SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Philippine Amusement and Gaming Corporation (Pagcor) wants dedicated hubs for Philippine offshore gaming operators (POGOs) – a proposal that did not sit well with the Chinese embassy.

China expressed grave concern that the move would infringe on the rights of its citizens. It also said that a huge amount of funds has flown out of China illegally to the Philippines because of POGOs.

The news immediately started a selloff. As of Friday, August 9, the property index had gone down by 1.5%.

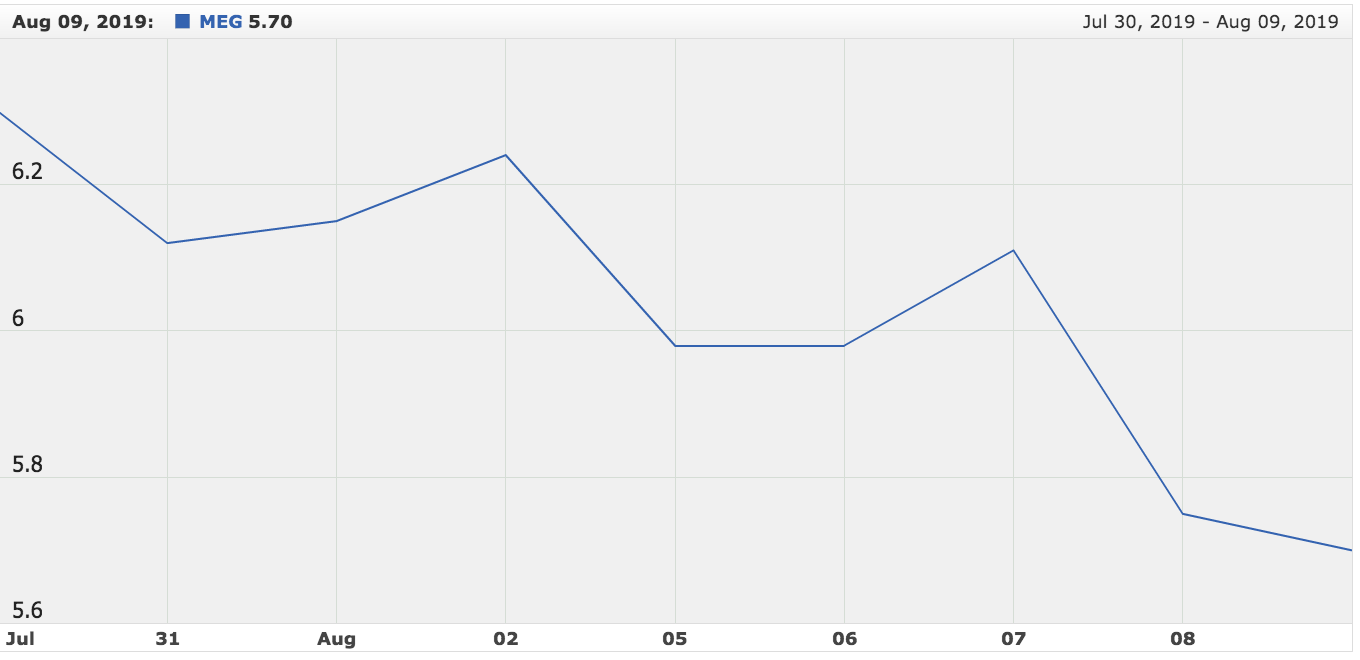

Meanwhile, shares of Megaworld fell by almost 6% when news broke on Thursday, August 8, its sharpest drop since 2017.

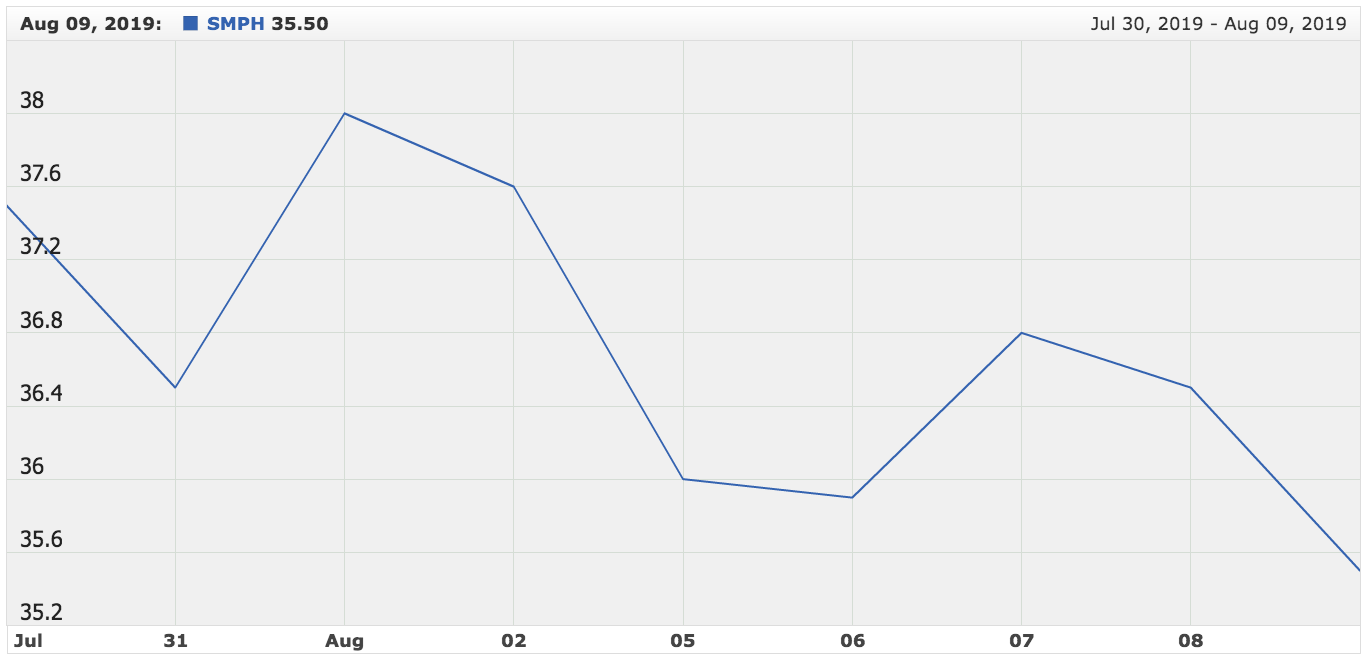

Meanwhile, SM Prime Holdings saw a 0.8% slide on Thursday, and another 2.7% drop on Friday.

Just how big will the impact be if POGOs flee Metro Manila?

Property boom

The properties sector has hit the jackpot since POGOs proliferated. In fact, some experts even said gambling prevented a bubble burst.

Leechiu Property Consultants expects POGOs to overtake the information technology-business process management (IT-BPM) industry as the largest consumer of office spaces in Metro Manila by the end of 2019.

Within Metro Manila, POGOs are seen to take up 450,000 square meters (sqm) by the end of the year.

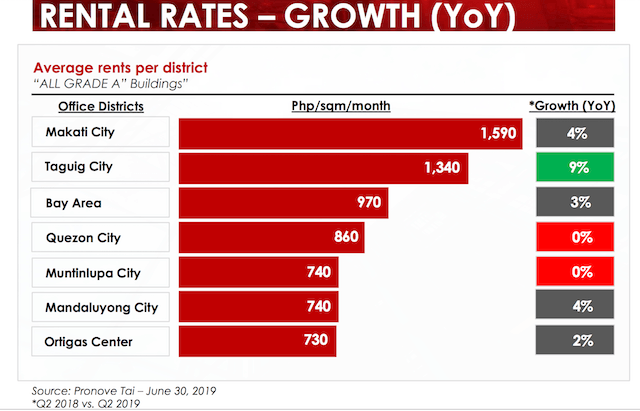

Meanwhile, data of Pronove Tai, another property consultancy firm, show that POGOs are already the top demand drivers. (READ: Online gambling: Good for whose business?)

As of the 1st half of the year, Pronove Tai said 45% or 315,000 of the 703,000 sqm of office space transacted were taken up by POGOs.

Traditional office and IT-BPM lagged behind POGOs at 28% and 26%, respectively.

POGOs don’t mind higher rental rates or more taxes either. Consultancy firms said gaming firms have enough margins to cover for additional expenses.

Knee-jerk reaction

In the coming weeks, Luis Limlingan of Regina Capital said investors should keep an eye on companies that have exposure to POGOs.

He said some investors might have a knee-jerk reaction and sell their shares of property firms which have projects in the Bay Area.

The Bay Area, which lies between Parañaque City and Pasay City, is home to DM Wenceslao, DoubleDragon Properties, and SM Prime.

Megaworld and Ayala Land have some POGOs renting their spaces as well.

Limlingan also noted that investors should closely watch banking and tourism-related stocks, since they are closely tied to properties.

However, Limlingan said there may be other factors at play which led to China issuing a strongly-worded statement against POGOs.

Last week, China’s central bank set the renminbi or yuan at below 7 against the United States dollar, its weakest since the global financial crisis in 2008.

“They are trying to protect the flight of capital. Remember, they let the renminbi depreciate and that caused panic. They are trying to limit [outflows] and make sure that is not channeled out through gaming,” Limlingan said. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.