SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

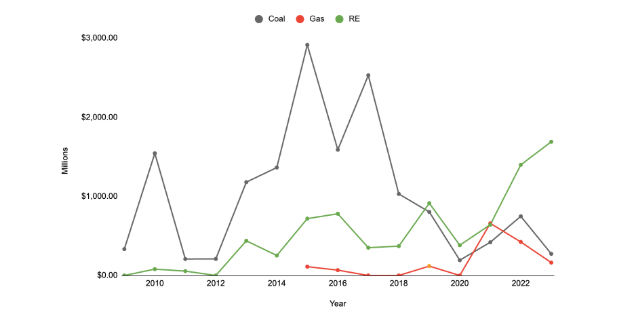

MANILA, Philippines – Total renewables financing from Philippine banks is now twice than that of fossil fuels, a report by policy think-tank Center for Energy, Ecology, and Development (CEED) found.

From 2009 to 2020, local banks funded $4.3 billion for the renewable industry. But after the coal moratorium in 2020, financing drastically increased in just a span of three years, amounting to $3.7 billion.

This is more than double of what the coal industry got from local banks in the same period, which is $1.4 billion. Before that, coal financing from 2009 to 2020 reached $13.8 billion.

While the decline in coal financing had been “drastic,” said Avril de Torres, deputy executive director of CEED, they are still concerned because a huge amount of money is still coming in.

“Despite being lower than what it was before the coal moratorium, would that crowd out renewable energy?” De Torres said during a press briefing on Wednesday, April 17.

“That’s a question that we want to keep answering as we continue scoring the banks,” she said. “But we do believe that the end of coal is near.”

Gas, touted as the transition fuel towards renewables, is getting momentum as financing also increased after the coal moratorium. The report said that from 2021 to 2023, gas financing amounted to $1.2 billion from local banks, compared to the $296.5 million from 2009 to 2020.

Mostly, however, it is the international banks that are funding gas expansion in the Philippines.

However, despite this trend, banks continue to finance coal. In the past 14 years, the 15 banks in the report financed the coal industry with $15 billion. Meanwhile, the renewable industry got $8 billion in 14 years.

CEED’s fossil fuel divestment scorecard this year accounts local banks’ renewable energy financing. The top five banks financing fossil fuels are:

- China Bank

- Bando de Oro

- Asian United Bank

- Bank of the Philippine Islands

- Land Bank

Bank of the Philippine Islands and Banco de Oro are both leading renewable energy financing, but they still remain the biggest funders for coal and gas.

“China Bank and AUB’s massive gas financing from 2009 to 2020, and their lack of fossil fuel phaseout plans and sustainability policies earn them the high spots in the 2024 Scorecard,” the report read.

The group noted that there were no coal or gas transactions recorded from April to December 2023.

In December 2008, former president Gloria Macapagal Arroyo signed the Renewable Energy Act which established the framework the development, advancement, and utilization of renewables in the country.

Renewables make up 22% of the Philippines’ energy mix, according to the latest report from the Department of Energy. To reduce emissions, governments are working double time to shift to renewables.

Renewable energy sources are naturally occurring. They replenish over time, like sunlight, water, wind, biomass, and geothermal resources.

– Rappler.com

Add a comment

How does this make you feel?

![[OPINION] Clear timelines needed for phaseout of fossil fuels](https://www.rappler.com/tachyon/2024/06/tl-fossil-fuel-phaseout.png?resize=257%2C257&crop_strategy=attention)

![[EDITORIAL] Anyare, Pilipinas? Anyare, COP?](https://www.rappler.com/tachyon/2023/11/animated-marcos-duterte-cop28-carousel.jpg?resize=257%2C257&crop_strategy=attention)

![[OPINION] What is the ‘endgame’ for BBM’s gas transition?](https://www.rappler.com/tachyon/2024/03/IMHO-Marcos-Endgame-gas-transition-March-19-2024.jpg?resize=257%2C257&crop_strategy=attention)

There are no comments yet. Add your comment to start the conversation.