SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Ask the Tax Whiz] Do agricultural producers need to issue receipts/invoices?](https://www.rappler.com/tachyon/2022/07/rice-farming-agriculture-bulacan-july-10-2022-004.jpg)

Do agricultural producers have to issue receipts and invoices for agricultural food product sales?

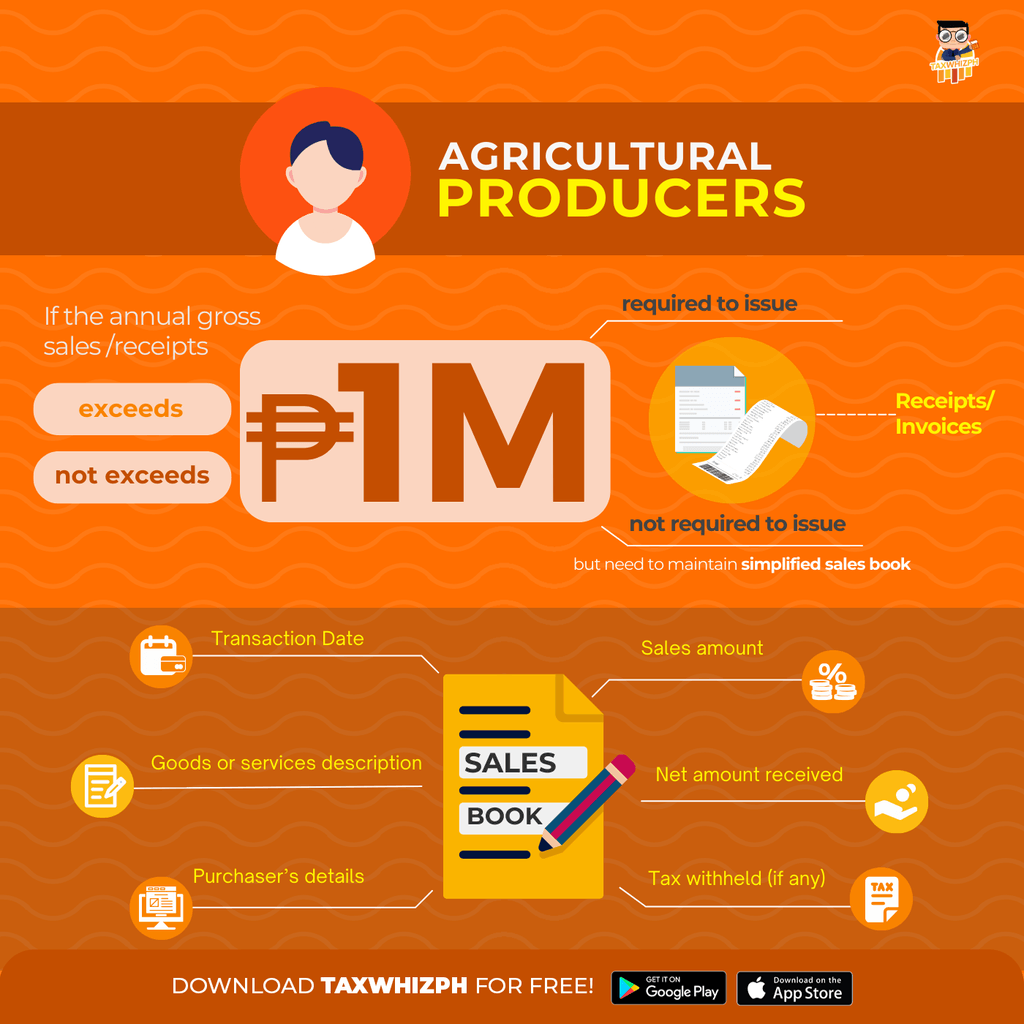

Under Revenue Regulation 12-2023, so long as their annual gross sales/receipts do not exceed P1 million, agricultural producers no longer have to issue principal or supplementary receipts and invoices for the sale of agricultural food products.

However, if their annual gross sales/receipts exceed P1 million, they are required to issue official receipts or sales invoices for all transactions valued at P100 or more.

Who are considered agricultural producers?

As provided under RR 12-2023, agricultural producers are those engaged in supplying, producing, selling, contract growing, and milling agricultural food products.

These products include farm produce, livestock, poultry, marine items, ordinary salt, and agricultural inputs, like fertilizers, seeds, and feeds. The regulation also covers these products, even if they undergo basic preparation or preservation like freezing, drying, salting, broiling, roasting, smoking, or stripping.

Are agricultural producers still required to be registered with the BIR?

Yes. Pursuant to Section 236 of the Tax Code, as amended, agricultural producers are required to be registered with BIR and shall file quarterly and annual income tax returns and pay their income tax due.

If I am exempted from issuing receipts as an Agricultural Producer, are there other requirements that I should comply with instead?

BIR requires agricultural producers to maintain a Simplified Sales Book which should be registered with the bureau with transaction date, goods or services description, purchaser’s details (name, address, TIN), sales amount, tax withheld (if any), and net amount received.

If I am transacting with agricultural producers, how would I be able to substantiate my expense if they are no longer required to issue receipts/invoices?

RR 12-2023 provides that the purchasers engaged in business with agricultural producers are required to be issued per purchase transaction (1) BIR Form 2304 when the cumulative amount in a year is less than or equal to P300,000, and it is exempt from withholding tax; and (2) BIR Form 2307 when the cumulative amount in a year exceeds P300,000, and a 1% withholding tax is applicable.

Empower your understanding on the issuance of receipts/invoices of Agricultural Producers. #AskTheTaxWhiz for expert insights and download the TaxWhizPH Mobile app today. – Rappler.com

Add a comment

How does this make you feel?

![[ANALYSIS] How one company boosts farmer productivity inside the farm gate](https://www.rappler.com/tachyon/2024/06/bioprime-farmgate-farmer-productivity-boost.jpg?resize=257%2C257&crop=465px%2C0px%2C1080px%2C1080px)

There are no comments yet. Add your comment to start the conversation.