These days, as the world endures industrial shifts, one particular business segment has risen as a barometer for the economy. MSMEs, or micro, small and medium-sized enterprises, currently make up 99.5% of operating businesses in the Philippines according to the Philippine Statistics Authority.

Over the past year under global pandemic, MSMEs have been a focus of financial efforts from both the public and the private sectors. With these initiatives and growing access to technology, MSMEs now have more financial resources than ever to lead the economy towards recovery.

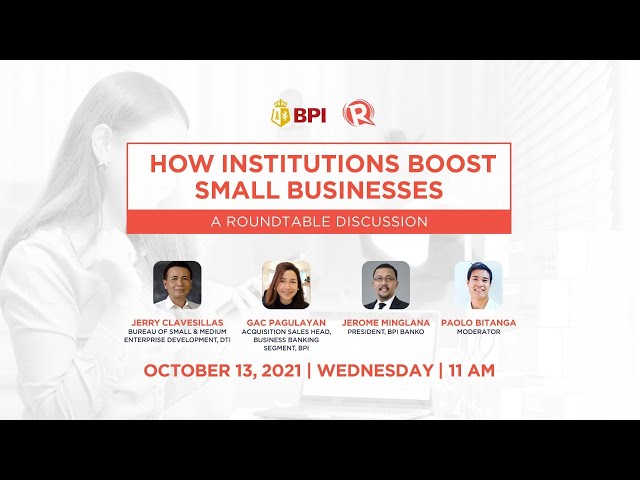

Watch our roundtable discussion on how institutions are boosting MSMEs in the Philippines. The panel features the following industry experts:

- Jerry Clavesillas, director of the Bureau of Small and Medium Enterprise Development, DTI

- Gac Pagulayan, acquisition sales head, Business Banking Segment, BPI

- Jerome B. Minglana, president, BPI Direct BanKo

This discussion was moderated by Rappler’s Inside the Industry host, Paolo Bitanga.

– Rappler.com

How does this make you feel?

![[Finterest] What exactly does a bank do, and how can they help you?](https://www.rappler.com/tachyon/2022/09/shutterstock-philippine-peso.jpg?resize=257%2C257&crop=329px%2C0px%2C900px%2C900px)