SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – The Aboitiz Group allotted P153 billion for capital expenditures in 2024, more than double the amount a year ago and the highest in recent years, as the conglomerate boosts its renewable energy portfolio.

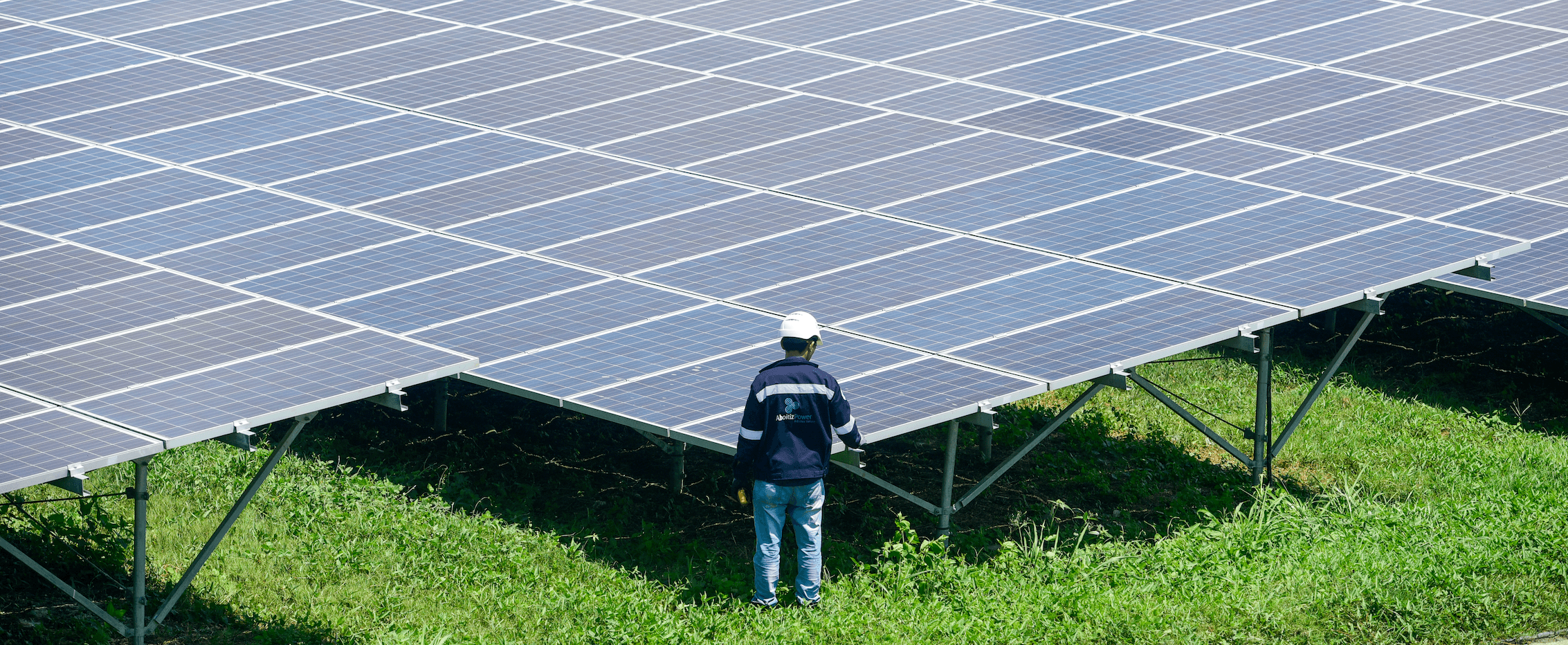

AboitizPower is getting the biggest share at P73 billion, or 48% of the group’s total capex. The company has over 1,000 megawatts of renewable energy projects in construction and development, and aims to reach 4,600 MW within the next decade.

For 2024, AboitizPower plans to break ground on several renewable energy projects, including an 89-MW solar project in San Manuel, Pangasinan, and a 50-MW wind plant in Camarines Sur. (WATCH: Business Sense: AboitizPower CEO Manny Rubio)

“Our substantial increase in capital expenditures is a clear reflection of our commitment to renewable energy. We believe that investing in sustainable energy sources is not just good for the environment, but also makes good business sense,” said Aboitiz Group president and chief executive officer Sabin Aboitiz.

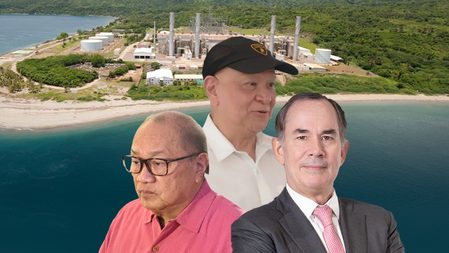

It was also recently announced that AboitizPower and Manny Pangilinan’s Meralco PowerGen Corporation will jointly invest in San Miguel Global Power Holdings Corporation’s gas-fired power plants, in particular the 1,278-MW Ilijan power plant and a new 1,320-MW combined cycle power facility.

The three companies are also acquiring the liquefied natural gas import and regasification terminal of Linseed Field Corporation, for a total venture valued at $3.3 billion, making it the country’s most expansive LNG project.

Coca-Cola, other projects

Meanwhile, 29% or P44 billion is allotted for the holding company, Aboitiz Equity Ventures, of which P40 billion is earmarked for the acquisition of Coca-Cola Beverages Philippines, the bottling arm of Coca-Cola in the country. AEV has a 40% stake in the deal, giving the group access to over 17 brands of alcoholic and non-alcoholic beverages.

Aboitiz InfraCapital and its partners allotted an aggregate P25-billion capex for various assets, spanning ecozones, water, airports, and digital infrastructure.

Around P1 billion was earmarked for major maintenance works and the purchase of critical spares of its cement business under Republic Cement.

Pilmico and Gold Coin Group is set to spend almost P4 billion for its agribusiness expansion projects in China and Vietnam.

Meanwhile, Aboitiz Land is getting P3.3 billion for existing projects. It plans to launch the second building of The Strides at LIMA, a mid-rise condominium development in Lipa City, Batangas.

AEV saw its net income fall by 5% to P23.5 billion in 2023.

Its power business accounted for 67% of total net income, while financial services comprised 18%. Net income from infrastructure, food, and real estate made up 6%, 5%, and 4%, respectively. – Rappler.com

Add a comment

How does this make you feel?

![[ANALYSIS] Why do we pay higher power rates when we have power outages?](https://www.rappler.com/tachyon/2024/07/tl-higher-power-rates-higher-power-outages.jpg?resize=257%2C257&crop=401px%2C0px%2C1080px%2C1080px)

There are no comments yet. Add your comment to start the conversation.