SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

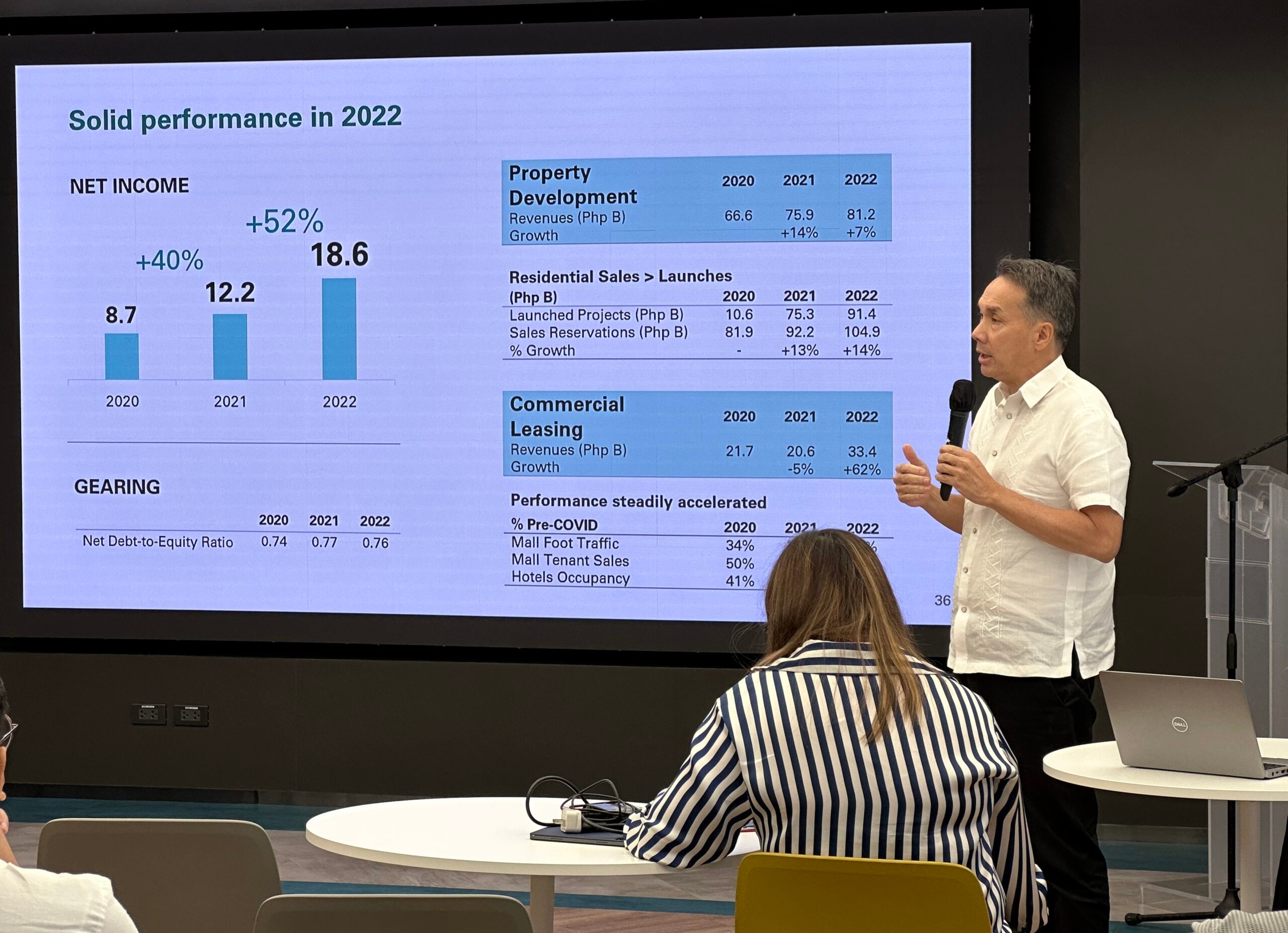

MANILA, Philippines– Ayala Land, Incorporated (ALI) saw its net income jump 52% to P18.6 billion in 2022, as consumers somewhat brushed aside the impact of higher interest rates and inflation.

ALI’s consolidated revenues grew to P126.2 billion, a 19% increase.

Reservation sales reached P104.5 billion, 14% better than in 2021. Sales from overseas Filipinos surged by 59%, while sales from other nationalities went up 13%.

ALI said that the projects that received the most demand were Ayala Land Premier’s Ciela at Aera Heights in Carmona, Cavite; Avida’s Serin East in Tagaytay City; Patio Madrigal in Pasay City; Amaia’s Skies Cubao in Quezon City; and Alveo’s Astela Towers in Circuit Makati.

The bounce back in sales comes as the central bank raised interest rates in an attempt to anchor inflation.

ALI president and CEO Bernard Vincent Dy said that all of their major businesses “achieved meaningful recovery.”

“Despite ongoing challenges in the operating environment, we remain positive in our outlook for 2023, and look forward to introducing new offerings that will meet the evolving needs of the market,” Dy said.

Commercial leasing revenues jumped 62% to P33.4 billion, as mall rent and foot traffic normalized. Shopping centers and hotel revenues doubled to P16.1 billion and P6.2 billion, respectively.

Meean Dy, ALI executive vice president, said that mall foot traffic and tenant sales are already 110% higher than pre-COVID levels. Rent concessions had been stopped since the fourth quarter, as Filipinos frequented malls.

Meanwhile, revenues from office leasing grew 13% to P11.1 billion.

Capital expenditures in 2022 reached P72.4 billion, where 50% was spent on residential projects, 19% for land acquisition, 16% on real estate development, 11% on commercial projects, and 4% for other purposes.

ALI’s capex for 2023 is at P85 billion, bulk or 39% of which will be spent for residential projects. –Rappler.com

Add a comment

How does this make you feel?

![[ANALYSIS] Not all REITs are created equal](https://www.rappler.com/tachyon/2024/06/tl-not-all-reits-are-created-equal-06012024.jpg?resize=257%2C257&crop=233px%2C0px%2C720px%2C720px)

There are no comments yet. Add your comment to start the conversation.