SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – With debates surrounding the latest push for charter change heating up, the country’s chief economist has also spoken up: it’s time to remove “unnecessary restrictions” on foreign investments.

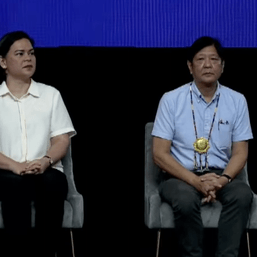

“We need to make the country more competitive. We need to eliminate those unnecessary restrictions on foreign investments [so] that we have a better chance of attracting foreign investments,” National Economic and Development Authority (NEDA) Secretary Arsenio Balisacan said.

The NEDA secretary said the constitutional restrictions on foreign ownership are “impediments” that cause big investments to flow to neighboring Asian countries instead.

Balisacan also echoed the view of President Ferdinand Marcos Jr., who recently said that “the 1987 Constitution was not written for a globalized world…. We have to adjust so that we can increase the economic activity in the Philippines, we can attract more foreign investors.”

“Our President has mentioned that the Constitution was designed for a period that perhaps [was] not responsive to the current state of the world now. So, we need to address those, remove those,” the NEDA secretary said in a Palace briefing on Friday, January 26.

In particular, Balisacan believes that opening up education to full foreign ownership is “long overdue.”

“I think we have missed a major opportunity to have the country as a base for higher education of many countries that have looked for branch campuses outside of their country,” he said, pointing to how educational institutions from advanced economies have put up campuses in neighboring Southeast Asian countries instead of the Philippines.

“We would have been the best candidate, because our educational system is something very close to the US, very close to the western countries, and we get the language. But we missed it because we won’t allow ownership of foreigners in the area of education.”

The Constitution limits foreign ownership in industries following a 60% Filipino-40% foreign general rule. In recent years, a slew of new laws and regulations have circumvented this rule and opened up businesses in several industries – such as telecommunication, shipping, airlines, startups, and renewable energy – to full foreign ownership. (READ: How Philippine economy opened up to the world without charter change)

The latest push for charter change has hinged on the potential benefits of lifting these economic provisions, but there are fears that opening up the Constitution to changes could allow politicians to remove term limits and stay in power.

The national economist acknowledged these concerns, prompting him to wish that politicians can “come to a common position quickly” before the Philippines spooks domestic and foreign investors.

“I hope that they can agree very soon because we don’t also want those uncertainties because one of the factors that inhibit investments, whether it’s domestic or foreign, is the state of uncertainty,” he added.

Cha-Cha not the only path to growth

To support economic development, Balisacan underscored that there are other actions the Philippines must take besides lifting foreign ownership restrictions.

For instance, he pointed to the issues surrounding the ease of doing business in the country, the high cost of energy, and the unpredictability of policies and regulations.

A 2021 study by economists in the Bangko Sentral ng Pilipinas similarly concluded that “while reducing FDI (foreign direct investment) restrictions and the corporate tax rate could provide a boost to a country’s FDI performance, improving the way business is done in a country would most likely have a more positive impact in attracting and retaining FDI.”

In the meantime, NEDA targets gross domestic product growth in the Philippines to reach 6.5% to 7% in 2024 and to reach upper middle-income country status by 2025. Challenges to that growth target include geopolitical tensions in the Middle East and food inflation that could be worsened by the effects of El Ñino. – Rappler.com

1 comment

How does this make you feel?

![[In This Economy] Stop using the PH economy as excuse for charter change](https://www.rappler.com/tachyon/2024/01/stop-economy-excuse-for-charter-change-January-26-2024.jpg?fit=449%2C449)

![[In This Economy] Part 2 | POGOnomics: Are we banning POGOs out of fear, outrage, not rational thought?](https://www.rappler.com/tachyon/2024/06/thought-leaders-pogonomics-part-2b.jpg?resize=257%2C257&crop=292px%2C0px%2C720px%2C720px)

![[In This Economy] POGOnomics: Weighing the costs and benefits of POGOs](https://www.rappler.com/tachyon/2024/06/thought-leaders-pogonomics-part-1.jpg?resize=257%2C257&crop=279px%2C0px%2C720px%2C720px)

![[In This Economy] Is the Philippine economy stable?](https://www.rappler.com/tachyon/2024/05/philippine-economy-stable-may-10-2024.jpg?resize=257%2C257&crop=461px%2C0px%2C1080px%2C1080px)

![[EDITORIAL] Apat na taon na lang Ginoong Marcos, ‘di na puwede ang papetiks-petiks](https://www.rappler.com/tachyon/2024/07/animated-bongbong-marcos-2024-sona-day-carousel.jpg?resize=257%2C257&crop=280px%2C0px%2C720px%2C720px)

![[In This Economy] Delulunomics: Kailan magiging upper-middle income country ang Pilipinas?](https://www.rappler.com/tachyon/2024/07/in-this-economy-upper-middle-income-country.jpg?resize=257%2C257&crop=421px%2C0px%2C1080px%2C1080px)

![[EDITORIAL] Marcos Year 2: Hilong-talilong](https://www.rappler.com/tachyon/2024/07/animated-bongbong-marcos-2nd-sona-carousel.jpg?resize=257%2C257&crop=136px%2C0px%2C720px%2C720px)

![[Newspoint] A fighting presence](https://www.rappler.com/tachyon/2024/07/thought-leaders-a-fighting-presence.jpg?resize=257%2C257&crop=441px%2C0px%2C1080px%2C1080px)

Prof. JC Punongbayan has just written, “Stop using the Philippine Economy as [an] Excuse for Charter Change,” here we have President Marcos Jr. and NEDA Secretary Arsenio Balisacan doing the opposite. I believe President Marcos Jr. wants to have his legacy Philippine Constitution: the Marcos Jr. Philippine Constitution. That is why he is doing the opposite, no matter what.