SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask the Tax Whiz] Is the deadline for ITR filing extended?](https://www.rappler.com/tachyon/2022/04/shutterstock-tax-calendar.jpg)

Will the April 15, 2022 deadline for filing annual income tax returns (ITRs) be extended since it’s a regular holiday?

Yes. Since April 15, 2022 falls on a regular holiday (Good Friday), the deadline for the filing and payment of the 2021 ITR is moved to Monday, April 18, 2022. As a general rule, if the deadline falls on a weekend, holiday, or non-working day, the actual deadline for filing and/or payment of tax returns will automatically be moved to the next working day.

I will be on vacation during Holy Week. I’m worried that I may not be able to return to Quezon City in time to pay my income tax due. Can I pay tax even outside my revenue district office (RDO) jurisdiction?

Yes. The Bureau of Internal Revenue (BIR) issued Bank Bulletin 2022-06 that mandates authorized agent banks (AABs) to accept manually filed and out-of-district returns.

A separate BIR advisory issued last March 22 also states that taxpayers may file their ITR for 2021 and pay the corresponding taxes through AABs and revenue collection officers notwithstanding the RDO jurisdiction.

I’m using eFPS for filing and paying my tax returns. Unfortunately, the required ITR form is not yet available in eFPS. Can I file and pay through eBIRForms? Is there any penalty for that?

Yes, you can file through eBIRForms. If the specific ITR is not yet available in eFPS but already available in the eBIRForms system, taxpayers may file using eBIRForms and pay through any payment channel without any violation due to wrong venue.

Since the filing of ITRs for 2021 is fast approaching, will the AABs extend their banking hours to accommodate taxpayers’ payments until April 18?

Yes. AABs’ banking hours will be extended to 5 pm instead of the daily 3 pm cutoff to accommodate taxpayers from April 1 to 18.

Aside from the extension of banking hours, the RDOs were also advised to assign BIR personnel to receive annual ITRs and corresponding payments as well as assist AABs opening for three Saturdays (March 26, April 2, April 9).

I’m using eBIRForms to file my ITR. Do I still need to submit my filed return to the BIR? Is there any online facility where I can submit it instead?

Taxpayers who filed and/or paid returns using eBIRForms without any attachment required need not submit a printed copy of e-filed tax returns to their corresponding RDO.

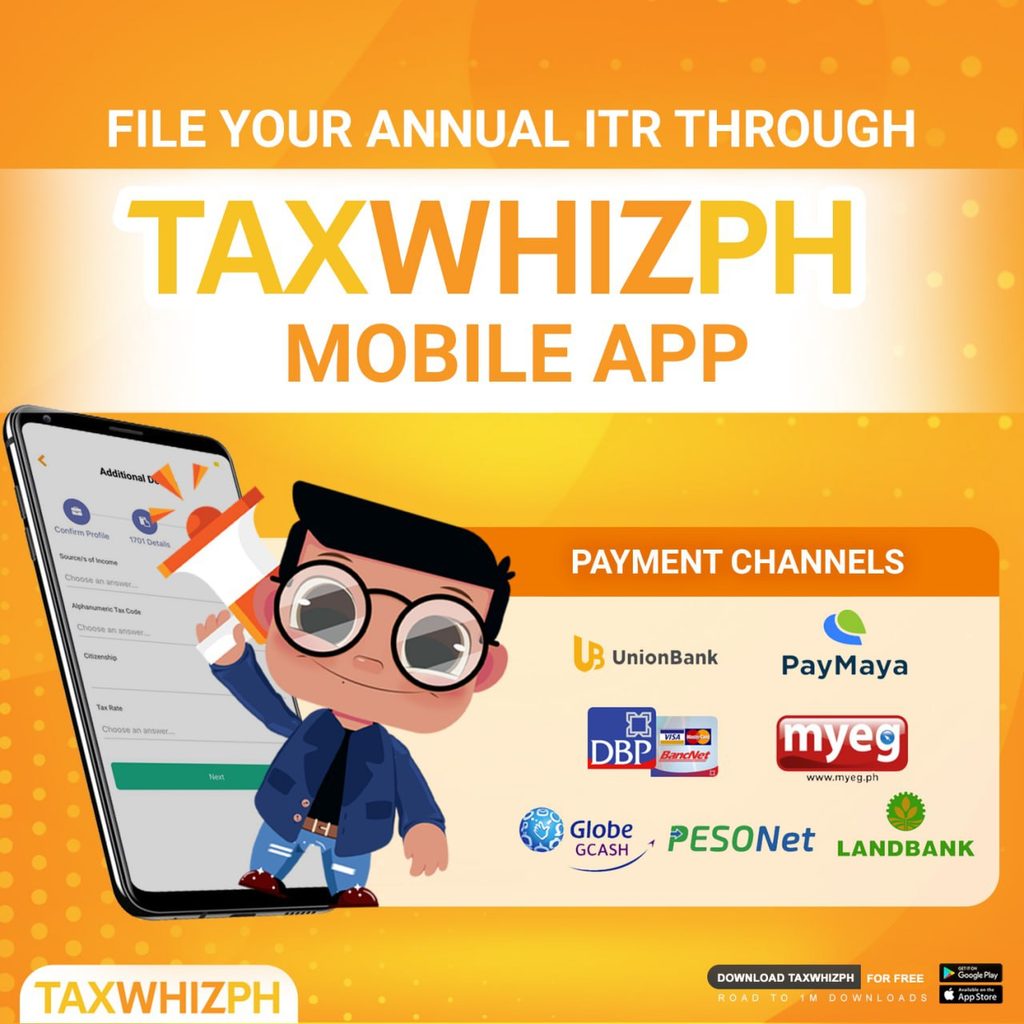

Meanwhile, there are online channels available. Taxpayers may submit their filed ITR and required attachments to the Electronic Audited Financial Statement System available on the official website of the BIR. Individual taxpayers may also file their annual ITR (BIR Form 1701/1701A) for free anytime and anywhere using the TaxWhizPH mobile app. Download the TaxWhizPH app for free! Visit www.taxwhiz.ph for more information or follow TaxWhizPH on Facebook, Instagram, and YouTube.

– Rappler.com

Mon Abrea, CPA, MBA, is the co-chair of the Paying Taxes-EODB Task Force. With the TaxWhizPH mobile app as his brainchild, he was recognized as one of the Outstanding Young Persons of the World, an Asia CEO Young Leader, and one of the Ten Outstanding Young Men of the Philippines because of his tax advocacy and expertise. Currently, he is the chairman and CEO of the Asian Consulting Group and trustee of the Center for Strategic Reforms of the Philippines – the advocacy partner of the Bureau of Internal Revenue, Department of Trade and Industry, and Anti-Red Tape Authority on ease of doing business and tax reform. Visit www.acg.ph for more information or email him at mon@acg.ph and download the TaxWhizPH app for free if you have tax questions.

Add a comment

How does this make you feel?

![[Ask The Tax Whiz] How to file annual income tax returns for 2023](https://www.rappler.com/tachyon/2022/11/tax-papers-hand-shutterstock.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.