SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Incoming Bureau of Internal Revenue (BIR) commissioner Lilia Guillermo wants president-elect Ferdinand Marcos Jr. to be a role model for Filipinos and comply with the High Court’s decision on the estate tax obligations of his family.

However, she noted that she has yet to see documents about it and needs time to go over them, even though the matter has been settled way back in 1997. In particular, she wants to know if the floated P203-billion figure is accurate.

“Puwede ba maging role model kayo? The Marcoses will now pay their taxes, because nag-comply sa batas, it came from the Supreme Court, it’s final and executory.’ ‘Yun lang naman ang sasabihin ko sa kanya, pero I should have the correct data. I should know what really is in that decision,” she told the ABS-CBN News Channel’s Headstart on Wednesday, June 22.

(‘Can you be a role model? The Marcoses paid their taxes because they have to comply with the law, it came from the Supreme Court. It’s final and executory.’ That’s what I will say to him but I should have the correct data. I should know what really is in that decision.)

“I have not seen any documents about it. [If it’s] final and executory, then it is our mandate to collect. That’s one of the mandates of the BIR, collection enforcement,” Guillermo said in a mix of English and Filipino.

Guillermo added that she has not discussed the matter with Marcos.

“Hindi ko alam kung talagang P200 billion ‘yan (I don’t know if that’s really P200 billion), and maybe if that’s really the amount, imagine it will help really collections of BIR,” she said.

Estate tax is tax imposed on the assets left by someone who has died. The estate will not transfer to the heir unless the estate tax is paid.

What did the Supreme Court say?

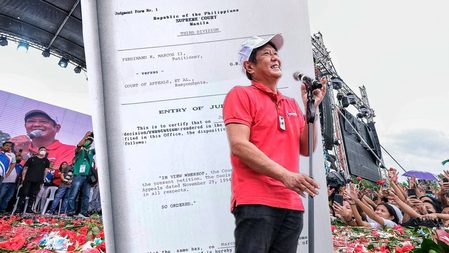

The Supreme Court 1997 ruling that ordered the Marcos family to pay P23 billion in estate tax became final in March 1999, the entry of judgment shows, and it’s a debt that remains unpaid up to now according to no less than Finance Secretary Carlos Dominguez III.

“BIR is collecting and demanded payment from the Marcos estate administrators. They have not paid,” Dominguez told reporters on March 30.

The entry of judgment, a document that the Supreme Court issues when a ruling has attained finality, shows that G.R 120880 became “final and executory” on March 9, 1999, according to the entry that Rappler obtained.

The BIR earlier said it sent its last demand on December 2, 2021.

This very issue was settled way back 1997. In that ruling, the Supreme Court already said: “The Court is at a loss as to how these cases are relevant to the matter at issue. The mere fact that the decedent has pending cases involving ill-gotten wealth does not affect the enforcement of tax assessments over the properties indubitably included in his estate.”

The Marcoses did not protest the assessment.

“Where there was an opportunity to raise objections to government action, and such opportunity was disregarded, for no justifiable reason, the party claiming oppression then becomes the oppressor of the orderly functions of government,” the High Court said.

Based on the penalty and interests, the estate tax liability of the Marcos estate has now ballooned to P203 billion today.

Can Marcos still appeal it?

Retired Supreme Court Associate Justice Antonio Carpio pointed out that the Marcoses can no longer appeal the case.

The Court of Appeals ruled that since the tax assessment had become final and unappealable, “the manner and method in which the tax collection is sought to be enforced can no longer be questioned.”

Carpio also said that the Marcoses can be charged criminally by the BIR and the Department of Justice under the Tax Code for refusing to pay up.

– with reports from Lian Buan/Rappler.com

Add a comment

How does this make you feel?

![[ANALYSIS] The estate tax liability of the Marcos Estate](https://www.rappler.com/tachyon/2022/04/tl-marcos-estate-tax.jpeg?fit=449%2C449)

![[Ask the Tax Whiz] Withholding tax under Ease of Paying Taxes law](https://www.rappler.com/tachyon/2022/11/tax-papers-shutterstock.jpg?resize=257%2C257&crop=205px%2C0px%2C900px%2C900px)

![[Ask The Tax Whiz] Output VAT credit on uncollected receivables: What taxpayers must know](https://www.rappler.com/tachyon/2022/11/tax-papers-hand-shutterstock.jpg?resize=257%2C257&crop_strategy=attention)

![[Ask The Tax Whiz] What’s new on invoicing requirements under the Ease of Paying Taxes law?](https://www.rappler.com/tachyon/2024/06/tax-whiz-receipts.jpg?resize=257%2C257&crop=459px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.