SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

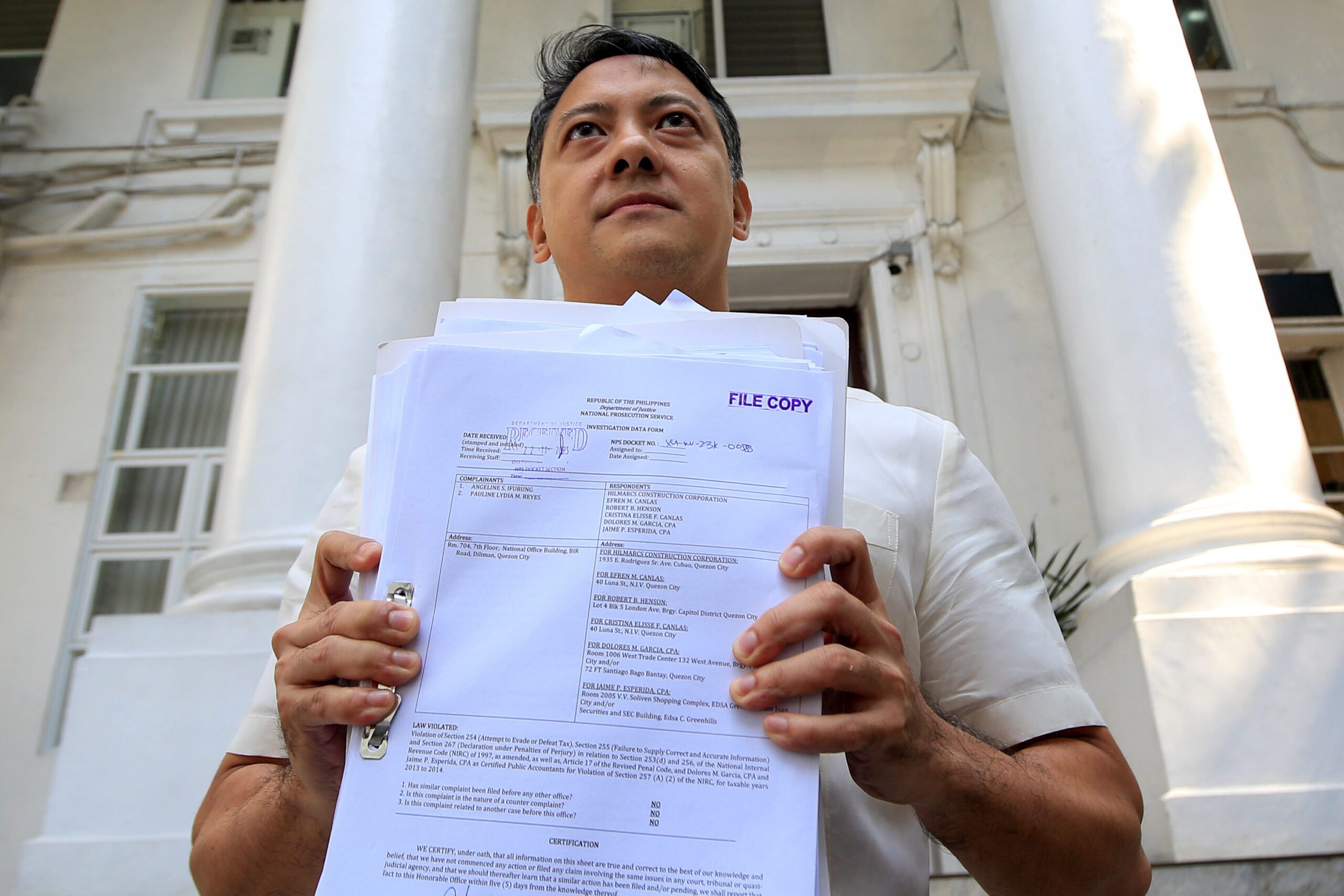

MANILA, Philippines – The Philippines’ tax agency on Wednesday, November 22, filed 15 criminal cases against buyers and sellers of ghost receipts involving 69 respondents.

Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui Jr. led the filing of the cases at the Department of Justice against 69 respondents – corporations, corporate officers, accountants – whose tax liability amounted to around P1.8 billion.

“The sale and use of ghost receipts is a tax evasion scheme of the highest order. The BIR is committed to filing civil and criminal charges against all corporations, corporate officers, and accountants involved in this syndicate. We are already preparing the next set of criminal cases,” Lumagui said.

The BIR said the buyers and sellers of ghost receipts came from the following industries:

- construction and hardware

- marketing of goods and equipments

- office supplies

- automotive oils

- trading of metals

- contractor of electrical and mechanical systems

- hotel

- food services

“This shows the magnitude of this syndicate because it covers an array of industries,” the BIR said.

The rules violated by the respondents under the National Internal Revenue Code are:

- Section 254 – tax evasion

- Section 255 – failure to supply correct and accurate information in the Income Tax Return (ITR) and Value-Added Tax (VAT) returns

- Section 267 – perjury

- Section 257 – making false records or report under the National Internal Revenue Code

Sarangani Rural Bank officers convicted

Meantime, the Bangko Sentral ng Pilipinas (BSP) said three courts in General Santos City have convicted former officers of the now-closed Sarangani Rural Bank Incorporated (SRBI) over fraudulent transactions with fictitious loans.

Most of the depositors of SRBI were reportedly market vendors.

In a press release, the BSP said the following were sentenced by General Santos City Regional Trial Court (RTC) Branch 60 to six years’ imprisonment and ordered to pay a fine of P50,000 for violating the BSP’s Manual of Regulations for Banks (MORB), the General Banking Law of 2000, and the Revised Penal Code:

- former SRBI president and chairman Francisco Laiz Jr.

- former loans sookkeeper Marydelle Arbilo

- former loans clerk Annalyn Brumo

- former account officer Charity Villa

- former SRBI credit committee loans supervisor Arsenia dela Cruz

- former SRBI credit committee general bookkeepers Mizpah Santos and Lilibeth Girado

They were also perpetually disqualified from holding employment in any of BSP-supervised financial institution.

The BSP also said that General Santos City RTC Branch 55 convicted former technical assistant Justino Tamala Jr. for violating provisions in the BSP’s MORB and for falsification of public and commercial documents.

Tamala was sentenced to five years’ imprisonment and ordered to pay a fine of P50,000 for each of the five counts of the charges against him with subsidiary imprisonment in case of insolvency.

In addition, the Municipal Trial Court in Cities, Branch 2 in General Santos City convicted Laiz, Arbilo, Brumo, Villa, Dela Cruz, and Santos for falsification of public and commercial documents. They were sentenced to one year and eight months’ imprisonment, and ordered to pay a fine of P3,000. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.