SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask The Tax Whiz] If I am in the United States, where do I file and pay my taxes?](https://www.rappler.com/tachyon/2022/11/tax-papers-shutterstock.jpg)

1. I’m a Filipino citizen currently staying in the US. Do I need to file anything or pay taxes to the IRS?

Yes, but it depends on whether or not you’re a resident alien or a non-resident alien. If you are a Resident Alien, then you are taxed on all your income worldwide. You are essentially treated in the same manner as a US citizen for the purposes of taxation. If you are a non-resident alien, then you are only taxed on your income from the US only.

A person is considered a resident alien if they pass either the Green Card test (i.e., they hold a permanent resident card) or the Substantial Presence test. Under the Substantial Presence test, a person who has stayed in the United States for at least 31 days in the current year and 183 days during the current and prior two years is considered a Resident Alien.

In counting the days present in the US, you also should not include the days that you are considered as an exempt individual. For example, if you are the holder of an F-1 or J-1 student visa, you are exempt for five (5) calendar years. Hence, those five calendar years do not count towards the Substantial Presence test.

However, you must file Form 8843 to exclude those days that you were exempt, along with your income tax return. Note that, even if you have no income sourced from the US, you still have to submit Form 8843.

There are some cases where you can override the Green Card test and Substantial Presence test like by applying for a “closer connection exception” so that you will still be considered as non-resident alien for tax purposes.

2. What are the tax forms, documents, or tax returns that I need to file for 2022 with the IRS?

If you are a US citizen or resident alien, you’ll need to file Form 1040(US Individual Income Tax Return) . On the other hand, Form 1040-SR (US Tax Return for Seniors) for individuals 65 or above or senior citizens. If you have no income or below the IRS minimum you don’t need to file a tax return, but must file if you have to claim a refundable tax credit.

For those who are non-resident aliens, you’ll need to file Form 1040NR (US Non-Resident Alien Income Tax Return) if you have income sourced from the US. In addition, to exclude the days you are present in the US or where you were unable to leave the US because of a medical condition or problem, then you have to submit Form 8843 as well. This is relevant for those with student visas, professional athletes competing in the US, foreign-government related individuals, etc.

Again, even if you have no income sourced from the US, a Non-Resident Alien is still required to submit Form 8843.

Further, before a resident alien or a US citizen files their tax return, they must also complete their tax reporting documents if they received income during the taxable year. Non-resident aliens with no income sourced within the US will not need tax reporting documents.

Here are some forms that you are likely to received from your employer or other entities if you have income that you need in preparing your tax return but not limited to the following:

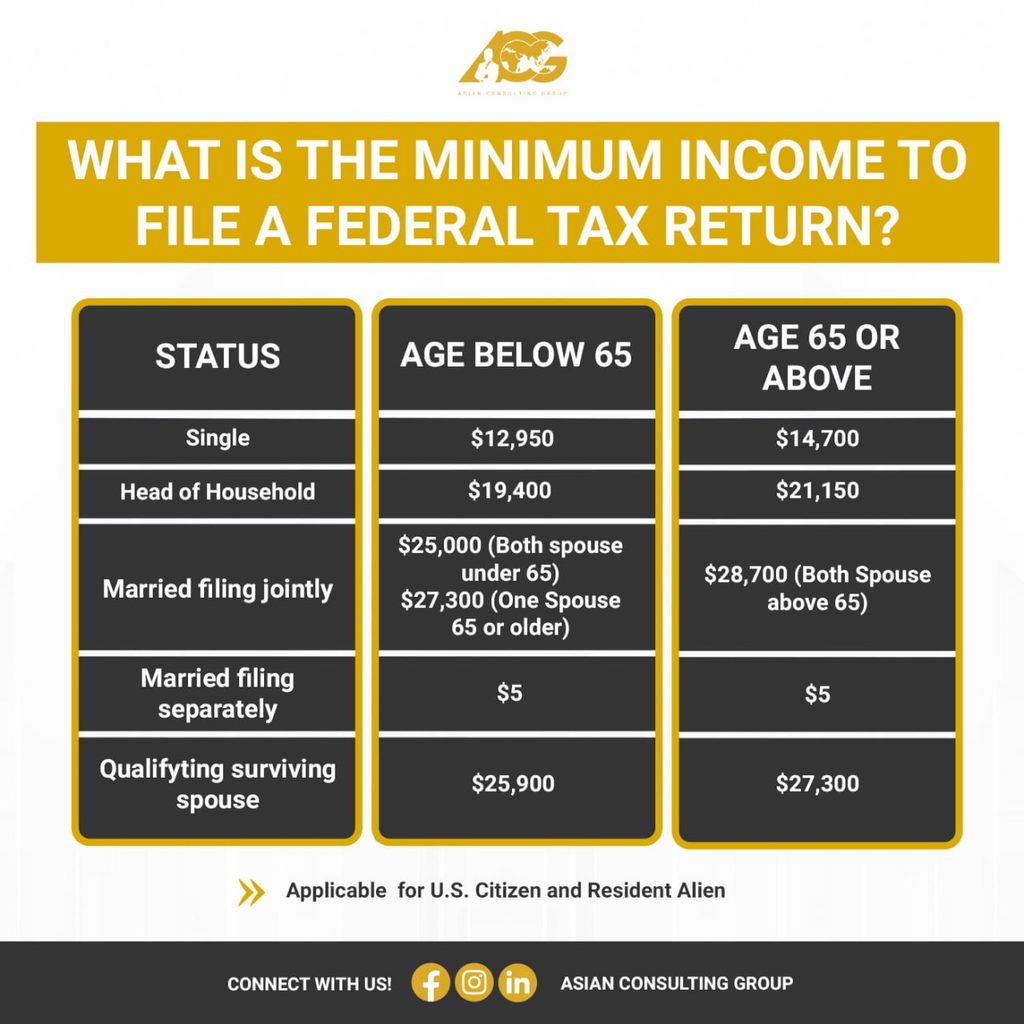

3. What is the minimum income to file a tax return?

If you are a US citizen or resident alien, filing a federal income tax return depends on your gross income, age, and status. If your gross income falls below the threshold, you are not required to file a federal tax return

There are several individuals that needs to file tax returns in 2022 like if you (or your spouse if filing jointly) received Archer MSA, Medicare Advantage MSA, or health savings account distributions, you had net earnings from self-employment of at least $400, you had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer social security and Medicare taxes.

For more information, you may refer to Publication 501 for more individuals who are qualified to file tax return.

4. How would I file my tax returns?

There are different ways to file your tax return, you can file your tax returns by manually mailing them or by doing it online through different tax software. The IRS Free File Program also has a guided tax preparation that offers different software that will help taxpayers prepare their tax return if their adjusted gross income was $ 73,000 or less in 2022. The IRS Free File program also offers a Free File Fillable form on which you can file your tax return electronically.

5.When is the deadline for filing income tax returns and Form 8843?

The deadline for filing income tax returns (IRS Form 1040/1040SR, or IRS Form 1040NR with Form 8843) is April 18, 2023. If you are filing Form 8843 only, then you have until June 15, 2023.

Note, however, that all this discussion pertains only to your federal tax return. You may also be required to file your state tax returns whose deadline of filing depends on each state.

If you are a Filipino working or studying in the US and are having a hard time understanding how to file their taxes, Asian Consulting Group is offering a free webinar for Filipino Communities abroad. You may also download the TaxWhizPH app to quickly schedule a consultation with the Tax Whiz. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.