisitions and new deals in the past months – all under the 1st year of his longtime friend, President Duterte.

In May, he secured the go signal from the Philippine Amusement and Gaming Corporation to build a $300-million integrated resort and casino near the Mactan-Cebu International Airport – a first of its kind outside Metro Manila. To raise funds for the ambitious project, he sold a 25% stake in Phoenix to a little known financial strategy firm, ES Consultancy Corporation.

There’s also that foray into the LPG industry.

In July, he acquired Enderun Colleges – a move seen to support the diversification of Udenna.

To seal his stature as a member of the country’s business elite, the 24-storey Udenna Tower will rise in Bonifacio Global City in Taguig in 2018. It will house the Luzon offices of the Udenna Group of Companies, including Phoenix Petroleum’s.

An underdog like Duterte

Uy’s come-from-behind rise to business elite status mirrors that of President Duterte’s political life. Duterte, a longtime mayor of Davao, was intially dismissed as an underdog in the 2016 national elections but had a groundswell of supporters who made him the 16th president of the country.

Uy knows too well what underdogs go through as he started to grow his business outside Davao City. “I felt the struggles of being a probinsyano (someone from the province). Of course, I was belittled [by the established, major players]… When it comes to banks, they only give credit to those who already have a name,” he said.

But his biggest challenge was the smuggling case against Phoenix Petroleum.

Phoenix Petroleum was his bet on oil terminals in early 2000s, before expanding into retailing of petroleum products, initially in Mindanao. As the business grew, it started nibbling into the market shares of giants Petron, Shell, and Caltex.

“[The] smuggling issue [was my] biggest headache. It is not even the accusations that got me, because we are confident we are cleared. It is the stigma. I am not used to being published in [newapapers]. I was really being targeted by my critics. I said, this is really something different,” Uy recalled.

The Court of Appeals (CA) eventually nullified the resolutions issued by former justice secretary Leila de Lima that found probable cause to charge Phoenix Petroleum for allegedly violating the Tariff and Customs Code of the Philippines in 2010 and 2011. The CA said the Department of Justice disregarded Phoenix Petroleum owners’ right to due process.

“That was when I said I don’t want this anymore. I’ll just sell my businesses and migrate. There were really times when you just feel like giving up. I asked myself what I did to deserve all these attacks,” Uy said.

Duterte came to the rescue. The then-mayor said he called up the Bureau of Customs to warn them not to harass Uy.

“[Then] Mayor [Duterte] just said one thing to me – look yourself in the mirror and curse a hundred times. He told me: ‘You don’t even know how to curse. You are so kind.’ So that’s what I exactly did inside the restroom of Marco Polo Hotel Davao,” recalled Uy, amused at the memories.

About a decade hence, Duterte continues to support Uy, even gracing the 10th listing anniversary of Phoenix Petroleum in July. Duterte is the first Philippine president in recent history to attend the anniversary of the listing of a company on the stock exchange. (READ: Duterte visits PSE for campaign donor Dennis Uy)

This helped Phoenix become the best performing stock in Duterte’s first year. Phoenix’s stock price increased a whopping 92% from P6.25 apiece on July 1, 2016, to P11.98 as of Friday, July 21, data from the PSE showed.

“When we invited the President, we got a lot of criticisms. [This is the] same as I [was] growing the business. I said: ‘It is okay. You cannot please everybody.’ It is also one of the reasons I don’t want to be interviewed. I just want to do my job. I don’t want attention,” Uy told Rappler.

He remains unfazed. “You have to be secured in your place in this world. But if you are insecure and you drag people down, that is a waste of time,” Uy said, echoing a truism.

Uy said he met Duterte in a socials night in the 1990s through Christopher Lawrence “Bong” Go, now the President’s executive assistant. (READ: The man they call Bong Go)

Go and Uy go a long way back. In their 20s, they played basketball and rode jet skis together. Davao is just a small city, Uy explained. Uy was eventually appointed presidential adviser on sports.

Some of Uy’s relatives are local politicians in the Davao region. But he knew early on he would not be following in their footsteps. He’s too shy and straightforward. It’s enough that he’s providing support.

“Plenty of people are close to the President and I am just one of the supporters. We support our leaders, not only him. It is just that we support him more because he is from Davao,” Uy said. Duterte is the first president to come from Mindanao.

Uy was one of the biggest contributors to Duterte’s presidential campaign.

From newspapers to oil

“I was born to be an entrepreneur,” he said after showing a baby photo of himself on his phone sent by his wife. In July, the couple just had their first son who he claimed looks like him.

He knew all too well the expectations on a son who belongs to a family steeped in Chinese tradition. After breezing through 10 semesters of his business management course, he – being the eldest grandson of a migrant from Fujian, China – was called to return to Davao City.

“I had no choice but to work,” he said. And work he did.

For almost all the small and mid-sized businesses the family was into or putting up, he was the elders’ “utos boy,” or the gofer. “Utos dito, utos doon,” he said in the vernacular. Based in Tagum, Davao and initially involved in trading copra, Uy’s entrepreneurial family has expanded into mining, supermarkets, car dealership, and almost everything in between.

On the side, he had his own ventures, ranging from a daily newspaper in Davao City to a chicken barbecue restaurant, Dencio’s Kamayan Incorporated.

“Dencio’s was my and my friends’, including Bong Go’s, brainchild. We had a eureka moment after playing basketball because we did not have a hangout place that time. So we said, ‘Why don’t we put up one?'” The eldest of his 3 sisters is currently handling the food business.

Uy also bankrolled community newspapers, Davao Daily and Mindanao Insider, to leverage on his second sister’s penchant for writing. Davao Daily ran for 5 years – from the late 90s to the early 2000s – with a circulation of around 5,000.

“It went bankrupt because good news doesn’t sell that much,” he said as a matter of fact.

Eventually, he decided to do business on his own, no longer reporting to his elders. “If there is failure or success, I would then owe it to myself,” Uy said.

Risk taking

Uy became interested in the petroleum business when he saw an opportunity to take advantage of the Oil Deregulation Law of 1998. In one of his visits to Manila for their family’s mining ventures, he noticed outlets of independent players, like Unioil and Flying V, cropping up in Luzon.

Keen to start one in Mindanao, he hired a University of Southern Philippines professor to conduct a feasibility study on the supply and demand in Davao City’s petroleum industry. He then entered into a joint venture to establish an oil wholesaler, Oilink Mindanao Distribution Incorporated.

He borrowed P30 million in initial capital from his father, but the younger Uy called the shots.

“That was the start. Slowly from my earnings, savings, and debt, I was able to put up the petroleum company. It clicked because even if you hold it (oil inventory) as the price was going up, we’d earn even if just a little. Typical churn,” Uy recalled.

Due to differences, the partnership fell apart. He took over the 3 oil terminals after the settlement, and established Davao Oil Terminal and Services Corporation in 2002 to earn passive income from renting out those fixed assets. He stuck it out since all his savings were there, and he just got married. He was in his late 20s then.

His big break was with Cebu Pacific Air, the budget airline of the Gokongwei family. “By hearsay, I knew they needed a depot because they were not happy with Shell. So I initiated a cold call and went to the airline’s headquarters. I told them I would give them whatever rates they want. In exchange was a 5-year contract, so I have recurring income. That contract back then was worth at least P40 million,” Uy said,

In 2005, Uy expanded into retailing. A franchise-based network was set up under Phoenix Petroleum, a rebirth of Davao Oil Terminal. “We had to change the corporate name to Phoenix Petroleum because we will list [on the stock exchange].”

He sought to list for better access to additional and cheaper capital. “Going public will also give us the necessary discipline. Being young, we didn’t want to make decisions in haste or dependent on mood… We were a latecomer in the industry. Most of the independent [oil players] were there already. Seaoil has been there since 1990s, Unioil, Flying V in 1980s. So I asked, ‘What’s my competitive advantage against them?’ We don’t have the capital and we don’t have the manpower so we will just list and maybe we can overtake them.”

It worked. The initial public offering (IPO) in 2007 raised about P220 million, while a preferred shares issuance in 2010 raised an additional P5 billion. It opened more doors for Uy as banks no longer snubbed him but supported him with credit lines. These funds financed his expansion nationwide.

Another bonus was attracting veteran professionals who knew the business better than he did. “It pays to know what I don’t know. i don’t like to pretend. It’s better to be bobo (dumb) so I don’t have to be ashamed of asking. Until now, I’m stil learning.”

His ingredients to successful expansion are realistic goals, a good relationship with stakeholders, and connections. “Our selling point is they can talk to me directly. Dealers and business partners at Phoenix can call me and we can make decisions right away. My competitors had district managers, and they cannot make decisions on their own. The decision-making process takes long for them,” he said.

Going big on shipping

To support the needs of Phoenix, Uy ventured into the shipping and logistics sector. In 2006, he put up Chelsea Shipping Corporation, named after his first daughter. “Logistics is a necessity for petroleum businesses,” he stressed, citing the country’s archipelagic geography.

Oil imports are usually shipped to Batangas or Subic, both in Luzon. Uy’s tankers would fetch the commodity to bring this to Mindanao. But the 8-day back-and-forth sea travel meant that if the commodity’s price changed after the usual 7-day locked-in period, Uy may have to pay a higher price.

He needed additional vessels to have better control of the logistics of his own business, but he also wanted those vessels to provide better returns. A good relationship with the manager of Singapore-based PTT International Trading became key.

According to Uy, PTT lent him the initial capital of P100 million to buy additional vessels to transport petroleum products. “PTT is big here. They bid for other projects and they have their clients but they did not want to own shipping assets,” Uy said. PTT became Chelsea’s first customer outside of Uy’s group.

Aside from Phoenix and PTT, Uy said Chelsea also served Cebu Pacific, shipping the airline’s jet fuel to Davao City. “When they were renting [the depot], they had the same challenges [as we did] on bottlenecks in getting tankers. Their guys said, ‘Oh, you have tankers. Add more and we’ll add another 5 years to your contract,'” he shared.

The capital-intensive shipping business has since grown into the country’s largest shipping group operating throughout the Philippines and Southeast Asia. It has the largest tanker fleet in terms of capacity with a total 39,271.64 gross registered tonnage.

Aside from advancing its expansion plans, Udenna is poised to further expand its footprint in the logistics sector with the planned consolidation of its stake in 2GO Group Incorporated with its other shipping businesses under Chelsea.

Big gun

Uy said he does not usually set out to disrupt established players, but is just like a typical entrepreneur always on the lookout for any worthy business opportunity that comes along.

“I’ll take a look at it. I had my share of failures and successes. But as an entrepreneur, you take big risks. All the time, life is a risk. Business is a risk. So you have to give it a try,” he said.

Uy’s story is typical of a third-generation businessman in a family of Chinese descent. His is no longer the usual tale of rags-to-riches having been born to privilege. He had access to good schools, and stayed in the family condominium unit in Manila while he was studying at De La Salle University, an elite school that has produced numerous movers and shakers in Philippine business.

“Being someone from the province, it is when I finally had a taste of independence,” Uy said, recalling how his strict father used to call him every day to check on him and his studies. Uy loved all the “action” the big city offered.

Since his allowance was just enough for school, Uy said he would work for the family business to earn extra cash. After school, he would canvass mining equipment, buy goods from their Manila supplier, and facilitate the goods’ delivery to Davao.

“I learned all the ropes here [in Manila]. I did not have car for the first year of college so I rode MRT (train) and bus. I also had to make up for my allowance because it wasn’t enough for parties,” he said.

During his free time, Uy said he would go to the Makati Stock Exchange to watch and observe traders. In his early 20s, he earned his first P1 million by trading stocks.

It didn’t take long for him to earn his first billion from his oil and shipping ventures.

Uy is on a roll. After petroleum as well as shipping and logistics, he’s planning to grow his tourism and hospitality businesses in the next 3 years.

“I am still growing Udenna’s portfolio. We don’t know yet what is really its core businesses. We are still fixing, cleaning, and adding more people to our organization. Hopefully, in the next few years, we can list Udenna on the stock exchange, depending on the opportunities presented,” Uy said.

Now that he is overseeing his own business empire, he feels the pride of running something from scratch. Where he struggles is calling himself a big gun. “I would like to disagree on that,” he said. “I am not big.” – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.