SUMMARY

This is AI generated summarization, which may have errors. For context, always refer to the full article.

MANILA, Philippines – A global consortium of journalists obtained documents of over 18,000 Credit Suisse accounts and easily found names of corrupt officials, criminals, and dictators.

Some of the names were not obscure and a “simple Google search” gave away the misdeeds of the Swiss bank’s clients.

So why did Credit Suisse, one of the largest banks in the world, with vast security resources at its disposal, continue to keep criminals as its clients?

Current and former employees pointed to a toxic corporate culture that “incentivized taking on risk to maximize profits – and bonuses,” according to the Organized Crime and Corruption Reporting Project (OCCRP).

“The bank incentivizes a banker to look the other way with an account they know to be toxic,” OCCRP quoted a former senior manager in private banking as saying.

“If you close a toxic account, especially a large account in excess of $20 million, the banker finds himself in a deep hole. A deep hole that is almost impossible to get out of.”

Credit Suisse employees claimed they were “encouraged” to look the other way for high net-worth accounts.

“The kind of people the bank attracts are mercenaries, and they all look to enrich themselves first – probably understanding that there is no real relationship with the bank. You’re only there for as long as you make money, however you make that money,” a manager told OCCRP.

In a statement, Credit Suisse said it “strongly rejects the allegations and insinuations about the bank’s purported business practices.”

“Approximately 90% of the reviewed accounts are today closed or were in the process of closure prior to receipt of the press inquiries, of which over 60% were closed before 2015,” it said.

Who’s who

OCCRP, which includes 163 journalists from 48 media outlets in 39 countries, spent months analyzing bank account information leaked from Credit Suisse. This is said to be the only known leak of a major Swiss bank’s client data to journalists.

The leak included more than 18,000 accounts that held over $100 billion at their peaks.

Compliance experts who reviewed the findings said many of these people “should not have been allowed to bank at Credit Suisse at all,” OCCRP said.

The Suisse Secrets data was provided to the German newspaper Süddeutsche Zeitung by an anonymous source more than a year ago. Nothing is known about the source’s identity.

Some of the personalities in the leak include:

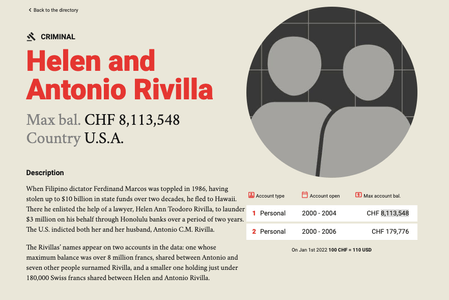

- A Philippine lawyer who had been convicted of money laundering for creating and maintaining accounts for the late dictator Ferdinand Marcos and was able to hold 8 million francs in a joint account before it closed in 2006

- The family of an Egyptian intelligence chief who oversaw torture of terrorism suspects for the Central Intelligence Agency

- An Italian accused of laundering criminal funds for the infamous ‘Ndrangheta criminal group

- A German executive who bribed Nigerian officials for telecommunication contracts

- Jordan’s King Abdullah II, who held a single account worth 230 million Swiss francs ($223 million) at its peak, even as his country raked in billions in foreign aid

- Venezuelan elites accused of plundering the state oil firm

- A Serbian drug lord known as “Misha Banana” who is suspected of laundering cash from drug transactions

- Zimbabwean fraudster Billy Rautenbach, a notorious mining magnate who was later sanctioned for his role in Zimbabwe’s 2008 election

The full list of problematic account holders can be viewed here. – Rappler.com

Add a comment

How does this make you feel?

There are no comments yet. Add your comment to start the conversation.