SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – Filipino tycoon Ramon Ang’s San Miguel Corporation (SMC) ended 2022 with consolidated core net income reaching P43.2 billion, as its topline surpassed pre-pandemic levels.

Core net income for 2022, which considers only the diversified conglomerate’s profits from its primary businesses, was lower than the P48.2 billion consolidated net income reported in 2021. Before the pandemic or in 2019, SMC’s net profit stood at P48.6 billion.

While SMC’s bottomline has yet to return to levels before the pandemic, its revenues or topline reached P1.5 trillion in 2022, 60% higher than the P941 billion in 2021 and surpassing 2019’s P1 trillion.

Consolidated income from operations rose 10% to P134.5 billion, driven by the sustained performance of Petron, San Miguel Food and Beverage, San Miguel Packaging, and SMC Infrastructure.

SMC likewise attributed the increase to “cost management efforts” which aimed to mitigate the effects of increasing raw material costs, inflation pressures, and foreign exchange movements.

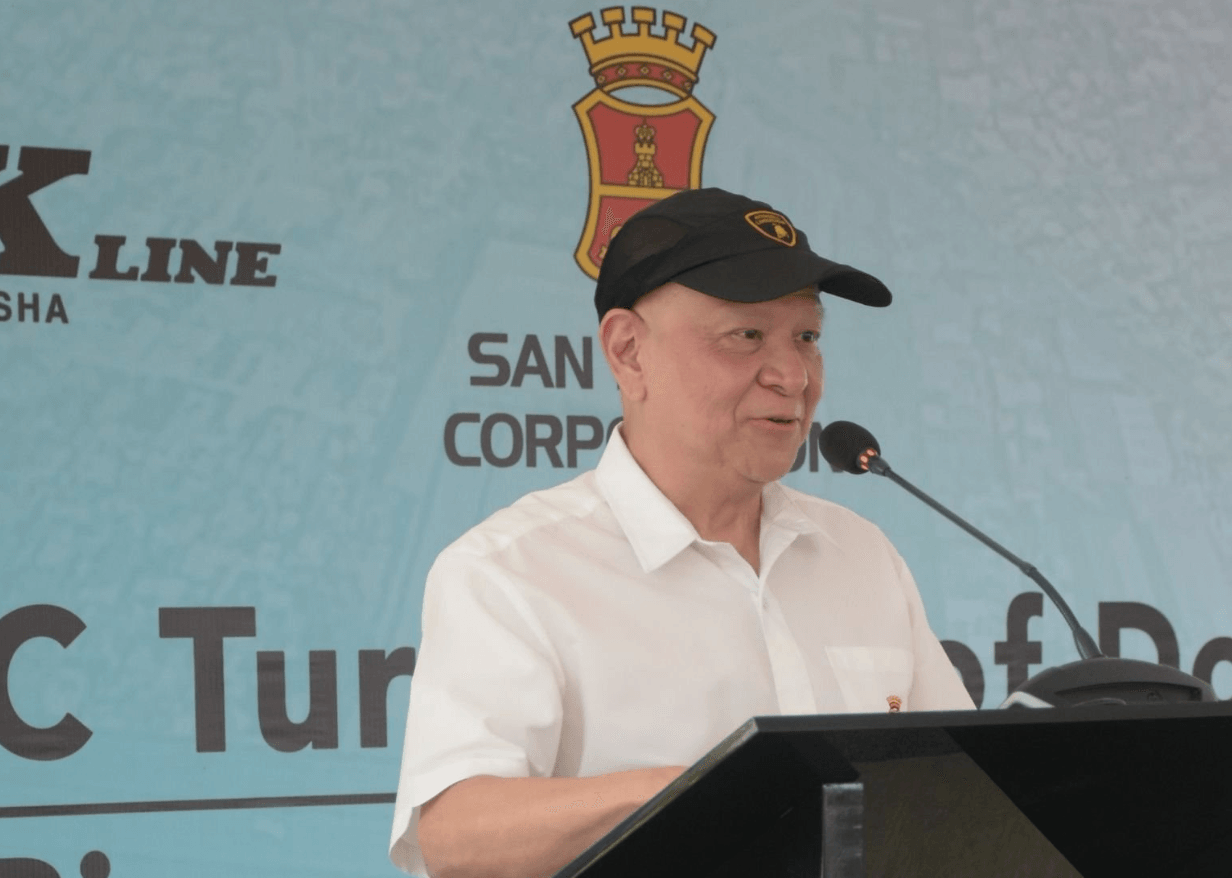

“Our strong top-line performance is a clear indication of our economy’s continuous recovery as well as the strong consumer demand for our products and services. While challenges remain, we’re confident in the measures and programs we’ve put in place to weather these,” Ang, SMC president and the Philippines’ 9th richest individual, said.

Here is a summary of the financial performance of SMC’s subsidiaries:

SAN MIGUEL FOOD AND BEVERAGE

Net income rose 10% to P34.7 billion while consolidated revenues went up 16% to P358.9 billion, driven by sustained volume growth and better selling prices across the beer, spirits, and food divisions.

San Miguel Brewery

Net income ended at P21.8 billion, 6% higher than the previous year, while consolidated revenues rose 17% to P136.2 billion.

Consolidated volumes jumped 10% to 224.5 million cases driven by “effective brand-building and demand generation programs that capitalized on positive economic growth in both domestic and international markets.”

Ginebra San Miguel

Ginebra San Miguel posted its highest-ever net income of P4.5 billion, exceeding 2021 results by 9%. Volumes reached an all-time high of 44.6 million cases, surpassing 2021 levels by 7%.

2022 revenues increased by 11% to P47.3 billion.

San Miguel Foods

Consolidated revenues increased by 16% to P175.3 billion, while net income surged 21% to P9.2 billion.

“Amid rising inflation, volumes across most segments grew, boosted by intensified distribution, aggressive promotional activities, the launch of new products, and utilization of additional capacity from new facilities,” SMC said.

San Miguel Global Power Holdings

Net income dropped 80% to P3.1 billion, while operating income declined 22% to P28.9 billion, reflecting the impact of tremendous increases in fuel costs, exposure to high Wholesale Electricity Spot Market prices, and the deration of the Ilijan power plant.

Consolidated revenues went up 66% to P221.4 billion due to an increase in average realization prices, higher spot sales prices, and improved power nominations.

Petron

Petron’s net income amounted to P6.7 billion, a 9% increase year-on-year. Consolidated revenues jumped 96% to P857.6 billion on the back of the fuel demand growth and higher crude prices.

Combined sales volume from its Philippines and Malaysia operations reached 112.8 million barrels, up 37%. Domestic volume climbed 43%, as demand from the industrial and aviation sectors recovered.

Infrastructure

SMC Infrastructure delivered consolidated revenues of P29 billion, 47% higher than 2021. Traffic volume at all operating toll roads increased 25%, while operating income grew 110% to P14.2 billion due to higher traffic volume. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.