SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

![[Vantage Point] Is PLDT still a good buy?](https://www.rappler.com/tachyon/2022/12/Vantage-Point-PLDT-good-buy-December-29-2022.jpg)

What is it with Metro Pacific Investment Corporation (Hong Kong-based First Pacific Company’s investment arm) that it somehow always finds itself in due-diligence rigmarole?

Its recent missteps in failing to account for some P48-billion budget overrun in its telephone company, the Philippine Long Distance Telephone Company (PLDT), is not the first time that Metro Pacific’s pencil pushers blundered.

When Metro Pacific bought a 17.5% controlling stake in PLDT for approximately P29.7 billion in 1998, First Pacific’s managing director and CEO Manuel V. Pangilinan got the surprise of his life when he discovered that PLDT’s mobile-phone subsidiary Piltel owed P40 billion (at the then exchange rate of P46 to $1), P12.88 billion of which wasn’t on the balance sheet! Piltel couldn’t meet its principal payment and lost P1.88 billion in the first six months of the previous year, more than 15 times as much as its loss in the same period in 1998.

Three years earlier, in 1995, Metro Pacific went for the kill when it outbid all its rivals for the then much-coveted Philippine military base Fort Bonifacio (now Bonifacio Global City or BGC) for what market analysts saw as an alarmingly high price. Its bid of P64.95 billion for the 150-hectare property was 31% higher than Ayala Land Incorporated’s bid of P44.815 billion. The price was also more than triple the P1.18-billion minimum bid stipulated by the Bases Conversion Development Authority.

Although the sale price was definitely a good PR boost for the company and the country as a whole, real estate experts saw the mind-boggling bid as an overkill and devoid of, again, due diligence. The sale of the Fort Bonifacio property to Metro Pacific upended the real estate market as it created a glut, which proved to be a catastrophic gamble by Metro Pacific on the country’s property market. A buyer’s market dominated the real estate sector for years.

I just couldn’t get over how mind-boggling and almost suicidal Metro Pacific’s bid strategy was and how they could have profited from that investment. Paying P33,000 per square meter was too high in 1995 for a property which had no infrastructure, no underground electrical wiring, no water system, and no road network.

With Manila property values still reeling from the disastrously wrong move by Metro Pacific, the Asian financial crisis erupted in 1997 and crippled many industries, hitting the property sector hard. Alas, the ill-fated property project has become an albatross for Metro Pacific, which lost P460 million in the first quarter as it bathed in red for the rest of the year.

Cash-strapped and debt-laden as it was, Metro Pacific held on to the Bonifacio property until it was left with no choice but to announce its sale in 2002. Coming to the rescue, Ayala Land bought more than 50 hectares of commercial and residential land at a price much less than its original bid in 1995.

Déjà vu

Now, Metro Pacific is again in a maelstrom. The Philippine Stock Exchange (PSE) and the Securities and Exchange Commission (SEC) are investigating how and why a P48-billion budget overrun – representing about 12.7% of PLDT’s P379-billion capital expenditure (capex) over the past four years – slipped through the company’s auditors. PSE Chairman Jose T. Pardo told Rappler that the PSE will conduct an exhaustive probe. He did not give a timetable on when the PSE would render the verdict, but gave the assurance that the exchange would do its best to ferret out the truth.

Aside from SEC and PSE, US law firms are poised to investigate PLDT for possible violations of the federal securities law. On December 23, New York-based Kirby McInerney LLP announced its own probe for potential claims against the telephone company. PLDT has shares of common stock listed on the PSE and American Depositary Shares listed on the New York Stock Exchange. On December 20, Robbins Geller Rudman & Dowd LLP also announced an investigation focused on “whether PLDT and certain of its top executive officers made false and misleading statements and/or failed to disclose material information to investors.”

Rappler earlier reported that PLDT CEO and president Alfredo S. Panlilio disclosed that a confluence of factors, such as years of underinvestment, heightened competition, and the strong demand for fiber connections during the coronavirus pandemic, led to the overspending.

Other factors, Panlilio pointed out, were “the threat from former President Rodrigo R. Duterte for telcos to shape up; intense competition in the telco sector with the then anticipated entry of DITO Telecommunity Corp. funded by China Telecom Corp., Ltd., as well as the emergence of a competitor in the fiber space, Converge ICT Solutions, Inc.”

The company plans to reduce fresh capex steadily, starting in 2023, which he said would be “a year of consolidation as we continue to strengthen and grow the business.”

Analysts see PLDT writing off P50 to P55 billion of assets in 2022 which would substantially pull down the company’s bottom line.

No fraud

Even as Pangilinan assured investors and government regulators that there was no fraud in relation to the budget overrun that triggered a management revamp, the SEC announced that it was also investigating the sell-off as part of its mandate to protect investors.

In a mandatory disclosure sent to the PSE, PLDT said an internal investigation did not find any fraudulent transactions, procurement anomalies, or loss of assets arising from the budget overspending. Since 2019, the telco giant has embarked on a capital-extensive network expansion program to improve its services, including the LTE and 5G rollout.

Prior to the mandated disclosure, however, shares in PLDT had tumbled as market talk of an internal investigation floated for weeks. In its statement, the listed firm said that, while it has to make timely disclosures, it had to “understand the range of issues involved and the extent of the matter” even as there were rumors already circulating about the company.

“Until this information is complete, any announcement would have been premature to the detriment of the public shareholders,” PLDT explained. The disclosure was done not a day sooner because PLDT needed time “to conduct its investigation of the contracts and expenditures involved as well as to meet its major vendors for reconciliation of outstanding amounts and project status.” The company added that it had to identify and indicate in the disclosure its action plan moving forward.

PLDT valuation

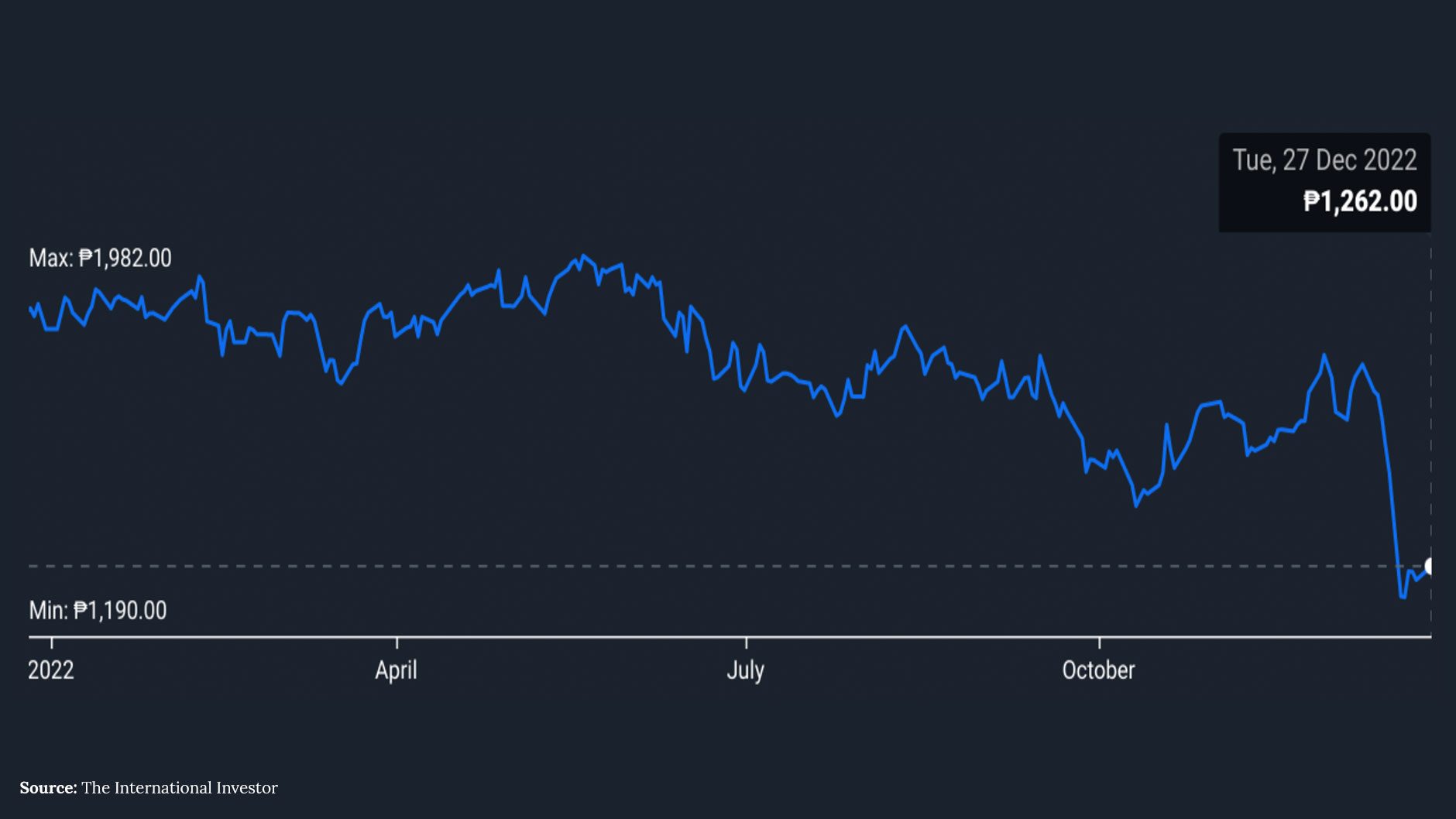

PLDT’s capex budget overrun kicked down the company’s share price by 24% over the past 30 days. The price drop suggests that the market may be fearful at the moment.

Is the market irrationally underestimating the company’s future profits?

We calculate the current true value of a company (and its shares), based on an estimate of how much profits the company will make in the future.

According to our resident analyst, US-based hedge fund manager Eric Jurado of the International Investor, “A simple and modified version of a discounted cash flow valuation model is used to calculate the true value of a company’s shares to quickly know whether the current share price is fairly valued, overvalued, or undervalued.” This industry standard is used not only by analysts from the most reputable brokers, institutions and research firms around the world, but also by well-known investors like Warren Buffett.

The valuation model,” Jurado said, “makes a number of assumptions, including the level of risk and the perpetual growth rate, etc. But, the most important estimate is how much the company can grow its profits.”

Based on Jurado’s valuation model, let us summarize PLDT’s past performance, analyst forecasts, and industry and market comparable, that were used to help estimate its profit growth and calculate its shares’ true value: Over the past year, PLDT’s profit grew by 49.0%, while it grew by 15.7% per year in five years. In terms of future growth, analysts forecast profits to decline by -0.9% per year over the next three years. Viewed in the context of industry and market trends, profits of companies in the wireless telecom industry declined by -0.1% over the past year, even as profits of companies in the Philippine market grew by 22.3% over the past year.

If the company would be able to achieve its profit growth estimate, using analyst forecasts and the valuation model, this is how it would look:

Based on the December 26, 2022, share price of ₱1,230, the market expects profits to decline by -5.2% per year, over the next three years. To achieve the most pessimistic one-year analyst target price of ₱1,398, profits would need to decline by -2.1% per year over the next three years.

To achieve the most optimistic one-year analyst target price of ₱2,210, profits would need to grow by 9.2% per year, over the next three years. Analysts forecast profits to decline by -0.9% per year, over the next three years. If profits decline by that rate, the share should be priced at ₱1,467.19.

If the company’s true value is ₱1,467.19, the December 26, 2022 share price of ₱1,230 is 16% undervalued, and has an upside opportunity of rising by 19%.

The price target is essentially an indication of where analysts think the share price could be trading in the future, usually in a year’s time, based on their research and forecasts of a company’s business prospects. Historically, it has been demonstrated that analyst estimates, on average, are relatively accurate over the short term (three to five years).

The analyst price target opportunity test tells us whether the current share price might have an upside opportunity, and if we should have confidence in that consensus price target.

The chart below shows the historical share price (blue line) with what the consensus price target was at that time, looking forward to one year (purple line). The shaded area also shows the range of analyst estimates at that time, from highest to lowest, and shows how much they agreed (or disagreed) with each other.

There are two criteria needed for a company to pass the analyst price target opportunity test. First, the current share price must be at least 20% below the consensus price target. This will indicate if the share might have a decent upside opportunity. Second, the dispersion from the consensus must be less than 15%. This indicates that analyst expectations are largely the same.

Since the December 26, 2022, share price of ₱1,230 is 34% below the one-year analyst consensus price target of ₱1,871, and the analyst target price dispersion is 13%, which is within a statistically confident range of agreement, the verdict is that analysts are in good agreement that the share price will rise by 52%.

The current share price is the market’s estimate of how much profits the company will make in the future. If profits grow more than the market’s estimate, the shares will be worth more. If profits grow less than the market’s estimate, the shares will be worth less.

Pangilinan says that his company neither hides nor will it tolerate malfeasance. I have no reason to doubt this. Despite its accounting and due diligence mishap, PLDT remains to be a solidly built professional company. It has weathered financial storms through the years.

Do I believe that PLDT is still a good buy?

Intelligent investors usually buy into a business (or pieces of it) when they believe the market undervalues profit prospects, and not when the market does the opposite. That is something to be guided by when it comes to investing in any shares of stocks. – Rappler.com

Val A. Villanueva is a veteran business journalist. He was a former business editor of the Philippine Star and the Gokongwei-owned Manila Times. For comments, suggestions email him at mvala.v@gmail.com.

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.